Image Source: AbbVie

In the pharmaceutical realm, the productivity of the clinical pipeline is essential to replace the loss of revenue due to an expiration of the patent life of a product. AbbVie is facing the monumental task of having to diversify away from the top-selling pharmaceutical product in the world with little in the way of assurances the transition will be a success. We are pleased with the recent data release on Upadacitinib as we view the molecule as AbbVie’s top R&D product.

By Alexander J. Poulos

Upadacitinib in Rheumatoid Arthritis

AbbVie (ABBV) believes it can successfully transition its portfolio from top-selling product Humira over to its next-generation treatment. AbbVie’s Upadacitinib belongs to the novel class of JAK-1 inhibitors, which in our view, hold significant benefits over the current TNF blocking agents. We see the once-a-day oral formulation as a distinct advantage of the class. We feel once the products begin to enter the market, they may immediately erode market share, with the older products such as AbbVie’s Humira and Amgen’s (AMGN) Enbrel the most vulnerable. The head-to-head clinical data of the class thus far versus Humira augments our belief in the superiority of the treatment.

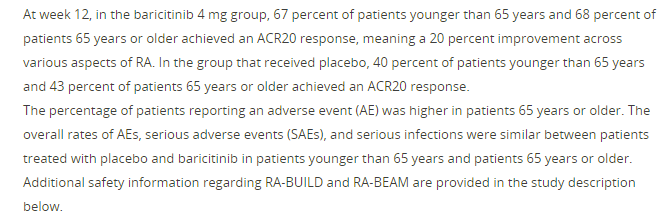

The first of its particular class to file is Baracitinib which is co-developed via a partnership between Eli Lilly (LLY) and Incyte (INCY). Lilly has a notable sales force in the field; we feel once Baracitinib may be approved, it will synergistically blend with Lilly’s Talz from a marketing and sales force perspective. We were shocked when the FDA issued a complete response letter denying Baracitinib marketing authority while the FDA’s European counterpart authorized the product for sale. The CR letter has thrown the future of the product under considerable doubt; if additional clinical trials are deemed necessary, it could delay the product for more than two years, thus negating critical first-mover advantage. We are pleased to see Lilly has decided to refile for approval in January with an expected six month period needed for review. We expect the product will be approved as the need for additional therapies for Rheumatoid Arthritis (RA) remains in dire need. Keep in mind Baricitinib has documented trials demonstrating a notable efficacy above what is witnessed in Humira.

Image Source: AbbVie

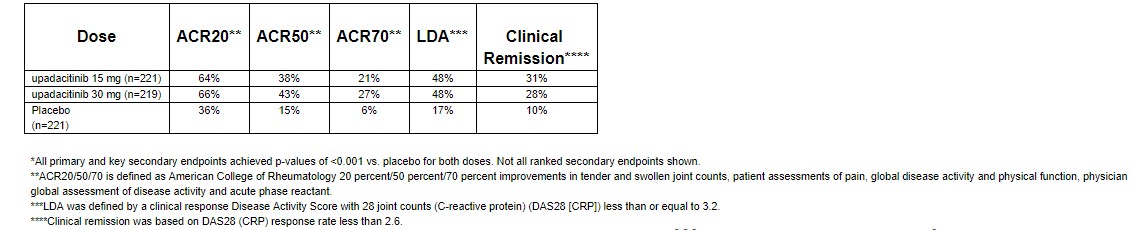

AbbVie, to its credit, is not sitting idly by, as a direct threat to its therapeutic superiority is about to enter the market. Abbvie has released some impressive phase 3 data which demonstrated a 66% reduction in ACR 20, in-line with the data posted by Baracitinib. Thus far, Abbvie reports that Upadacitinib does not demonstrate any new safety signals with the increased risk of blood clots cited by the FDA as the main reason why they initially rejected Baracitinib.

Image Source: Incyte Corp

Gilead Sciences (GILD) has also entered the fray with Filgotinib, thus ensuring what we’d describe as fierce competition for the top spot in the Jak-1 Class. Filgotinib has posted an ACR20 of 69 for those with high expression of the C-Reactive protein and 80 for low C – reactive protein expression patients treated at the 200mg a day dose in recent phase 2 studies. We would like to caution readers not to place an absolute value on the actual number–it is not reasonable to conclude that Filgotinib must be superior just because it posted an ACR 20 of 80 as there are some variables in each study.

We view the data as supportive of the class as a whole with a demonstrable difference in efficacy over conventional treatments. We feel the eventual winner of the class will emerge a few years post-marketing as real-world safety data is amassed. At the current time, assuming Baracitinib is approved next year, the product will have a head start over the other products in the group, but the first-mover advantage would have been much more robust as Lilly/Incyte would have had ample time to gain formulary approval. We feel 2018 will be a baby step for Baracitinib as the product will be left off most formularies with the biggest jump in sales occurring in 2019 upon full formulary placement.

