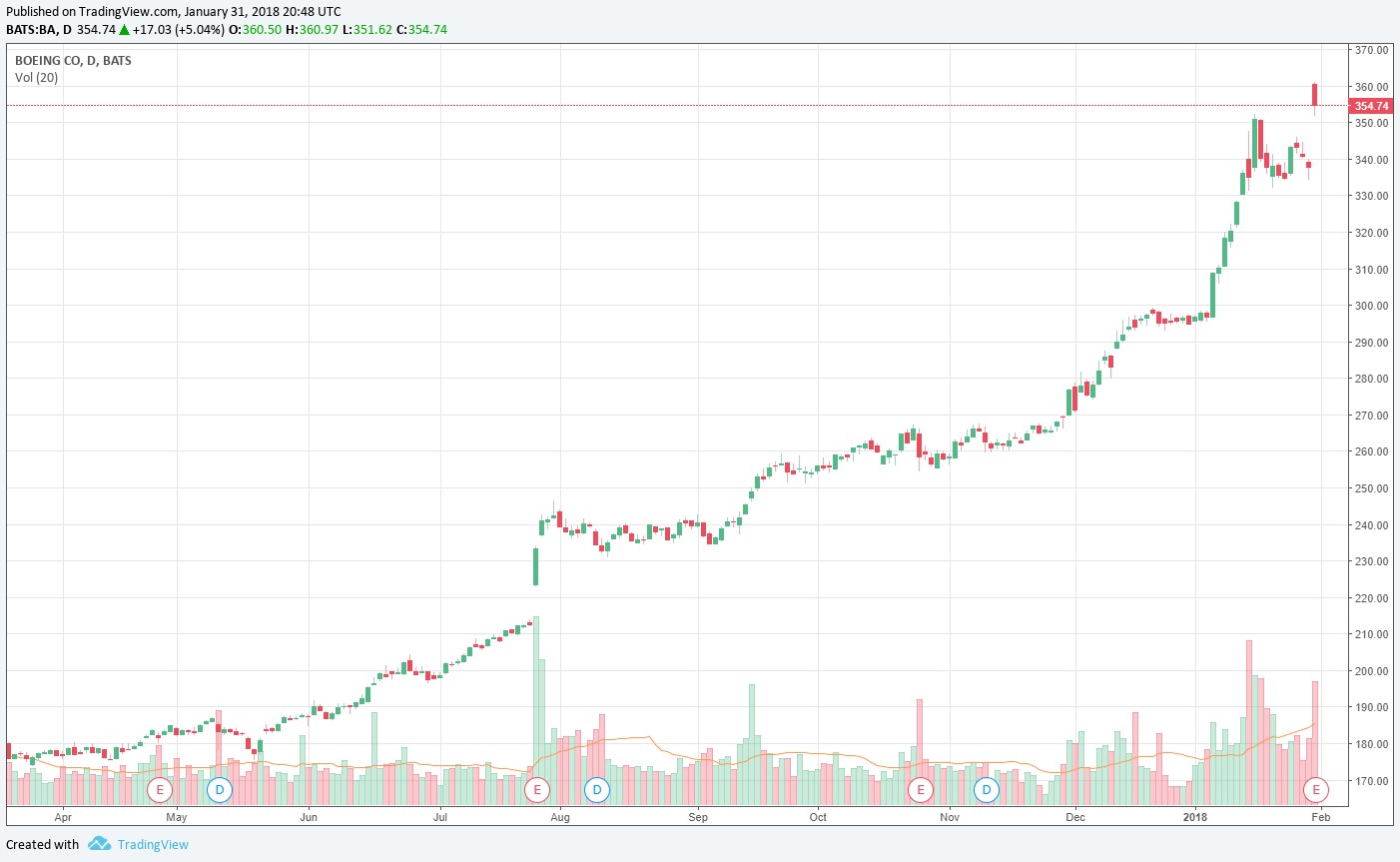

Image shown: Boeing’s shares have been rocketing higher of late!

We couldn’t be more pleased with how one of our best ideas for consideration has performed: Boeing!

