Image Source: Loxo Oncology

The field of oncology remains an area of intense focus with a dire need for new novel therapies. Loxo Oncology generated lots of excitement with the release of its clinical data for Larotrectinib, a TRK-inhibitor for the treatment of a diverse number of tumors.

By Alexander J. Poulos

TRK Fusion

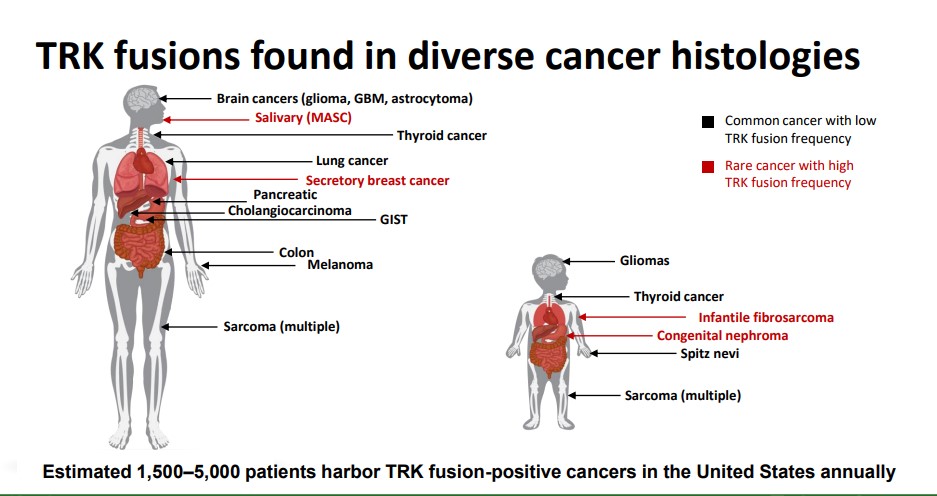

Loxo Oncology (LOXO) is targeting new therapies that take aim at the tropomyosin receptor kinase (TRK) gene abnormalities that lead to TRK-fusion cancers. A defective TRK gene can fuse with another otherwise healthy gene resulting in abnormal growth. The newly fused cell will continue to grow leading to tumor growth.The abnormal TRK fusion gene is witnessed in a wide swath of tumors–genetic testing can help identify eligible patients for therapy.

Larotrectinib

Loxo’s lead product is Larotrectinib, a highly selective pan-TRK inhibitor that can treat a wide swath of ailments. We are initially attracted to the large overall addressable market–Loxo estimates between 1.5-5k patients can be treated annually. Adding to the appeal of the product in our view is the potential use in a pediatric setting. Pediatric cancer remains an area of high unmet need–from a humanitarian perspective, nothing tugs at the heartstrings more than seeing a young child afflicted with a form of cancer. From a marketing perspective, the payers are particularly sensitive to any criticism pertaining to denying care based on the cost of therapy for children. If Larotrectinib is proven effective with a favorable side effect profile, the product will likely become widely used, in our view.

Clinical Trials

Image Source: Loxo Oncology

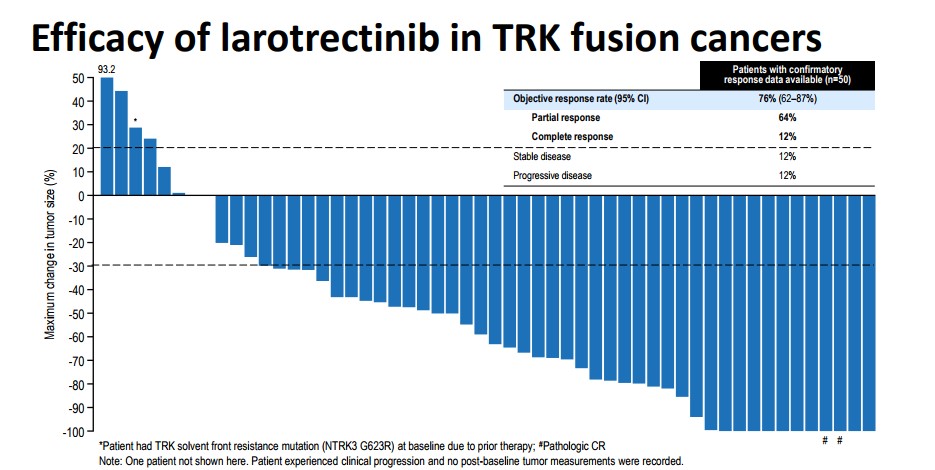

We are very pleased with the overall response rate produced by Larotrectinib. The molecule showed an overall response of 76% with 12% of those demonstrating a complete response. The graphic above is a measurement of the shrinking in the size of the tumor over the course of the entire clinical trials. The vast majority witnessed a decrease of over 50% of the overall tumor size—a notable treatment success. While the data is impressive, the side effect profile is critical. If the compound is toxic (an abundance of Grade 3-4 Adverse events), it will limit the commercial potential especially in the use of children.

