Image Source: Celgene Q4 2017 Earnings presentation

Although the combination of disruptive new discoveries coupled with burgeoning demand thanks to the aging demographics of the world’s population sets the biotech space for a potential virtuous long-term cycle, we’re not too happy with with the recent developments at Celgene. Let’s dig in.

By Alexander J. Poulos

Pipeline Woes Continue

The share price of Celgene (CELG) was accelerating heading into the Fall of 2017 as the strength of its existing oncology pipeline coupled with a few late-stage molecules augured well for a continued advance in the share price.

As detailed in a recent piece aptly named “Celgene Implodes,” the costly discontinuation of Mongersen cast doubt on Celgene’s ability to hit its long-term sales and earnings targets. Celgene, unlike its competitors in the biotech space, namely Gilead Sciences (GILD), remained a darling on the Street as the management team at Celgene would promote an earnings “roadmap” that assumed the approval of key pipeline assets, in direct contrast to the more reserved team at Gilead that would avoid such proclamations, in our view.

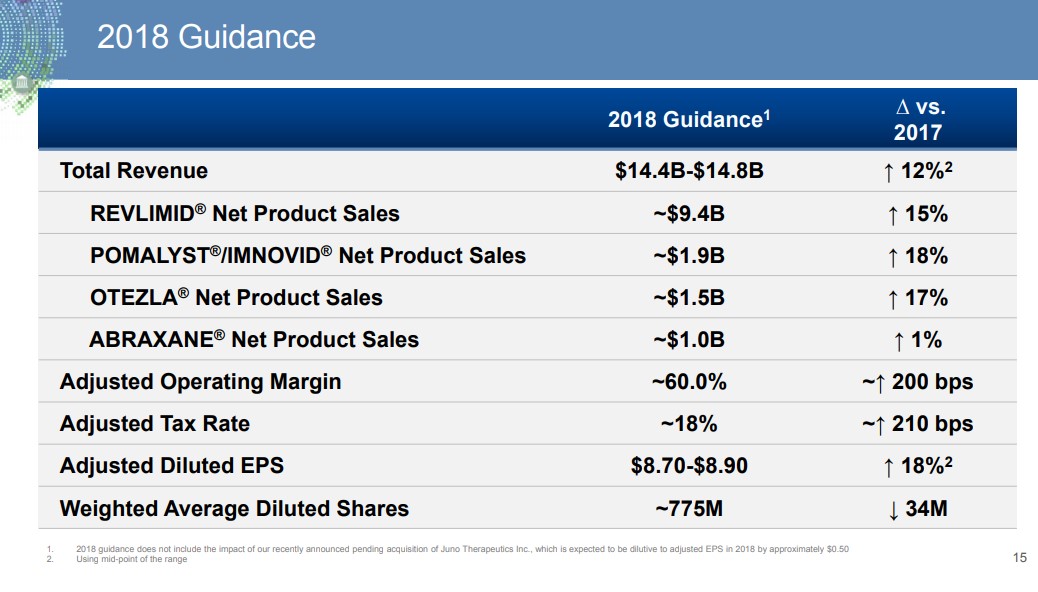

The drug-discovery business is inherently risky with little in the way of guaranteed success. Celgene’s descent began with the stunning failure of Mongersen in phase 3 trials even though the phase 2 data was less than robust. We continue to feel the weight of the roadmap may have clouded longer-term judgment, and the team at Celgene decided to “wing it” and press forth with a very costly phase 3 flop. The failure of Mongersen began the downward cascade that culminated with a simply abysmal earnings report on October 26, 2017, which saw revenues come in less than expected, which placed further pressure on the vaunted “roadmap.” Management saw fit to pour additional gasoline on the fire by reducing longer-term expectations—never a positive with the share price dropping nearly $20 per share to the $100 range, as many exited positions.

Our focus immediately shifted to Ozanimod, an asset Celgene acquired via the acquisition of Receptos in July of 2015 for the staggering sum of $7.2 billion in cash. Celgene initially believed it could break into the lucrative Multiple Sclerosis (MS) market and take on some of the industry heavyweights such as Biogen (BIIB) and Novartis (NVS). The Novartis treatment dubbed Gilenya is the most comparable product yet, in what we can only describe as another failure by Celgene’s management. Gilenya is losing patent coverage in 2019 after a recent courtroom failure. Bringing to market a similar product in a very expensive field when the mainstay therapy has lost patent protection is not the recipe for success. We fully expect payers will push back on the cost of Ozanimod, which will hamper its overall sales potential.

To neatly sum up the chain of events: Instead of sticking to its lucrative field of oncology, Celgene decided to venture into a new vertical (MS) by wildly overpaying for an asset with a challenging path to market that would have had a very difficult time distinguishing itself from the established product (Gilenya). Overpaying for an asset is hardly a recipe for longer-term success. Instead, we should view the disaster as a cautionary tale of the importance of disciplined deal-making.

