DaVita has been left out in the cold with its share price losing ground in 2017 due to continued fears over reimbursement of care.

By Alexander J. Poulos

Overview

DaVita (DVA) is an innovative healthcare provider with its primary focus on high-quality dialysis care. DaVita has embarked on a journey to consolidate the highly-fragmented dialysis care market through a series of acquisitions, which have transformed the enterprise into one of the largest providers in the United States. Industry consolidation is inevitable as US government insurance (Medicare) accounts for the bulk of reimbursement. We feel the industry operates as a quasi-oligopoly with few incentives for the individual players to compete on price.

Reimbursement Woes

We feel Davita remains under a cloud of suspicion due to its reliance on the American Kidney Fund (AKF) for reimbursement for some of its patients. The AKF is a charity that was founded in 1971 with its mission to educate and advocate on behalf of those afflicted with kidney disease. Under current US law, charitable organizations can assist patients with their healthcare costs including premium assistance. The share price of Davita came under intense selling pressure in the late summer of last year upon the release from CMS of a public request for information as to the extent of premium assistance given to dialysis patients. CMS is concerned that patients may be steered into plans that would benefit the providers the most instead of traditional Medicare.

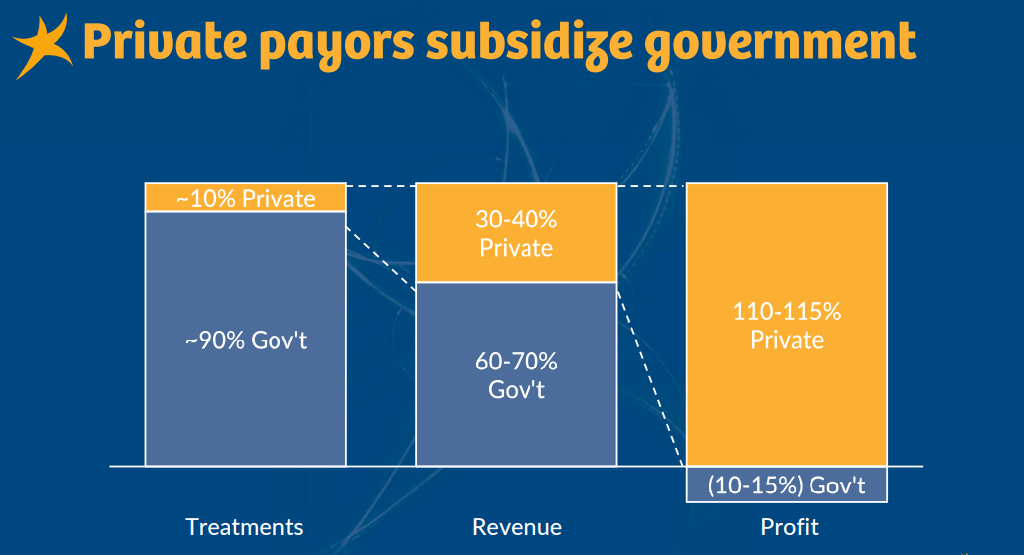

Image Source: DaVita Capital Markets Day

To some, we feel the reimbursement dynamics in the dialysis market may give the perception of an underhanded scheme. If a patient has private insurance and requires dialysis, Medicare coverage will begin in the fourth month of treatment. From this point, assuming a permanent loss of kidney function, a coordination period of 30 months begins with Medicare acting as the secondary payer. Let’s keep in mind, after 30 months all of the patients will have Medicare cover treatment which is not a profitable endeavor for the dialysis providers yet by law is a certainty. As a recipient of Medicare, a patient may choose a Medicare Advantage plan which often offers greater coverage options than traditional Medicare—the ability to choose is an individual right much like those who are granted Medicare based on age (CMS mentions this in its handbook):

Medicare Advantage Plans & other options

You usually can’t join a Medicare Advantage Plan (like an HMO or PPO) if you already have ESRD and haven’t had a kidney transplant. However, you may be able to join a Medicare Special Needs Plan (SNP), if one is available in your area for people with ESRD. A Medicare SNP is a type of Medicare Advantage Plan for people who have a severe or disabling chronic disease, who are institutionalized, or who are entitled to Medicaid. These plans must provide all Medicare Part A and Medicare Part B health care and services, as well as Medicare prescription drug coverage. You also may be able to join a Medicare Advantage Plan if you are already getting your health benefits (for example, through an employer health plan) through the same organization that offers the Medicare Advantage Plan. While you are in a Medicare Advantage Plan, your plan will be the primary provider of your health care coverage. If you had ESRD, but have had a successful kidney transplant, and you still qualify for Medicare benefits (based on your age or disability), you can stay in Original Medicare, or join a Medicare Advantage Plan.

Quote Source: CMS

Quantifying the Impact

DaVita issued a press release estimating the net impact of the loss of charitable assistance would impact operating income by $100-250 million. We happen to agree with DaVita’s assessment the discontinuation of charitable aid is highly unlikely as it will force many to discontinue treatment. We feel it is important to highlight the patient class afflicted with dialysis are the “sickest of the sick.” We would be shocked if the public at large would allow this outcome. We feel the third and fifth bullets are the most salient points.

