Image Source: Cisco

Cisco is trading well below the market multiple, while sporting a large net cash position and a solid cash dividend backed by copious amounts of free cash flow.

By Brian Nelson, CFA

Cisco’s (CSCO) name has become synonymous with networking, but over the years, the company has broadened its appeal as the preeminent go-to entity for delivering a vast portfolio of incremental IT-based products and services. It’s hard not to like its enviable position at the intersection of data, the cloud, video proliferation, enhanced mobility, the growing need for security, and the increased importance of collaboration and analytics. Rightly so, Cisco believes that “data is the most strategic asset,” and it is working tirelessly to connect “everything that can be digitally connected.” From where we stand, the tech giant is at the sweet spot of helping businesses and governments around the world in an increasingly-connected global environment. Cisco is also shifting its business model to one with a more predictable revenue stream, a move we applaud. From Cisco’s 10-K:

Over the last several years, we have been transforming our business to move from selling individual products and services to selling products and services integrated into architectures and solutions…We have begun aggressively transitioning our portfolio to enable delivery both on premise and through the cloud in alignment with our strategy to shift to a business model based on more recurring revenue. We plan to expand the approach we have taken with our cloud-networking platforms to an increasing portion of our product and service portfolio to accelerate our shift to a more subscription and software-based model…We continue to drive product transitions, including the introduction of next-generation products that offer, in our view, better price-performance and architectural advantages compared with both our prior generation of products and the product offerings of our competitors. We also plan to continue to deliver innovation across our portfolio in order to sustain our leadership, and strategic position with customers.

Cisco reported decent fiscal fourth-quarter (calendar second quarter) 2017 results August 12. The company’s gross margin faced pressure during the quarter, but we can’t help but feel it was more timing-related even as the company noted that pricing was a factor. Though the top line faced some headwinds and non-GAAP earnings per share of $0.61 came in a little light relative to market expectations, we were generally pleased with the company’s ongoing business-model transition, with 31% of total revenue now recurring, up 4 percentage points on a year-over-year basis. From the fourth-quarter press release:

“We had another strong quarter and a transformative year. We made tremendous progress transitioning our business to more software and recurring revenue and delivered on our commitment to accelerate innovation in our core and across the portfolio,” said Chuck Robbins, CEO, Cisco. “The network has never been more critical to business success and we are building the network of the future.”

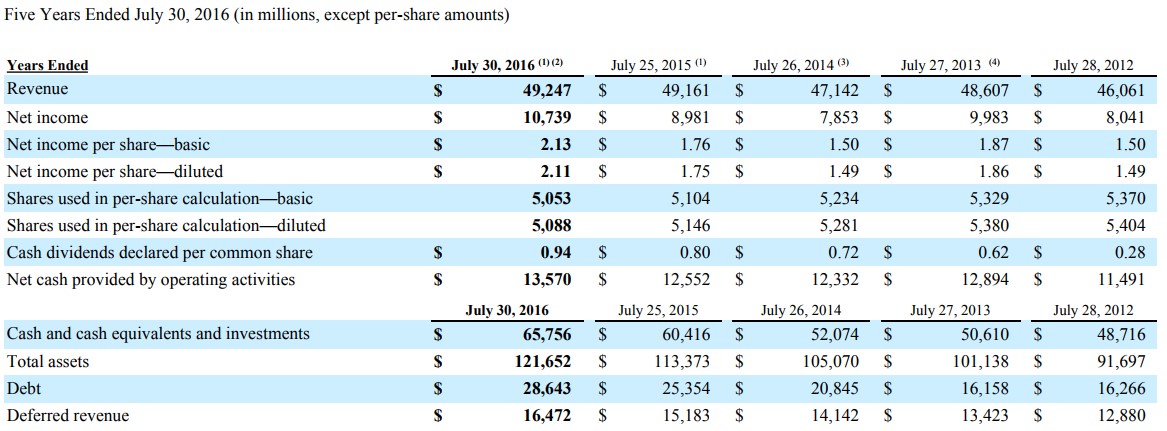

Frankly, it is just hard to be disappointed with a GAAP gross margin of 62.2% in the period, a measure of such magnitude that we view as emblematic of an enduring economic moat. At the end of fiscal 2017, Cisco hauled in an incredible $13.9 billion in cash flow from operations, an increase of 2% versus last fiscal year, and it ended the fiscal year with $70.5 billion in cash, cash equivalents, and investments (total debt stood at $33.7 billion). The company is anxiously awaiting potential tax reform in the US, namely a repatriation holiday, though we note our bullish stance on Cisco is not contingent on new developments in this area.

At the midpoint of its guidance range, Cisco is anticipating $0.60 per share in non-GAAP earnings for the first quarter of fiscal 2018 (this quarter). Annualizing such a measure means Cisco’s shares are trading at less than 13 times current fiscal-year earnings, a valuation augmented by a strong net cash position. Though Cisco’s business model remains in transition, we don’t think the market is giving it nearly enough credit for its future free cash flow stream and competitive position. Its dividend yield is also quite attractive at ~3.8%, and free cash flow generation of $12.9 billion in fiscal 2017 more than doubled cash dividends paid of $5.5 billion, suggesting material room for further payout expansion. There may be fits and starts along the way given a revenue model in transition, but we’re maintaining our $40+ fair value estimate for shares. Its Dividend Cushion ratio is 2.7.

Communications Equipment: CIEN, HRS, PLT, QCOM, SATS, VSAT

Communications Equipment – Networking: CSCO, FNSR, JNPR, KN, NOK, SMCI, ZAYO