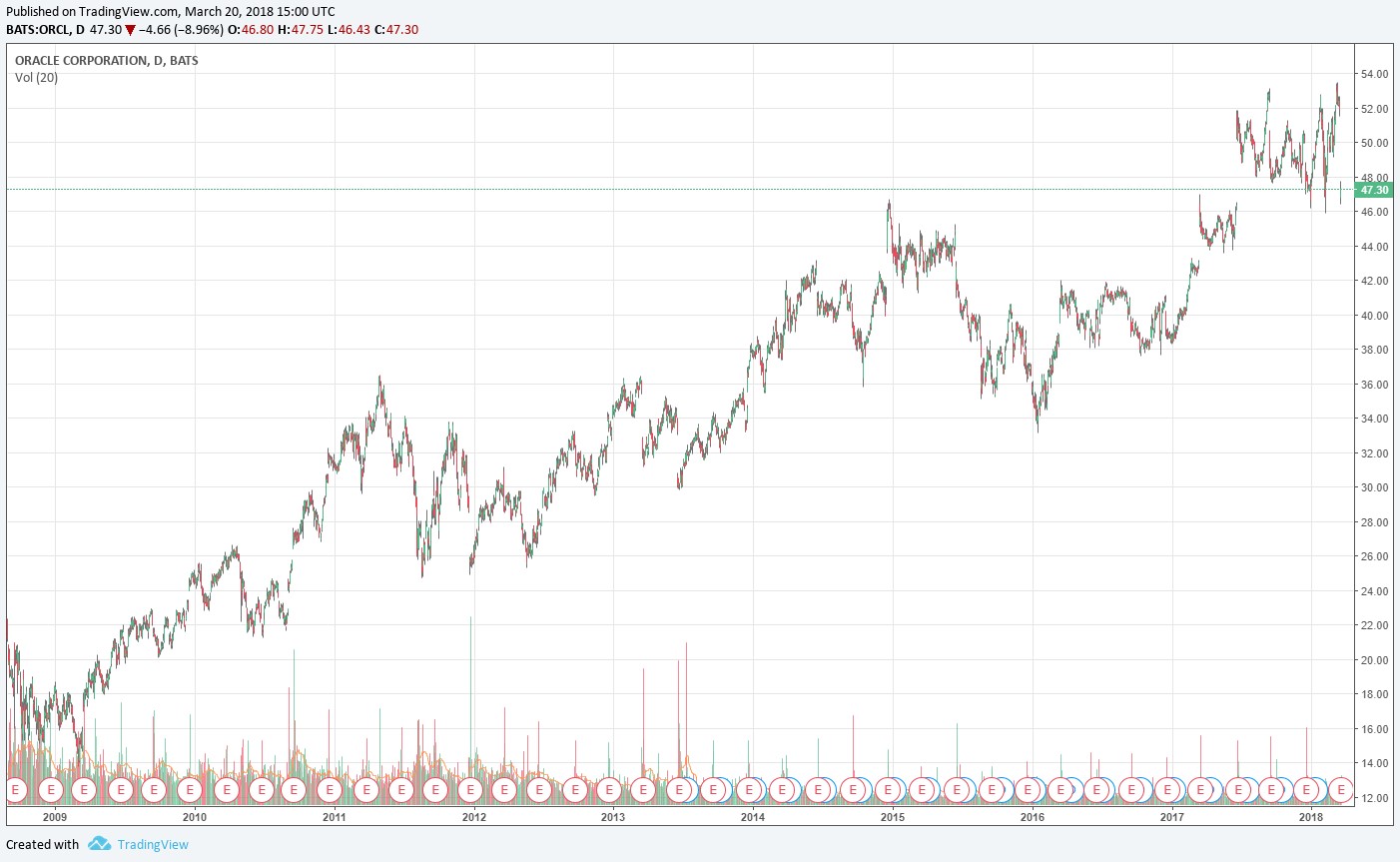

Image Shown: The performance of Oracle since the March 2009 bottom.

By Brian Nelson, CFA

On March 19, Oracle (ORCL) reported in-line fiscal third-quarter results that showed revenue advancing 6.1%, operating income increasing 15.2%, and net income before income taxes jumping 22.3%. The quarter was impacted by a large one-time impact from the U.S. 2017 Tax Cuts and Jobs Act, making year-over-year comparisons on an after-tax basis less meaningful. The company’s fiscal third-quarter non-GAAP earnings per share number of $0.83 translates to 20% growth, and thus far during the fiscal year, non-GAAP earnings-per-share has advanced 16%. Oracle continues to execute well on its growth initiatives.

However, the market was looking for a bit more with its outlook, as shares were sent down aggressively following the report. The market had been expecting cloud revenues including SaaS, PaaS, and IaaS to grow 23% in the current quarter versus management’s expectations of 19%-23%, meaning the midpoint for guidance came in slightly lower than analyst’s modeling expectations. Management noted on the call, however, that the fiscal fourth-quarter of last year was a tough comparison, so the disappointment may be more of a function of analysts expecting too much, rather than Oracle dropping the ball on the pace of cloud revenue growth.

Including expectations for a tax rate of 19.5%, which incorporates the latest tax law changes, management is targeting all-in constant-currency earnings per share in the range of $0.89-$0.92 on total revenue growth of 1%-3% in USD. Consensus expectations had pegged the quarter’s earnings at $0.90, so even considering a modest setback on the top-line trajectory, the bottom line still looks good. Through the nine months ended in February, Oracle has hauled in $10.7 billion in operating cash flow (up from $9.7 billion in the comparable period last year), while capital spending has dropped to $1.4 billion (down from $1.5 billion in the comparable period last year), revealing not only strong levels of free cash flow generation, but also a nice pace of growth.

Oracle seems to get left behind among other tech powerhouses. A lot of attention is often given to Amazon (AMZN) and Microsoft (MSFT) when it comes to the cloud, but Oracle is not one to be overlooked. Shares yield ~1.5%, so they don’t turn many heads when it comes to income, but the company’s Dividend Cushion ratio is remarkable at 3.9 at the time of this writing. The company’s cash and cash equivalents balance stood at more than $70 billion, higher than its notes payable and other debt accounts balance of ~$60.1 billion. Strong free cash flow and a solid balance sheet are two items we think are necessary to facilitate real dividend growth. Oracle last raised its dividend 27% in March of last year.

————————-

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.