Our preferred biotech idea, Gilead wisely declined to invest large sums in crowded fields. Gilead very methodically waited for the Car-T space to take shape and pounced on the asset (Kite) that has a commanding lead, in stark contrast to Celgene, which in our view, overpaid for an asset (Juno) that is much further away from entering the market. Celgene paid the equivalent of $9.9 billion versus $11 billion paid by Gilead for Kite, but Gilead gained critical first-mover advantage. Celgene is optimistically targeting a 2019 approval while Gilead’s product is already approved with the provider network ramping up as we speak.

Breakdown in Management

The skill of the management team in the biotech industry is heightened above what is typically seen in other sectors, as the best performers typically combine a stellar sense of the underlying science coupled with a sharp business acumen.

The team that comes from a strict sciences background is well versed in some of the underlying challenges in research versus the positive spin that often emanates from those with a marketing background. We can not stress enough we feel the long-term roadmap out to 2020 remains a critical misstep in a once-vaunted team—dare we say slavishly following the plan that has set forth a cascade of negative events that has simply destroyed the share price?

We feel the final straw is the recent refusal to file letter issued by the FDA for its key near-term asset Ozanimod. We harken back to what we originally posted—

Celgene wisely hedged its bets with the acquisition of Mongersen by acquiring the rights to Ozanimod, too, an innovative oral treatment that is being studied for a host of specialty diseases ranging from multiple sclerosis to Ulcerative colitis. We have recently reviewed the data posted by Ozanimod versus beta-interferon (Avonex) and came away impressed with the efficacy coupled with a side-effect profile on par with Avonex. We feel the oral dosage form is a crucial differentiator on par with Roche’s (RHHBY) recently-approved MS treatment Ocrevus. Ozanimod is currently in phase 3 trials for Multiple Sclerosis and Ulcerative Colitis along with phase 2 for Crohn’s Disease. Assuming the molecule is a success, it will in our opinion more than offset the expected loss of revenue from Mongersen.

Quote attributed to Alexander J. Poulos

The reason stated for the rejection by the FDA in our view highlights the utter disarray at Celgene—the application was rejected due to insufficiencies in the application.

Upon its preliminary review, the FDA determined that the nonclinical and clinical pharmacology sections in the NDA were insufficient to permit a complete review. Celgene intends to seek immediate guidance, including requesting a Type A meeting with the FDA, to ascertain what additional information will be required to resubmit the NDA.

The quote is taken from Celgene’s press release.

We cannot stress enough the huge anomaly of the FDA issuing a refusal to file especially for such a well-capitalized company such as Celgene. In layman’s terms, the application was filled out incorrectly—this is 100% unacceptable as an experienced team in conjunction with legal should have had the application in an acceptable form for the FDA to begin the review process. The denial will now set back the clock, which in our view, will delay the potential approval, thus wasting critical time in establishing the product before Gilenya loses patent protection and further complicating the product’s ability to become the blockbuster Celgene envisioned when it acquired the asset.

Celgene has a “Humira Problem.”

We currently view the mess at Celgene in similar terms to AbbVie (ABBV), namely a company with an outsize dependence on a single product for the vast majority of its revenue. We have been generally bearish on AbbVie’s prospects as multiple companies launched extensive patent challenges, which we felt would result in a binary event that could wreck an investment overnight if the patent protecting Humira was overturned. In essence, AbbVie holders could wake up the next day down over 30%, maybe more–never a good feeling.

AbbVie’s share price, however, has nearly doubled since the summer as euphoria has set in with clinical data on two late-stage assets, along with a more-favorable patent outlook. We do not believe Celgene will follow a similar path for a variety of reasons. The primary reason may perhaps revolve around the lack of a dividend. AbbVie wisely, in our view, rewarded shareholders with a generous payment, which provides underlying support for the share price.

Celgene, on the other hand, has decided to repurchase stock. It recently authorized a $5 billion share-repurchase plan, which in our view, parallels the failed plan undertaken by Gilead in 2016, which did little to arrest the share price slide. We cannot emphasize enough: Biotech and to a lesser extent big pharma may trade on the viability of the near-term pipeline—one shouldn’t let a low price-earnings multiple fool you, as it is a misleading metric as the assets valued are a wasting asset versus what is typically ongoing in other industries. Once the patent lapses, the product will often lose 90% of sales, maybe more, within five years due to generic competition.

Celgene’s best hope of diversifying its revenue stream took a big hit with the delay of Ozanimod. We think the failure coupled with the severe drop in the share price may more than likely lead to another takeout, as Celgene is now placed in a rather uncomfortable position of having to purchase an asset at elevated prices to more than likely meet its 2020 guidance. A further reduction in long-term guidance may further destroy any credibility the management team may still possess. This is far from the ideal set-up to negotiate a transaction, as the target now has the upper hand of waiting out Celgene, thus forcing them to overpay.

Conclusion

To say the least, the past two quarters have been less-than-kind for shareholders of Celgene as a series of missteps—some clinical and others avoidable—has simply decimated the share price. At this juncture, we are very uncomfortable in considering the company to the simulated newsletter portfolios, as we feel a few issues would need to be resolved before we are again comfortable with the company.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent biotech contributor Alexander J. Poulos is long Gilead Sciences. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.