We continue to be impressed with the depth of Novartis’ clinical pipeline, which should aid in the company’s acceleration from the revenue cliff experienced as a result of the patent loss of top-selling product Gleevec. We are adding Novartis to the portfolio of the Dividend Growth Newsletter.

By Alexander J. Poulos

Overview

Novartis’ (NVS) primary strength, in our view, remains the company’s diverse revenue stream. Thus far, for example, Novartis has capably handled the revenue cliff from the loss of patent protection of its top-selling product Gleevec admirably, with only a 1% drop in sales during the first half of 2016. Though such a dynamic can change in coming periods, we have found the relative predictability of Novartis’ revenue stream comforting, at least with respect to other drug companies. Unlike many of its biotech cousins, a loss of patent protection would have had an outsize impact on revenues. A recent example of this phenomenon has been the precipitous drop in revenue at Gilead Sciences (GILD). Granted, Gilead retains the patent protection of its key HCV franchise, but we similarly view the IP estate in the same vein as the dynamics witnessed in a branded product upon the lapse in patent protection.

Due to the significant magnitude of Novartis’ annual top-line revenue (north of $45 billion), double digit revenue growth will be unlikely, if only because of the law of large numbers. Though this may be turn-off for more growth-oriented investors, the larger-scale entities such as Novartis and Johnson and Johnson (JNJ) remain attractive, in our view, for the relative steadiness of the revenue base, allowing in these two instances, in particular, for a generous return of cash to shareholders in the form of a dividend. In any case, however, the depth of a company’s clinical pipeline remains critical in evaluating traditional larger pharma as weakness in the pipeline may require costly M&A to fill in the gaps to offset revenue declines due to patent expirations.

The very best at this, in our view, companies such as J&J, remain judicious in the use of M&A dollars (M&A executed poorly destroys shareholder returns). We feel partnerships with innovative biotechs that lack scale is the optimal structure; for example, Novartis teamed up with biotech star Incyte (INCY) to bring Jakafi/Jakavi to market. Novartis has also demonstrated the willingness to bankroll expensive late-stage clinical trials such as the recently-completed trial for Canakinumab. We detailed the results in a recent piece – “Novartis Is Building a Significant Cardiovascular Franchise.” Novartis gained control of the molecule via a royalty agreement with developer Regeneron Pharmaceuticals (REGN), thus gaining an innovative cardiovascular product to pair with Novartis’ internally-developed Entresto.

