Image Source: P&G

Let’s look at recent results from consumer-products behemoth P&G. Shareholders have benefited from the best of both worlds at P&G of late. Activist pressure is keeping management on its toes, and we like that a lot.

By Brian Nelson, CFA

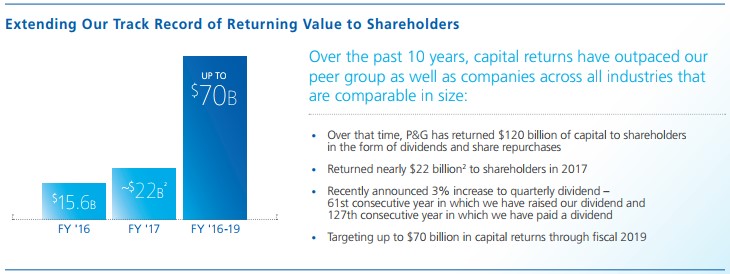

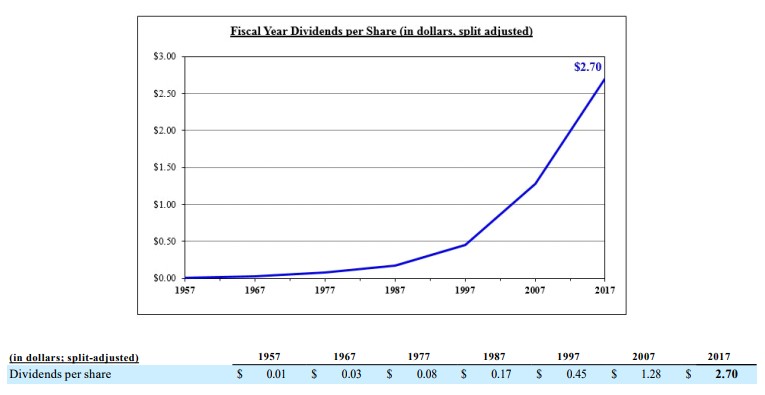

Procter & Gamble (PG) is a wonder of a company. Almost everyone knows its name, and it’s hard to argue against the view that its consumer-packaged goods have improved the lives of millions of consumers around the world. What we like most about P&G, however, is its history. Built on the foundation of an enterprise started by William Procter and James Gamble in 1837, P&G has a lot to be proud of over its long lifespan. The company’s recent 3% dividend hike, for example, marked the 61st consecutive year in which it raised the payout, and the 127th consecutive year in which it has paid a dividend. Our readers love ideas with incredible consistency, and Procter and Gamble fits that mold.

Image Source: P&G

In the past, we were worried about Procter and Gamble’s business transformation where it shed many well-known brands rather quickly, but we think our worries were overblown–if the company’s share-price performance is any indication. The company wrapped up fiscal 2017 results July 27, and frankly, the results were solid. Both the top line and operating income advanced over fiscal 2016 results, and net earnings from continuing operations approached levels that were once were a function of higher revenue performance.

P&G’s net income margin, for example, hit 15.7% in fiscal 2017, steadily increasing from 11.7% in fiscal 2015, and up from the 14.3%, 14%, and 12.1% marks set in fiscal 2014, fiscal 2013, and fiscal 2012, respectively. Clearly, we were underestimating P&G’s ability to execute its transformation plan, but we sure are happy to have still included the idea in the Dividend Growth Newsletter portfolio. Letting winners run has proven to be a fantastic component of the Valuentum approach during this prolonged, multi-year market upswing.

The company’s guidance for fiscal 2018 was also encouraging:

P&G said it is projecting organic sales growth in the range of two to three percent for fiscal year 2018. P&G estimates all-in sales growth of about three percent for fiscal 2018, which includes a neutral to half-a-percentage point benefit to sales growth from the combined impacts of foreign exchange and acquisitions & divestitures.

The Company said it expects core earnings per share growth of five to seven percent for fiscal 2018 versus core EPS of $3.92 in fiscal 2017. P&G said it expects core EPS growth in fiscal 2018 to be driven primarily by core operating profit growth. Additionally, a modest benefit to core EPS from a reduction in common shares outstanding will be partially offset by a net headwind from changes in interest expense, interest income and other non-operating income. P&G expects the core effective tax rate to be around 24%, essentially in-line with the fiscal 2017 rate.

All-in GAAP earnings per share are expected to decrease 26% to 28% versus fiscal year 2017 GAAP EPS of $5.59, which included the significant benefit from the Beauty Brands transaction that was completed in October 2016. The fiscal 2018 GAAP EPS estimate includes approximately $0.10 per share of non-core restructuring costs.

P&G said it expects results for the first quarter of fiscal 2018 to be the lowest organic sales and core EPS growth period of the year, as the period compares against the highest organic growth base period. Top-line headwinds from portfolio choices and the recent Gillette price reduction in the U.S. will primarily impact the first half of fiscal 2018 and will annualize as the year progresses. Additionally, productivity savings are expected to build throughout fiscal 2018.

The good business momentum, however, hasn’t stopped activist investors from asking for more. Recently, P&G released a letter outlining how it plans to continue to create economic value in hopes that shareholders will defeat the proxy fight with Nelson Peltz of Trian Fund Management, which holds a 1.5% stake, and on August 16, P&G followed up again, talking directly to shareholders. We like the efforts of and conviction by management in its current plan, but we also like that Nelson Peltz is keeping the executive team on its toes. No matter what may happen, it has been the best of both worlds for shareholders of late, with P&G’s stock price now north of $90 again, approaching highs last witnessed in late 2014. We’re going to keep letting this winner run for now in the Dividend Growth Newsletter portfolio. Shares yield ~3% at the time of this writing.