Let’s walk through some of the news before the Thanksgiving holiday, and one of the bigger missteps we made during 2017.

By Brian Nelson, CFA

I’d like to run through the news before many of you take a break for the Thanksgiving holiday. Thanks again for your attention. It means the world to our team that you see and understand the things that we’re doing, the great calls we make with our top-weighted ideas (see here and here), the extensive valuation processes we perform with respect to the discounted cash-flow process (see here), and how we provide that in downloadable pdf form (see here) – and we’re here to talk about our expectations! You can get reports from anybody, of course, but access to the analyst team? At what cost? Now, you’re getting it. ðŸ˜Å

You know what? Let’s start with those top-weighted ideas. Visa (V) is now a ~$110+ per share stock at the time of this writing. Apple (AAPL) is trading north of $170+ per share–these are the top two weightings in the Best Ideas Newsletter portfolio. Johnson & Johnson (JNJ) is hovering around $138 per share at last mark, while Intel (INTC) is roughly a $45 per-share stock. Those are two of our favorite dividend growth ideas. Alphabet (GOOG, GOOGL) is soaring over $1,000 per share, and Priceline is looking to get back on track at $1,750+ at the time of publishing. We’re really excited about Facebook (FB). The company is trading just north of $180 per share, but we think the equity is worth ~$220 on a per-share basis. PayPal (PYPL) is approaching $80 per share. Those are just a handful of stocks in the newsletter portfolios doing really well that we like quite a bit. Don’t forget Microsoft (MSFT), too!

Moving through the news, there’s not too much going on. Cracker Barrel (CBRL) reported a decent fiscal first quarter report, November 21, that showed only a modest increase in comparable restaurant sales thanks to strength in average check prices as traffic continues to fall, but it overcame some very tough weather. We like Cracker Barrel in part because of its “hidden” special dividends, but the company is facing quite the uphill battle with respect to industrywide traffic. In any case, it remains one of our favorite dividend-paying restaurants, and its outlook for fiscal 2018 wasn’t bad. Comparable store restaurant sales are expected to advance 2%-3% during the year, while comparable retail sales are expected to come in flat. Diluted earnings per share for the fiscal year is targeted at $8.75-$8.90. Read the commentary from the press release:

We delivered positive comparable store restaurant sales in the first quarter, outperformed our casual dining peers, and exceeded our earnings expectations, despite the challenges presented by the impact of hurricanes Harvey and Irma on many of the communities in which we, our customers and our employees live and work. In addition, our field and leadership teams made significant progress on the introduction of several key business initiatives, including the system-wide rollout of our off-premise platform. While being more cautious in our industry outlook and in our expectations for continued wage and commodity pressure, we remain well-positioned to deliver top-line performance and earnings growth as a result of our fiscal 2018 initiatives.

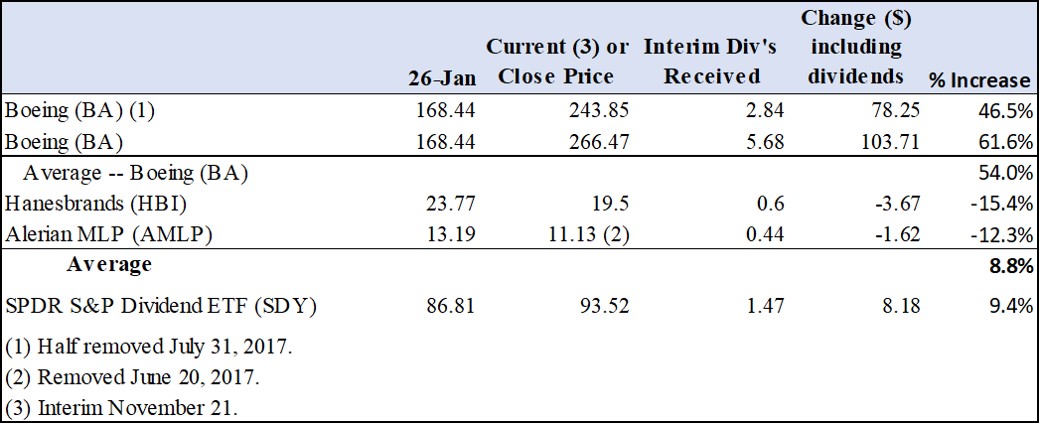

Quickly, I wanted to run through the outcome of one of the email notification ideas we presented as it relates to the Dividend Growth Newsletter portfolio January 26, 2017 (here). First and foremost, it hasn’t worked out as good as some of our other ideas, and we made an unforced error in the Alerian MLP (AMLP)–because we know we don’t like the group, generally–and Hanesbrands (HBI) continues to be beaten down unfairly, in my view. But to be completely fair to us, we haven’t heard much about Boeing (BA). Boeing’s shares have been among the best performing in the Dow Jones Industrial Average this year and surpassed General Electric (GE) as the largest industrial.

I swear we must have the worst luck because in what amounted to a simulated 9% portfolio position, in aggregate for the three new ideas, actually advanced nearly 9%, in aggregate, and only trailed the SPDR S&P Dividend ETF (SDY) by 60 basis points over the same time period, or on a portfolio level creating negative alpha of ~6 basis points! 6 basis points! Am I too hard on myself? I think I am. When you think about what the heavy hitters in Johnson & Johnson and Intel did this year in the Dividend Growth Newsletter portfolio, I must be losing my mind to be disappointed in Hanesbrands or Alerian MLP, right? When you look at the three ideas presented January 26, in aggregate, too, they collectively advanced nearly 9%! That’s a positive 9%.

You can view our “terrible” negative alpha-generating “trade” in the image below:

Before we wrap things up before the holiday break, I wanted to let you know that the DOJ is giving AT&T (T) some trouble with its Time Warner (TWX) deal, but we hope to share more on that as things progress. We think the media landscape is troublesome, and we’re steering clear of AT&T, as it will only be a matter of time before the likes of Netflix (NFLX) and/or Amazon (AMZN) really accelerate the natural course of disruption, which has already started. If you’re looking for some great holiday-break reading, check out this paper we wrote up a few weeks ago. I hope you like it.

Have a wonderful Thanksgiving holiday, and thank you so much!