Clinical Pipeline

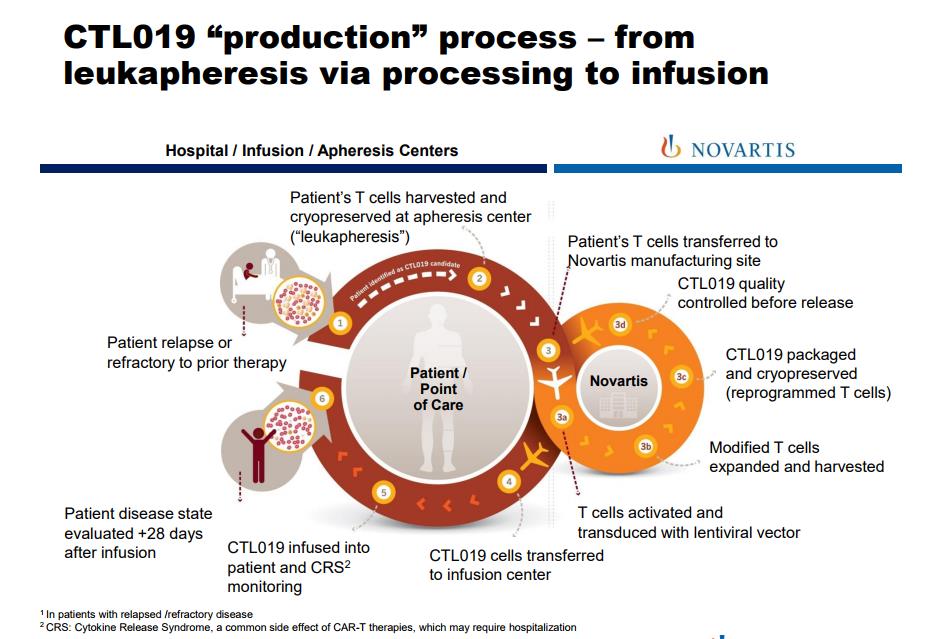

Image Source: Novartis

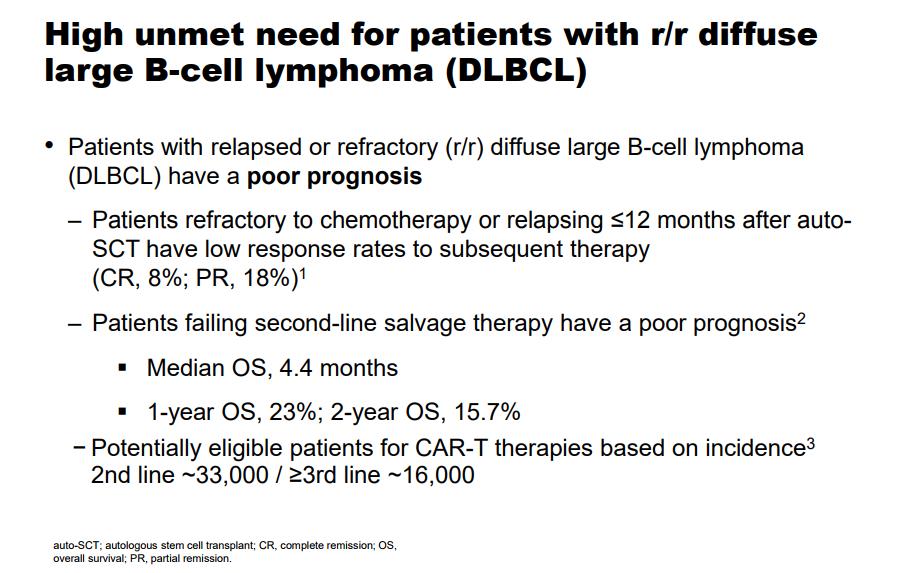

Novartis continues its recent run of impressive clinical data reads, the latest is the data presented for its novel CAR-T therapy. A brief overview of Car-T therapy–the treatment is a first step towards the path of highly individualized treatments for various disease states, in the current format, a patient afflicted with relapsed/refractory B-cell leukemia. The prognosis for those afflicted is rather grim with the group failing second-line salvage therapy posting a median overall survival rate of 4.4 months. The goal is to improve outcomes dramatically with a relatively benign side effect profile.

Image Source: Novartis

Novartis’ lead product Tisagenlecleucel has posted some impressive numbers recently, as evidenced by the recent data read in the JULIET trial. The overall response rate of 59% was recorded in a patient population of 51 individuals. The complete remission percentage is a rather robust 43% with a partial remission rate of 16%. The duration of response was positive, with 79% percent remaining relapse free at the six-month mark. The results appear to offer a new pathway to treat B-cell lymphoma, but let’s examine the side effect profile to determine the commercial viability of the product.

The most common adverse effect is cytokine release syndrome (CRS), a byproduct of the treatment. Cytokines are released to aid the engineered T-cells fight of the defective oncolytic cells found in the host. The excess release of cytokines can cause some complications, namely high fevers, inadequate oxygenation and a severe drop in blood pressure. Novartis mentioned additional ancillary care can reverse the adverse event (CRS). We feel the side effect profile is certainly one to monitor.

Commercialization

Car-T therapy is an exciting, cutting edge technology that possesses a host of challenging manufacturing issues for Novartis. Each sample needs to harvested from the host, then sent to a Novartis state-of-the-art facility in Morris Plains, New Jersey for processing. The vast majority of the work is done by hand, unlike the automation seen in traditional products. The intricate work is time-consuming–we feel a credible case can be made delays may occur if demand swamps the available personal. These fears were assuaged with the recent decision by the FDA’s Oncologic Drugs Advisory Committee (ODAC) voted 10-0 to approve CTL019 (tisagenlecleucel) for the treatment of pediatric and young adult patients with B-cell acute lymphoblastic leukemia (ALL). The decision is non-binding, but the FDA will often vote in parallel with the ODAC.

The complex, highly individualized manufacturing process, in our view, is best suited to those companies with deep pockets and an extensive history of manufacturing excellence. We feel Novartis is well-suited to capitalize on this novel therapy, but we are ambivalent to the ultimate profitability of the product. Profit margins, for example, may be less than what is typically witnessed in other oncology products.

Conclusion

We wanted to post an overview of the exciting news in the Car-T space as it pertains to the prospects of Novartis. We feel the latest crop of new products introduced to the marketplace bode well for revenue acceleration in 2018, as Novartis will attempt to return to growth. We remain intrigued by the prospects of Novartis as a stable, big-cap pharma company with a strong dividend. We will continue to monitor the developments at Novartis, and we are now adding it to the portfolio of the Dividend Growth Newsletter, a 3% at $85.16 per share.

Disclosures: Healthcare and biotech contributor Alexander J. Poulos is long Novartis, Regeneron Pharmaceuticals and Gilead Sciences.