In assessing the likelihood of dialysis patients losing access to charitable premium assistance, it is important to keep in mind several factors:

1. The ability to obtain and maintain optimal insurance coverage is of tremendous importance to dialysis patients, given their multiple comorbidities and associated high utilization of healthcare services. For some patients, Medicare is the best insurance, while for others commercial coverage is much better than Medicare.

2. Paying for coverage is a significant financial burden for many patients, as ESRD disproportionally affects the low-income population. Charitable assistance plays an important role for these patients by alleviating at least some of their financial burden.

3. Eligibility for charitable assistance is based on financial need, independent of whether the patient chooses a commercial or government plan. In fact, nearly 80% of patients receiving charitable premium assistance have Medicare as primary coverage.

4. Charitable assistance has long been a part of the government-designed dialysis ecosystem, with explicit recognition not only of the benefit of such assistance to dialysis patients, but also acceptance of provider funding for such assistance in an advisory opinion from the Centers for Medicare and Medicaid Services (CMS) Office of Inspector General (OIG).

5. Commercial health insurers are not disadvantaged by the unique rules of the ESRD ecosystem. They receive two unique, large government subsidies, namely the ESRD Medicare entitlement for patients under 65 and the 30-month limitation of the Medicare Secondary Payer statute.

Quote Source: DaVita

Cash Flow

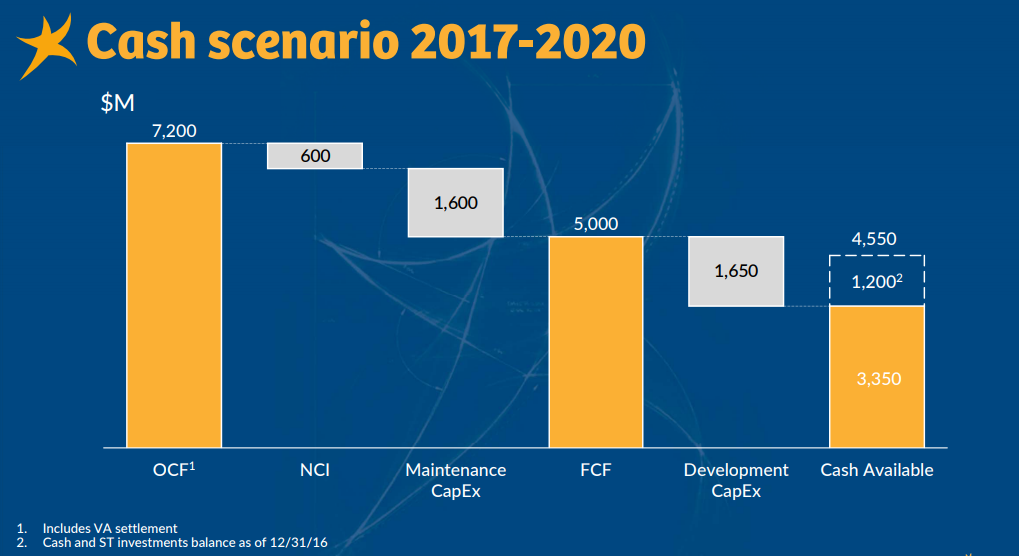

Our continued coverage of DaVita revolves around the enterprise’s unique ability to generate a tremendous amount of free cash flow. We remain impressed with the low-single-digit top line growth generated by DaVita, coupled with an uber-predictable business model that allows for more accurate modeling versus what is seen in the more cyclical industries.

Image Source: DaVita Capital Markets Day

DaVita has traditionally utilized its free cash flow to repurchase shares in addition to acquiring competitors. We feel the most recent acquisition of Healthcare Partners remains a work in progress as DaVita’s management team may have overpaid. The acquisition has diversified DaVita’s product offering, but in our view an error may have been made. Healthcare Partners’ (HCP) margins are far lower than the Dialysis unit, thus depressing overall margins.

The current CEO of DaVita has now assumed the lead role of the HCP unit, but we feel incremental gains have been made. We would prefer if the group were cleaved off returning DaVita to its roots as a premier provider in the US of dialysis, thus allowing management to pivot towards building out the brand overseas where it has a minor presence. The dialysis market has a firm tailwind at its back due to the worldwide aging demographic coupled with the sharp rise in obesity and diabetes (which increases the risk of kidney disease).

DaVita’s equity has experienced a near five-year standstill. The dreadful underperformance of the company in the midst of fast-ascending stock market, may be a cautionary tale of the problems that may arise from a growth-via-acquisition model. In Davita’s case, the departure from its core competency remains a big setback for shareholders.

Concluding Thoughts

We will continue to monitor events as they unfold at Davita. Davita is currently trading near the bottom end of our fair value range, but we are presently not enamored with the share price. We feel the missing element is the technical backdrop (market support that our fair value is “correct”) as the equity recently posted a new one-year low. At this juncture, we will remain on the sidelines, but will continue to monitor events as they unfold.

Health Care Services: CYH, DVA, HLS, LPNT, MD, THC, UNH, UHS