Image Source: hj_west

We think activist pressure on United Technologies is unwarranted, and we were highly encouraged by the company’s execution during the first quarter of 2018. Performance at Pratt & Whitney and UTC Aerospace Systems bodes well for the aerospace supply chain.

By Brian Nelson, CFA

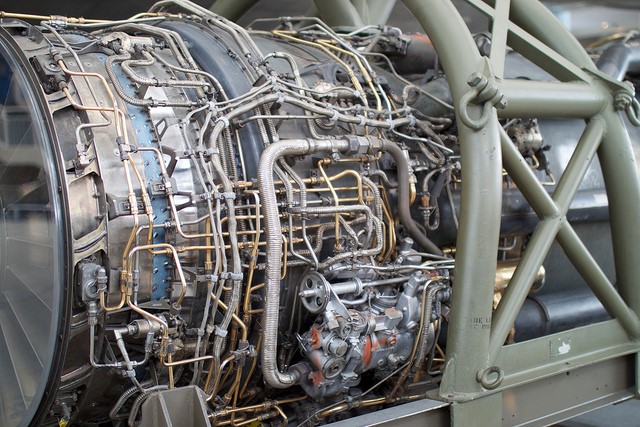

There’s a lot to like about United Technologies (UTX). The company is one of our favorite industrial companies, and we’re probably most fond of its aerospace exposure.

We’re against a break-up of the company as we continue to believe United Technologies is on the verge of fantastic top and bottom-line expansion in coming years thanks in part to the burgeoning backlog of unfulfilled deliveries at the airframe makers, Boeing (BA) and Airbus (EADSY). United Technologies’ acquisition of Rockwell Collins (COL) is still in the works, and we think activist pressure is more of a distraction at the moment. We’d like for overanxious investors to let management be, as the team executes on the promising prospects across its various business segments. We think pushing for a business separation may only cause headaches in the executive suite and reduce the magnitude that could have been had during one of the most robust upswings in aerospace demand in history.

United Technologies continues to execute well, as its first-quarter 2018 results, released April 24, revealed. Sales grew 10% in the quarter on the back of 6% organic growth, while adjusted earnings per share came in at $1.77, up ~20% on a year-over-year basis. This type of performance is not something that should have activist investors swirling. In fact, management noted that the 6% pace of organic growth was the “strongest first quarter organic growth rate since 2011.” All four of the company’s main business lines are contributing to organic expansion, too. United Technologies is doing so well out of the gates in 2018 that it even raised its sales and earnings per share guidance ranges, now to $63-$64.5 billion (was $62.5-$64 billion) and $6.95-$7.15 (was $6.85-$7.10) for the year, respectively. Free cash flow for 2018 is targeted at $4.5-$5 billion, well in excess of its annual run-rate cash dividends paid of ~$2.1-$2.2 billion.

We stand in awe of the pace of commercial aftermarket sales at both United Tech’s Pratt & Whitney (jet engine division) and UTC Aerospace Systems segments in the quarter, up 18% and 16%, respectively. The read-through to the aerospace supply chain is a positive one, in our opinion, and we maintain our view that deliveries at Boeing and Airbus may not slow until sometime early next decade. We like what’s happening at United Technologies these days, but value investors should still be a bit cautious. Shares aren’t as cheap as they could be, and United Technologies’ debt load may only increase as a result of ongoing acquisitive behavior. Our fair value estimate stands at $110 per share at the time of this writing, so downside risk is still very much present on the basis of a discounted cash-flow process.

Aerospace & Defense – Prime: BA, FLIR, GD, LLL, LMT, NOC, RTN

Aerospace Suppliers: AIR, AL, ATRO, COL, HEI, HXL, SPR, TDY, TXT

Related: HON, GE

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.