Given its track record of creative destruction, when Amazon plans to enter a particular line of business, it presents an ominous threat to incumbents. What is often overlooked, too, is that Amazon is more than willing to try new verticals—if they prove promising, additional assets will be devoted to the new line of business, often with fawning media coverage. If Amazon is unsuccessful in its endeavor, however, then it seems as though it will “fail fast” and shut down the project and move on. We found the recent announcement of a joint venture to tackle the healthcare industry as particularly noteworthy.

By Alexander J. Poulos

Amazon as the Great Disrupter

We have marveled at Amazon’s (AMZN) rumored ambition into pharmaceutical services especially in light of the recent purchase of Whole Foods giving the internet behemoth a network of brick-and-mortar storefronts.

Our recent piece discussing the finer aspects of entering into the pharmacy markets can be seen as “small potatoes” when measured against the ambition of the trio headlined by Amazon (along with JP Morgan (JPM) and Berkshire Hathaway (BRK.B). A new company will be formed with its own independent management team that will look to tackle the way in which healthcare is delivered in the US, with an eye towards leveraging technology to reduce overall cost and produce superior outcomes.

It sounds marvelous, but it is important to note that we have seen other outside corporations form their own buying groups with minimal impact on the overall cost of healthcare. We feel a different trend is far more noteworthy at this juncture that ironically can be traced back to Amazon’s rumored entry into pharmacy.

The End of the Standalone Pharmacy Benefit Manager (PBM)?

The standalone PBM business along with its business model may now officially in terminal decline, underscoring the need to merge with a managed-care organization to salvage any value for beleaguers shareholders. This is a bold statement, so lets break it down into its individual components to determine if it’s a justifiable statement or mere hyperbole.

- The PBM is a network that administers the healthcare benefits of a managed care organization (MCO) such as Anthem (ANTM).

- Let’s keep in mind, by virtue of the definition of bullet 1, the PBM is an intermediary– the infamous “middle man” that adds to the overall cost of care as it extracts its fee.

- There is nothing proprietary in the PBM model. The customer data is provided by the MCO; as such, there is little in the way of brand or customer loyalty, unlike in the MCO’s. Typically, if a patient is receiving excellent care with their healthcare insurance and is comfortable with the network of providers, he or she is loath to change especially in the Medicare market.

- The business model is rife with conflict predominately based on the role of rebates. The PBM will attempt to reduce costs by offering preferred formulary placement in exchange for a rebate based on volume. It seems innocent enough, but the conflict arises based on the percentage of rebate retained by the PBM. In essence, the PBM can “negotiate” a higher cost for the drug (for example, $100 per month) and based on the number of patients prescribed the product, a volume rebate of 20% (lowering the overall cost of the monthly treatment to $80 thus saving the insurer “$20” per month). If the PBM has an agreement in place to retain 15% of the overall rebate, it becomes clear it is in the PBM’s interest, not the payers’, to raise overall gross cost of treatment, only to insure a larger percentage rebate. The best example of this is the pending Anthem litigation against Express Scripts (ESRX), seeking $15 billion in damages and the abrupt end of its contract with Express.

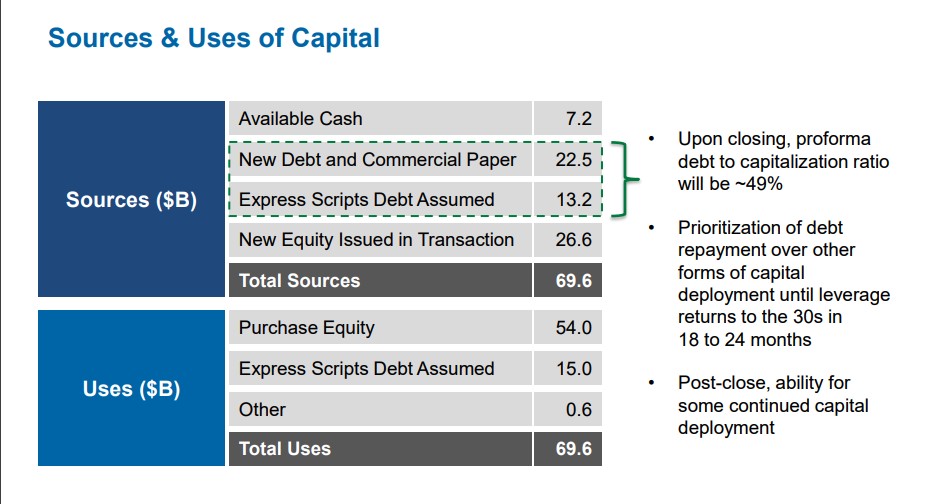

The potential demise of the standalone PBM may now be complete, with Express Scripts willing to sell itself to Cigna (CI) in a deal worth $67 billion, which includes the assumption of Express debt. We find it remarkable the speed of the unwinding of the PBM market. In less than a year after the rumored Amazon foray, CVS Health (CVS) purchased Aetna (AET) in a deal we unambiguously derided in a recent piece titled “CVS Health at the Crossroads, Too Much Debt” as we believe the combination is taking on an enormous debt load coupled with the distinct lack of meaningful synergies (as the management team indicated the deal will become accretive to earnings in year 2 of the deal). We have included a direct quote from our piece that neatly illustrates our disdain for the deal.

