Image Source: Omega Healthcare, March 2018 Investor Presentation

Omega Healthcare is a healthcare real estate investment trust (REIT) that has been battling concerns within its customer base regarding rent payments. Just how healthy its customer line-up truly is will likely play out in coming years, but for now, management is leaving the dividend intact. Shares yield 9%+ at the time of this writing.

By Brian Nelson, CFA

We’ve been concerned about the healthcare REIT arena ever since healthcare REIT HCP (HCP) slashed its payout in late 2016, “Dividend Aristocrat No More: HCP Cuts Its Payout,” leaving behind its long-term track record of consecutive annual dividend increases and the coveted Dividend Aristocrat nameplate. Omega Healthcare (OHI) has been one that we continue to keep a close eye on, too, in part because management seems committed to a dividend that implies a 9%+ yield, but also because its weakening customer base may have implications on other healthcare REITs we cover.

Where HCP struggled with a key customer HCRManor Care before it cut its payout a couple years ago, Omega is struggling with a number of customers, too, not the least of which are two of its top 5, Orianna Health Systems and Signature. What Omega and its skilled nursing facility customers are working through is a ho-hum backdrop given the aging of the “baby bust” generation. However, as the “baby boom” generation starts to reach the 85+ age group, a cohort that is expected to increase to 18 million people in the coming decades and make up as much as 5% of the total US population by 2050 (up from 6 million and 2% recently), things are expected to improve considerably. Though the long term looks good, industry participants are still feeling near-term pain, and this is having spillover implications on the healthcare real estate industry as customers fall behind on rent payments.

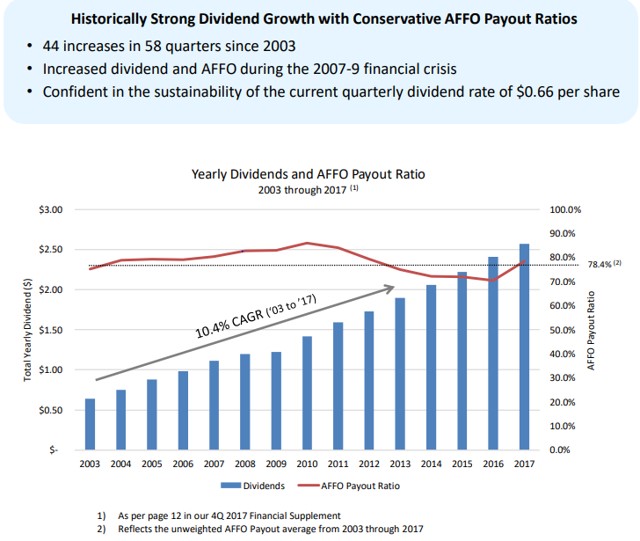

Omega Healthcare, which specializes in skilled nursing facilities, remains in the penalty box after revealing ongoing difficulties with collecting rent from a couple troubled customers. Things may not be as bad as they seem, however. Omega Healthcare’s adjusted funds from operations came in at ~$683 million, or $3.30 per share in 2017, compared to ~$689 million in the prior-year period. Though many viewed its adjusted funds from operations per-share guidance of $2.96-$3.06 for 2018 as disappointing, when it issued it at the time it reported fourth-quarter 2017 results, Omega Healthcare is currently just paying $2.64 per share in dividends, revealing some nice coverage. Omega Healthcare even raised its dividend in February 2018, to the current $0.66 per-share quarterly rate, and while it doesn’t expect to increase the payout in 2018, management is confident in the sustainability of the current quarterly dividend rate of $0.66 per share (see image above).

Omega Healthcare’s first-quarter earnings results, released May 7, brought some good news, too. Management noted that troubled customer Orianna recommenced partial rent payments, Signature’s consensual restructuring is nearing completion, and that adjusted funds from operations per-share guidance remains on track for the range of $2.96-$3.06 for the year. Though first-quarter results were buoyed by the timing of new investments and asset sales, things could have been a lot worse. Considerable risks to the payout remain, but for now, the dividend remains intact at Omega Healthcare. We value shares at $31 each.

REITs – Healthcare: HCP, HR, LTC, OHI, UHT, VTR, WELL

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.