Side Effect Profile

Image Source: Loxo Oncology

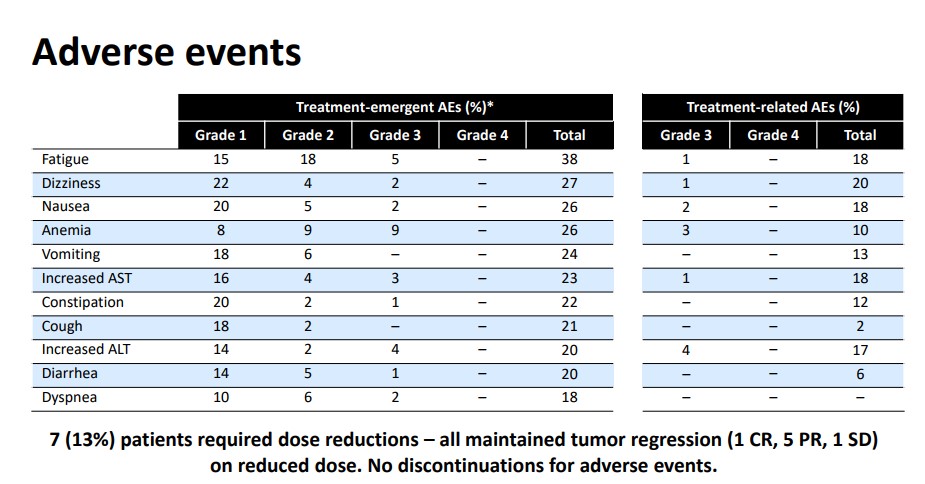

However, the side-effect profile remains very benign, too, which heightens the potential in the pediatric patient population. The most common Grade 3 adverse events are anemia and fatigue which is more often a byproduct of tumor growth. Given the information we have at this time, we are reasonably confident an experienced professional will likely have no problem mitigating the side effects.

Larotrectinib shows particular promise as a well-tolerated highly selective treatment. We remain intrigued by targeted therapies, especially those that target a specific genetic abnormality. We feel as the science progresses, additional targeted therapies will emerge that will hopefully have a more benign side-effect profile. Treatments with a favorable side effect profile will be favored by patients and payers alike as the overall cost of therapy should be less than with non-selective therapies. Part of the equation is the cost involved with managing side effects which needs to be taken into account.

Patent Estate

For biotech firms, especially late-stage entities such as Loxo, the patent estate is critical. Based on our research, the patent for Larotrectinib appears protected until 2029, giving Loxo a long runway to commercialize the product, in our view. The product is licensed from Array Biopharma (ARRY), we have looked at the disclosure from both companies’ respective 10-Ks:

Our patent portfolio includes patents and patent applications we exclusively licensed from Array, as well as exclusive worldwide licenses for all therapeutic indications for new intellectual property developed in our Loxo/Array discovery programs. This patent portfolio includes issued patents and pending patent applications covering compositions of matter, methods of use, methods of making, and synthetic intermediates.

Larotrectinib’s patent portfolio includes patents exclusively licensed to us by Array for our product candidates on a worldwide basis for all therapeutic indications. Composition of matter patents for larotrectinib is/are issued in the U.S., Hong Kong, New Zealand, Australia, Bosnia, Chile, Gulf Cooperation Council (“GCC”), Indonesia, China, Columbia, Japan, Russia, Taiwan, Ukraine, the Philippines, and Europe (which has been validated in all member and extension states). The issued U.S. and European patents expire in 2029, not taking into account any applicable extensions for patent office and/or regulatory delay in the relevant jurisdictions

Source: Loxo 10-K

Array receives advance payments for the preclinical research and other services that Array is providing during the term of the discovery program. To date, we have earned $2.0 million in milestone and other upfront payments and have the potential to earn up to approximately (i) $221 million with respect to products related to TRK, including LOXO-101 (Larotrectinib) and its backup compounds, and (ii) $213 million with respect to product candidates directed to targets other than TRK, if Loxo achieves additional clinical, regulatory and sales milestones plus royalties on sales of any resulting drugs.

Source: Array Biopharma 10-K

From our view, Array is not entitled to ongoing royalties outside of initial milestone payments. Loxo’s patent estate seems solid which bodes well for future sales and ultimate profitability.

Conclusion

Loxo Oncology is a highly speculative pre-revenue company with a focus on bringing forth additional novel oncology treatments. The initial data release is very promising, but a significant amount of risk remains, not the least of which is the complete loss of all principle if future endeavors do not pan out. Speculative biotechs are not for everyone, but we wanted to at least get this one on your radar.

Disclosures: Alexander J. Poulos is long Loxo Oncology and S&P Spiders Biotech Index (XBI).

Related ETFs: IBB, XBI