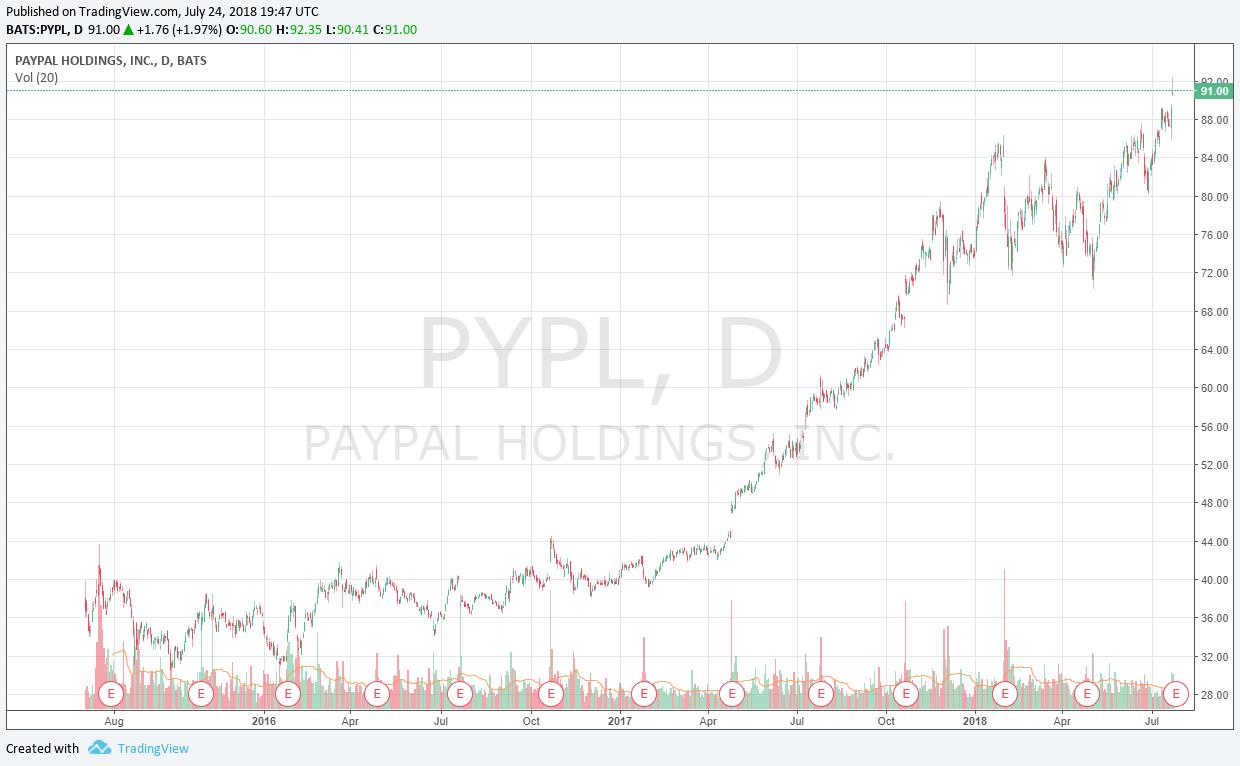

PayPal gets the backing of a new investor, and expectations are for the equity to trade to $125 within the next 18 months. We’re not as bullish on its valuation as others might be, but we’d be really excited to see this simulated Best Ideas Newsletter idea surge!

By Brian Nelson, CFA

We have been mighty pleased with PayPal’s (PYPL) performance since its split from eBay (EBAY), and while we do have some concerns regarding the impending and expected non-renewal of its agreement with eBay in coming years, we fully expect PayPal to replace lost business as eBay represents just a few months of expansion at its current growth run rate. Rivalries are heating up in the online payments space, too, but the industry’s opportunity is vast, and we only expect cryptocurrencies to be a positive catalyst for new business rather than a threat. Both Square (SQ) and PayPal seem to be embracing cryptocurrencies.

Helping PayPal’s stock of late has been Third Point’s Dan Loeb that has taken a liking to the company. In Third Point’s second quarter letter to investors, he had a lot of good things to say about the online payments giant. Among some of the notable quotes include: “PayPal enjoys a dominant competitive position with a 10x scale advantage relative to peers.” “We see parallels between PayPal and other best-in-class internet platforms like Netflix (NFLX) and Amazon (AMZN): high and rising market share, untapped pricing power, and significant margin expansion potential.” “We forecast above-consensus EPS growth driving shares to $125 within 18 months, for ~50% upside.”

Loeb also called out three revenue areas that could represent upside at PayPal: 1) Venmo monetization, 2) dynamic pricing, and 3) offline payments. Though we’re not as bullish on PayPal over the next 18 months as Loeb, we’d be nonetheless excited to see the equity continue its surge. We expect to take a closer look at our valuation of PayPal, and we expect a fair value increase on account of a lower cost-of-capital assumption coupled with stronger expectations for Venmo performance and pricing expansion.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.