Unfortunately, we also weren’t very happy with the seeming lack of meaningful potential synergies as the proposed $750 million in “synergies,” if achieved, would kick in year two after the approval of the deal. We are looking at a mid-2020 event assuming the deal closes in mid-2018 as projected. Denton further clarified the synergy expectations in the following quote:

On the $750 million synergies, there’s virtually no revenue synergies tied to this. This is mostly cost and a little bit of, I’ll say, care management synergies as we think about getting — or helping consumers get the lowest-cost site of care for the most part. So, I wouldn’t think about this as revenue synergies at this moment. I do think longer term, there are opportunities to grow revenues as we think about the enterprise and all the capabilities that we’ll have here. As it relates to the permanent financing and the cost of that debt, it will depend a bit about the tenor in which we place our portfolio. But you would think about it probably in the 4% ZIP code is our current thinking. That could wiggle a bit based on the amount of short- versus long-term debt that we ultimately place at the end of the day.

Quote Source: CVS Health

Keep in mind CVS Health is predominately a PBM (Caremark division) with a network of providers of pharmaceutical services that encompass the entire spectrum of practice settings.

Image Source: Cigna Express acquisition presentation deck

Analyzing the Cigna Deal

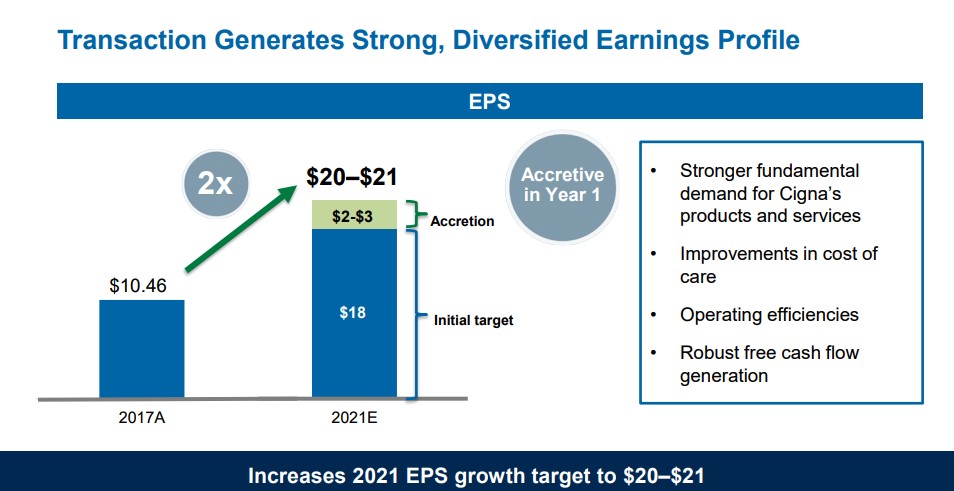

We are far more constructive on the Cigna/Express deal than the Aetna/CVS Health deal as the Cigna deal is immediately accretive to earnings. Cigna believes the deal will aid in nearly doubling 2017 realized earnings to $20-21 per share in 2021 as the new entity has identified nearly $600 million in duplicate cost reductions, which will enhance free cash flow thus allowing the company to rapidly de-lever.

Image Source: Cigna Express acquisition presentation deck

Two Different Models

There are now two unique business models at work, the augmentation of the PBM business through external acquisition coupled with the organic “build it by yourself” model. The main proponent of the organic model is United Healthcare which again has proven its leadership in healthcare by cultivating its superbly-managed OptumRx division. Optum has grown into the third-largest PBM in the country; it has also served as a rapidly-growing source of profitability for United, much to the dismay of its competitors.

We do not believe it is an accident that the new CEO of Anthem, Gail Boudreaux, a former executive of United is building out its own PBM from scratch via the aid of CVS Health. Anthem may have a golden opportunity thanks to Cigna to wiggle out of its disastrous Express deal earlier than expected.

By essentially removing the independent PBM for the marketplace, one of the potential areas for Amazon to disrupt has been eliminated, thus reducing the overall cost of healthcare. We would not be quick to count out Amazon out though, as its impressive track record of disrupting well-entrenched players is lengthy.

Concluding Thoughts

The healthcare sector is undergoing some significant changes, in an attempt to drive down the overall cost of healthcare, a very worthy undertaking. While a path has opened to reduce some of the intermediaries such as the PBM’s a whole host of unanswered questions remain. We will continue to closely monitor events in the healthcare sector with timely evaluations forthcoming when warranted. At the moment, we continue to prefer ideas in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

Related: XLV, IBB

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent healthcare and biotech contributor Alexander J Poulos is long Anthem and Amazon. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.