Upacitinib for the Treatment of Atopic Dermatitis

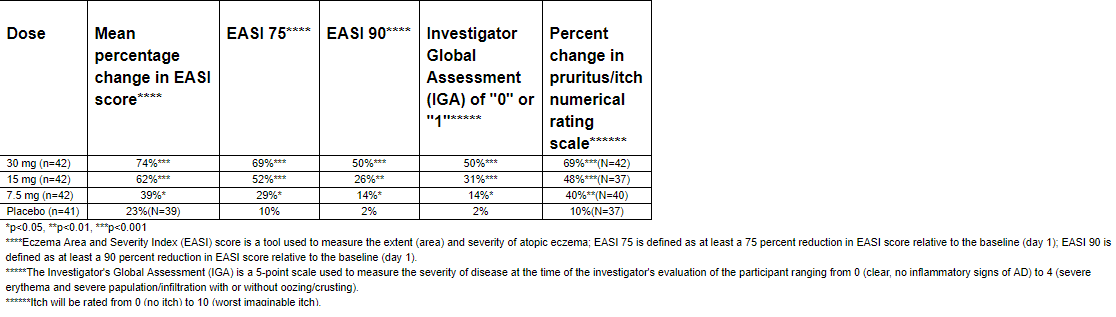

We are impressed with the data posted by Upadacitinib for the treatment of Atopic Dermatitis (AD). The treatment fields for AD remains wide open with Regeneron Pharmaceuticals (REGN) Dupixent the most notable new entry into the field. We view the AD market as robust with significant unmet need. Regeneron has a commanding lead with a significant first-mover advantage but payers would love for an upstart to enter the field, thus opening up ample room for negotiations and placing a “soft cap” on the ability to hike prices.

Image Source: AbbVie

Upadacitinib posted some impressive phase 2 data that indicates the product is effective in the treatment of AD. The results posted resemble the initial phase 2 results of Dupixent, with Upadacaitinib holding the key advantage of oral once-a-day dosing versus an injectable formulation for Dupixent. We remain highly impressed with the management team of Regeneron from a reimbursement sense; thus far, they have not raised the initial price of Eylea since its entry into the market and have “value priced” both Kevzara and Dupixent with the express purpose of gaining favorable formulary placement.

The pricing decision compares favorably to the standard industry practice of annual to bi-annual price hikes well in excess of the rate of inflation, thus indicating in our view the overall “tone deaf” level of upper management to the current political landscape concerning the price of healthcare. For example, AbbVie’s CEO Gonzalez pledged to raise the price of Humira once this year (8.4% is the actual increase) at a rate of less than 10% after hiking prices twice in 2016 (9.9% in January and 7.9% in June). We feel the following statement by CEO Scliefer neatly sums up Regeneron’s position on pricing:

“But the real reason we’re not liked, in my opinion, is because we as an industry have used price increases to cover up the gaps in innovation. That’s just a fact.”

Quote Source- Business Insider

Regeneron remains a disrupter in the pricing model of the industry, a fact that may negatively impact AbbVie’s ability to offset the expected rate of decline of its Humira franchise. While final reimbursement numbers between payers are kept confidential, if we utilize list prices, the reimbursement challenge posed by Regeneron becomes evidently clear. Dupixent is priced at $37k or $3,083 per month versus Humira’s current rate of $4,400 or $52.8k per year. AbbVie will need to price Upadacitinib in line with its current Humira price or risk mass defection to a more efficacious lower-priced option. With the dose of Upadacitinib in AD matching the treatment needed in Rheumatoid Arthritis, AbbVie is faced with an interesting dilemma. Should it undercut the price of Regeneron at $37k per year realizing that it will have now set the same price in RA, thus effectively sowing the seeds of Humira’s decline? There is an interesting precedent for such activity by none other than AbbVie, which aggressively priced its Viekira Pak treatment in hopes of stealing share in the HCV market from Gilead Sciences. AbbVie did take some share, but upon the entrance of a third competitor in Merck (MRK), all pricing power was lost with little in the way of recovery thus far.

Concluding Thoughts

Our cautious stance on AbbVie remains, even with the strong move in the equity over the past couple of months. With Abbvie’s over-reliance on one product for the bulk of its revenue, we feel the competitive landscape will shift dramatically over the next few years with little in the way of assured success.

We remain bullish on the future of Imbruvica and remain impressed with the potential of Upadacitinib. We do not feel Upadacitinib will come even close to replacing the expected revenue decline in Humira, however, especially with two other products of similar efficaciousness about to enter the market.

We continue to be bullish on the prospects of Gilead Sciences as the name resides in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. We added exposure to Gilead well in advance of the equity’s recent surge upswing; it seems that most of the uncertainty over its future revenues have been answered with the acquisition of Kite Pharma.

Disclosures: Independent healthcare and biotech contributor Alexander J. Poulos is long shares of Gilead Sciences, Regeneron Pharmaceuticals, and Incyte Corp.