CVS Health continues to perform as expected in the current lower reimbursement environment. We remain enthused with the copious amount of free cash flow that the enterprise produces, which has allowed management to continue its shareholder-friendly ways. We remain vigilant for signs of a key inflection point, however, and a catalyst may exist in the results of the current PBM selling season.

By Alexander J. Poulos

Overview

CVS Health (CVS) operates a hybrid pharmacy model–it has melded together a ubiquitous pharmacy chain with a world-class Pharmaceutical Benefit Management (PBM) business. The hybrid model directly contrasts with the model operated by its primary rival Walgreens (WBA), which maintains a focus on pharmacy retail operations. The pharmacy retail field continues to consolidate with CVS acquiring the pharmacy division from Target (TGT) and Walgreens acquiring a portion of Rite Aid’s (RAD) pharmacy locations. The consolidation hasn’t stopped there; Walgreens just announced its intention to become a minority investor in PharMerica (PMC) (provides pharmaceutical services to the assisted living and nursing home market) as it is taken private by KKR. The removal of Target’s pharmacies has now culled the field to three national players–CVS, Walgreens and Walmart (WMT)–with a host of regional players and supermarket operators, most notably Kroger (KR).

Quarterly Results

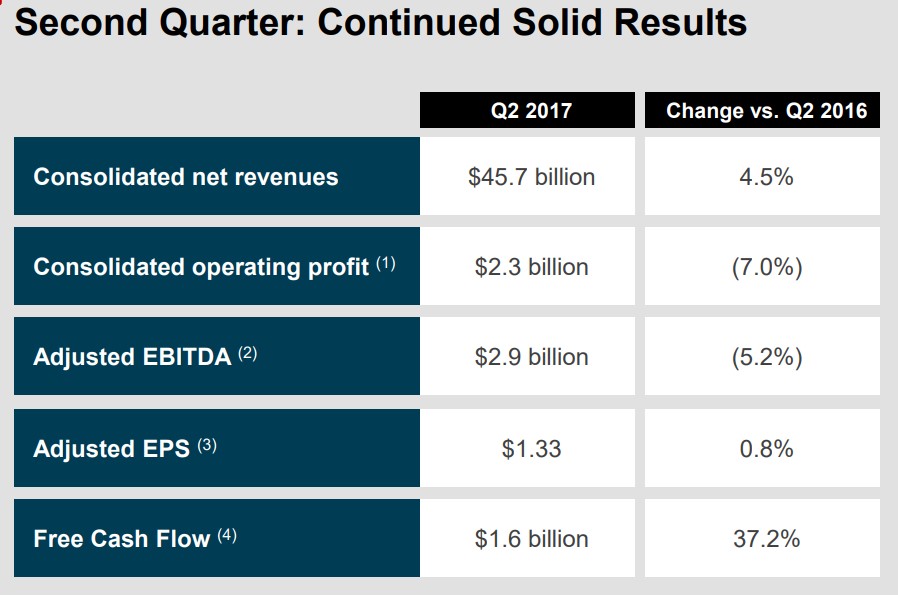

Image Source: CVS second-quarter presentation

CVS’ operating results continue to be impacted by the loss of a few key contracts at the end of 2016, which is pressuring overall prescription volume. On a 30-day equivalent basis, same-store prescription volumes were flat in the second quarter of 2017 compared to the year-ago period, but the aforementioned network changes resulted in a negative impact of 460 basis points on said volumes. In addition, the company revised its 2017 guidance for its ‘Retail/Long-Term Care’ segment to reflect expectations for slightly lower volumes. It now expects segment revenue to decline 2.75%-3.5%, total comps to be down 3.5%-4.25%, script comps growth of negative 0.75% to positive 0.25%, and the segment’s operating profit is expected to fall 8.75%-10%.

The loss of the contracts is the main culprit for CVS’ less-than-ideal performance, but other industry dynamics are causing some of the downward pressure as the reimbursement scheme for 2017 remains a significant headwind with reimbursement rates noticeably lower than last year. Pharmacy chains are well-versed in offsetting the headwind of lower payments with tactics such as higher generic dispensing rates coupled with an increase in script volume. The pharmacy business is saddled with high fixed costs, and the additional cost to service an increase in volume is rather negligible, meaning the last prescription filled is often the most profitable. Thus, the loss of volume deprives the organization of its primary method of offsetting lower reimbursement rates.

Digging further into the quarterly results, CVS’ ‘PBM’ segment posted a 4.5% jump in consolidated revenues from the year-ago period to $45.7 billion, while the number of claims jumped a very healthy 9.5%, a sign of strength in our opinion. The PBM segment is firing on all cylinders, but the drag remains the ‘Retail/Long-Term Care’ arm, which posted a sales decrease of 2.2% in the second quarter on a year-over-year basis. In addition, prescription volume weakness will have an adverse impact on store traffic, evidenced by the negative 2.1% comps performance in its retail store operations in the second quarter. The retail store division is the smallest portion of CVS operations, but it is highly dependent on pharmacy sales to drive foot traffic.

CVS Remains a Cash Flow Story

CVS continues to throw off gobs of free cash flow despite its struggles in the current operating environment, and it has generated over $4.6 billion in free cash flow through the first two quarters of 2017. Management is guiding for free cash flow in 2017 to fall within the range of $6.0-6.4 billion, and it continues to target top-notch shareholder friendliness with capital returned to shareholders in the form of dividends and share repurchases expected to surpass $7 billion in the year. Typically we would not be accepting of capital-return plans that exceed expectations for free cash flow, but we view CVS’ share buybacks as adding value at current price levels as shares continue to trade below the lower bound of our fair value range. Nevertheless, we would clearly love to see CVS find a catalyst to facilitate price-to-fair value convergence, and we may be on the cusp of such an event.

PBM Selling Season

We are currently in the midst of the 2017 PBM selling season, in which contracts are negotiated for services in 2018. In 2016, CVS was caught flat-footed by Walgreens’ move to make up for business lost in previous years as it bid more aggressively and offered more favorable terms than CVS. The net result of the situation was Walgreens winning some lucrative contracts that wound up excluding CVS. Shares of CVS were trading in the mid-to-high $80’s when the news was released, a level the company has yet to return to.

The PBM selling season seems to have gotten off to a positive start thus far for CVS with the company reporting $5.4 billion in gross wins and $1.8 billion in net new wins. We are confident the management team is keenly aware of the need to drive additional prescription volume to boost profitability, and it has maintained it is retaining pricing discipline, which should help margin performance. However, pricing discipline is a concern for us as we view it as counterproductive to accept contracts that will result in negative net margins once the full costs of servicing the contract are factored in. All things considered, a successful PBM selling season coupled with a lower share count could prove to be the proper prescription to fuel price-to-fair value convergence for CVS.

Conclusion

While we remain frustrated by the relative lack of movement in the equity of CVS against the backdrop of what has been a roaring bull market, we are willing to exercise patience as CVS continues to generate copious amounts of free cash flow that fund its shareholder capital-return program. The current PBM selling season may act as a catalyst should results show improvement over the 2016 season, but in the meantime we remain content with CVS’ quarterly dividend payments. We rate CVS’ dividend safety as as good–its Dividend Cushion ratio hovers just above parity (1), a figure that factors in robust double-digit growth in the payout–due to the strength of its free cash flow coverage of annual dividend obligations. Shares yield just over 2.5% as of this writing.

Healthcare and biotech contributor Alexander J. Poulos is long CVS Health.