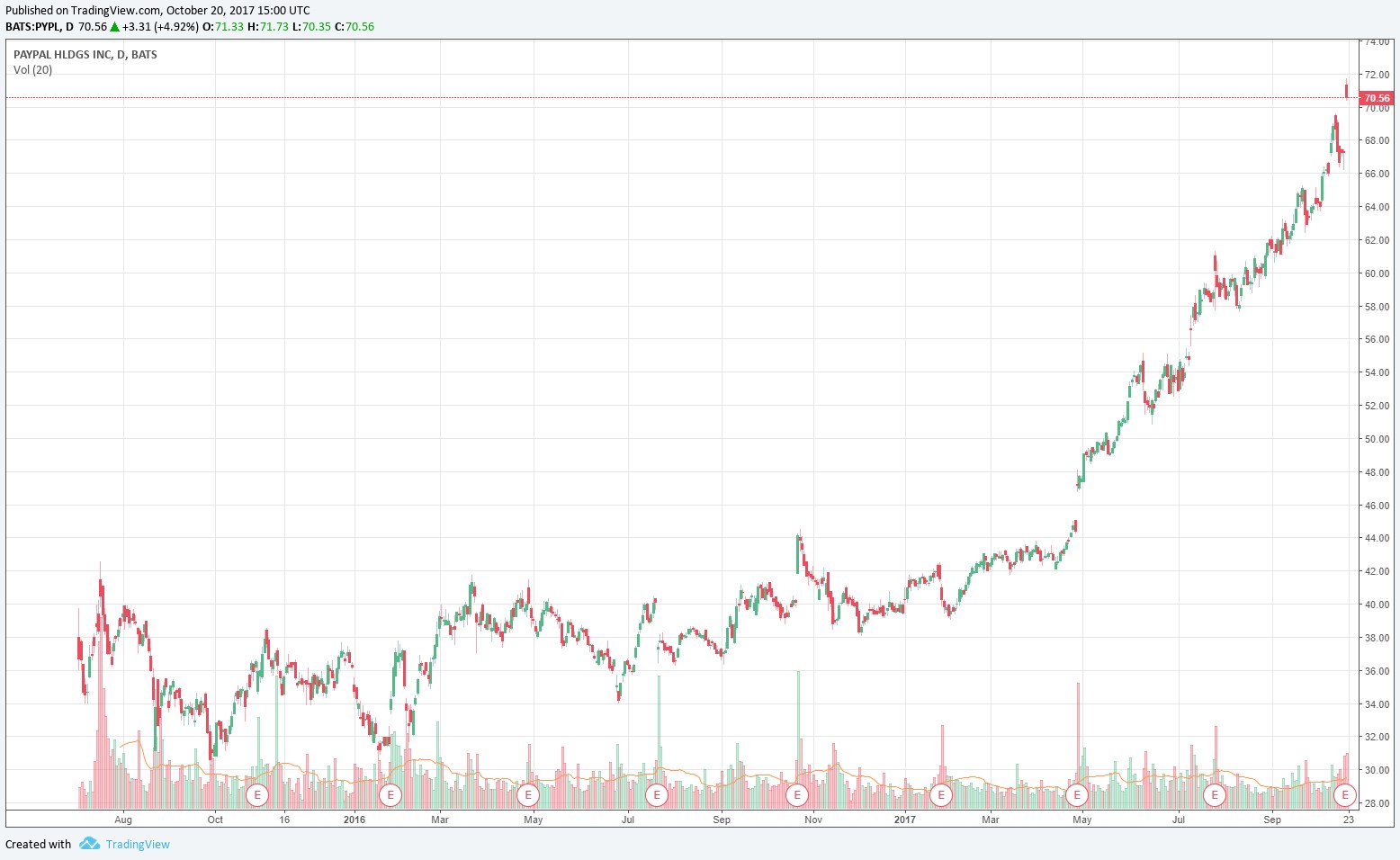

Image Shown: PayPal’s stock has been a huge winner in the Best Ideas Newsletter portfolio.

Payments processor PayPal reported fantastic third-quarter results and raised its full-year guidance for the third time in as many quarters. Shares are surging.

By Brian Nelson, CFA

We thought PayPal’s (PYPL) second-quarter results were fantastic, but its third-quarter results, released October 19, were even better. For a little background, here’s what we said about PayPal in July:

PayPal’s revenue advanced 20% in the second quarter, after excluding effects from currency exchange, and the company leveraged that growth into an impressive 27% jump in GAAP and non-GAAP earnings per share, the latter to $0.46, coming in ahead of expectations. PayPal added 6.5 million active customer accounts during the period, with net new additions up 80%, and its $106 billion in total payment volume was 26% higher than the mark in the year-ago period on a foreign currency neutral basis. The online payments innovator’s newly-landed partnership with Baidu (BIDU) July 26 broadens its opportunity with Chinese consumers, and news of the extension of its existing partnership with Visa (V) into Europe is equally exciting.

PayPal’s cash-flow generating capacity and balance-sheet health are top notch. The company generated operating cash flow of $921 million and free cash flow of $747 million during the second quarter of the year, both solid marks, and it ended the second quarter with more than $4 billion in cash and no short- or long-term debt. PayPal raised its full-year guidance, too, now calling for non-GAAP earnings per share in the range of $1.80-$1.84 (was $1.74-$1.79) on expectations of a 19%-20% increase in revenue (was 17%-19%), adjusting for impacts from currency exchange. This is the second time PayPal has raised guidance in as many quarters.

PayPal’s outlook for 2017 just got a tad bit better. Now, the company expects revenue to grow at a 20%-22% clip on a foreign-exchange neutral basis, and non-GAAP earnings per share is targeted in the range of $1.86-$1.88. That makes the third guidance increase in as many quarters, and frankly, we like the momentum behind the business, and management’s ability to set expectations. PayPal added 8.2 million active customer accounts in the quarter, and the 1.9 billion payment transactions processed during the period implies 26% growth. Operating cash flow during the third quarter eclipsed $1 billion, while free cash flow jumped to $841 million, up 36%. PayPal’s cash and cash equivalents totaled $7.1 billion at the end of the quarter, and the company has no debt to speak of.

We second CEO Dan Schulman’s view that “as the world rapidly accelerates to digital payments, (PayPal has) a tremendous opportunity in front of (it).” We’re pretty excited about the company that the Best Ideas Newsletter portfolio inherited from eBay (EBAY) some time ago, and while its chart is a bit extended at the moment, we’re going to continue to watch this big winner run. We rate its Economic Castle as ‘Attractive.’ What is an Economic Castle?

See here: /Valuentums_Economic_Castle_Rating