By Kris Rosemann

Dividend Gowth Newsletter portfolio idea Boeing (BA) continues its tremendous share-price run of late, hitting all-time highs following its earnings report before market open January 31. The aerospace giant turned in 9% revenue growth on a year-over-year basis, while GAAP earnings per share doubled from the year-ago period to $5.18. Free cash flow remained robust in the full-year 2017, advancing to ~$11.6 billion from ~$7.9 billion in 2016. The company expects operating cash flow to climb to ~$15 billion in 2018 (up from $13.3 billion in 2017), and its revenue gudiance of $96-$98 billion and GAAP EPS guidance of $15.90-$16.10 for the year reflect expectations for a favorable operating environment to persist, a notion that is underpinned by its robust backlog of $484 billion (up from $474 billion at the end of 2016).

Trucking stocks are motoring higher during the January 31 session after Knight-Swift Transportation (KNX) reported impressive earnings results before the open. The company expects rate increases in 2018 to be in the high-single-digit to low-double-digit range in its contract business, the core driver behind the industry-wide rally, due to strength in the freight market and driver wage inflation. However, a driver shortage remains a key challenge for operators, and it could impact the ability of companies to grow capacity and take greater advantage of the higher rate environment.

Pharma giant Eli Lilly (LLY) continues to face pressure as a reduction in its 2018 earnings per share guidance accompanied an otherwise solid fourth quarter 2017 earnings report. This pressure comes on the heels of the potentially industry-disrupting announcement that came from the planned group efforts of Amazon (AMZN), Berkshire Hathaway (BRK.B), and JP Morgan (JPM) to disrupt the healthcare industry and meaningfully lower nationwide healthcare costs.

The impacts of such a development are being felt across the healthcare space (XLV), with pharmacy benefit managers (PBMs) and drugmakers susceptible to price erosion from biosimilar competition feeling the brunt of it at this point as lower costs, scale efficiencies, and improved technology are the expected core tenants of the venture. Nevertheless, new product revenue growth at Eli Lilly of more than 12% in the fourth quarter was more than able to offset weakness in other areas as recent expirations provided a ~5.4% drag on the top-line in the quarter. Innovative drug development will never go out of demand.

Enterprise Product Partners (EPD) reported a record operational quarter before the open January 31 as volumes pushed higher and improved natural gas processing margins and lower turnaround expenses in its ‘Petrochemical’ segment drove record quarterly operating income, gross operating margin, adjusted EBITDA, and distributable cash flow (excluding proceeds from asset sales. On a related note, crude oil inventories came in significantly higher than expected for the week ended January 31 according to the EIA, a development that may be worth monitoring following conflicting comments from OPEC leaders and the EIA regarding the impact of US production levels on inventory levels and the balance of the global oil markets.

Bitcoin (XBT, GBTC) is on track for January to be its worst month since December 2013 as concerns over regulatory scrutiny mount. Subpoenas sent to a cryptocurrency exchange by the US Commodity Futures Trading Commission, a crackdown on cryptocurrencies in South Korea (EWY) and China, and tightening regulations in Japan (EWJ) following a ~$530 million theft by hackers are all reasons for the pessimism. The digital asset remains a tremendously speculative vehicle.

Meanwhile, a meaningful moment for stock market historians may be on the horizon, according to Deutsche Bank, which is speculating that General Electric (GE) may be dropped from the Dow Jones Industrial Average. GE is an original member of the index, which is comprised of 30 companies and dates back to 1896. A shrinking portfolio, challenging global power generation markets, potential cash flow shortfalls, management turnover, and SEC investigations are a few of the obstacles the industrial giant will have to overcome in the near term to retain its position in the index.

Healthcare Products Distributors: ABC, CAH, ESRX, HSIC, MCK, OMI, PDCO, STAA

Health Care Providers & Services: ALR, DGX, LH, PRXL, TVTY

Health Care Services: CYH, DVA, HLS, LPNT, MD, THC, UNH, UHS

Related tickers, CVS, WBA