Image Source: Mike Mozart

Walgreens continues its quest to build out its network of pharmacies. The goal is to maintain the largest network in the US, which would make exclusion from a payer’s network very difficult. Let’s review the recently-revised terms of the deal to acquire a portion of Rite Aid, the third-largest pharmacy chain in the US.

By Alexander J. Poulos

The Quest to Expand the Network

Walgreens Boots Alliance (WBA), under the very capable leadership of Stefano Pessina, is attempting to transform into a global pharmacy-led health and wellbeing provider. The genesis of the idea was initiated with the combination of Boots Alliance, a predominately UK-based pharmacy chain with Walgreens. Upon the consummation of the deal in 2014, Walgreens significantly expanded its global reach.

Pessina is not satisfied with merely a global presence–the goal is to enhance profitability by severely trimming operating costs. Pessina had teamed up with legendary private equity firm Kohlberg Kravis Roberts to merger Alliance Unichem with Boots Group PLC to form Boots Alliance. The transaction led to the combined entity going private with a large debt load. Pessina masterfully reduced costs while increasing sales–the payoff came when Walgreens agreed to purchase Boots Alliance with Pessina ascending to the role of CEO of the combined entity.

The rewards were enormous for Pessina–he became a billionaire. For KKR, the buyout led to a tripling of its initial investment. KKR, post the merger, retained an equity stake in Walgreens, which it has subsequently divested. We remain impressed with the deep knowledge of the industry possessed by Pessina, and we continue to view his leadership as “visionary.” With the bulk of his fortune tied to the performance of Walgreens, we feel he is properly incentivized to lead to the company.

Filling out Walgreens Reach in the US

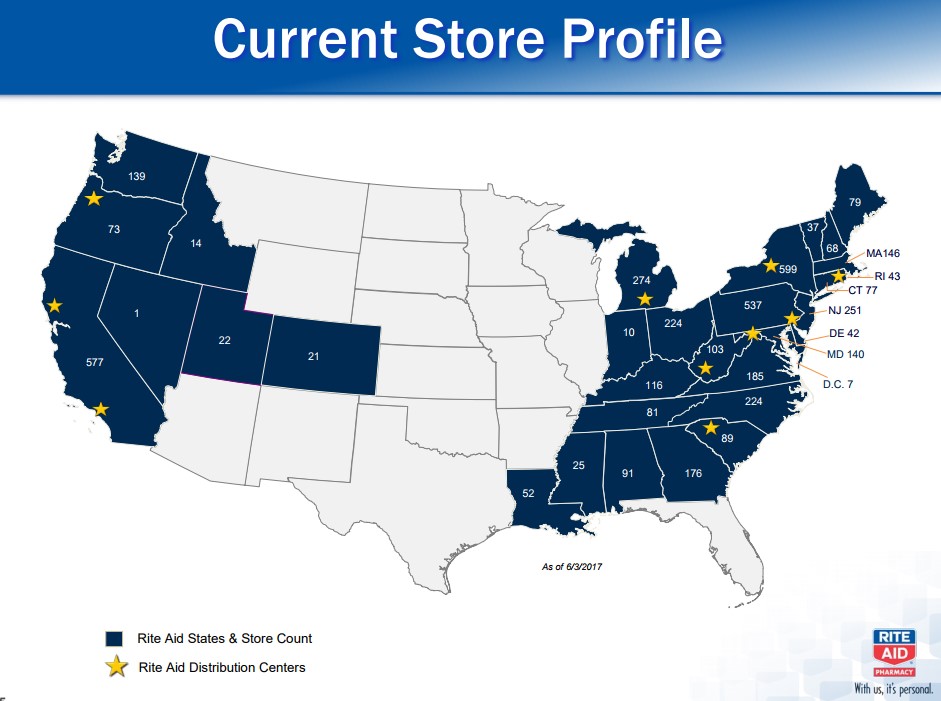

As it stands now, Walgreens’ coverage map has a noticeable deficiency in the Northeast, as the region is primarily dominated by its arch-rival CVS Health (CVS) and the third largest player in the industry–the beleaguered Rite Aid (RAD). The map below shows Rite Aid’s footprint.

Image Source: Rite Aid

A quick overview of Rite Aid is warranted to give an overview behind the motivation to sell on Rite Aid’s part. Rite Aid has yet to recover from the disastrous leadership of Martin Grass, in our view. The first cracks in the accounting fraud undertaken by Grass began to reveal themselves in the autumn of 1999 when Rite Aid shocked the Street by stating the accounting numbers issued by Grass should not be relied upon. Grass had embarked on an ambitious acquisition spree that saddled the company with an enormous debt load.

The result of the ordeal led to Grass being sentenced to eight years in prison. Rite Aid has staved off bankruptcy by selling off pieces of itself yet what remains is a barely profitable pharmacy chain saddled with an enormous debt load and a sub-$10 dollar share price.

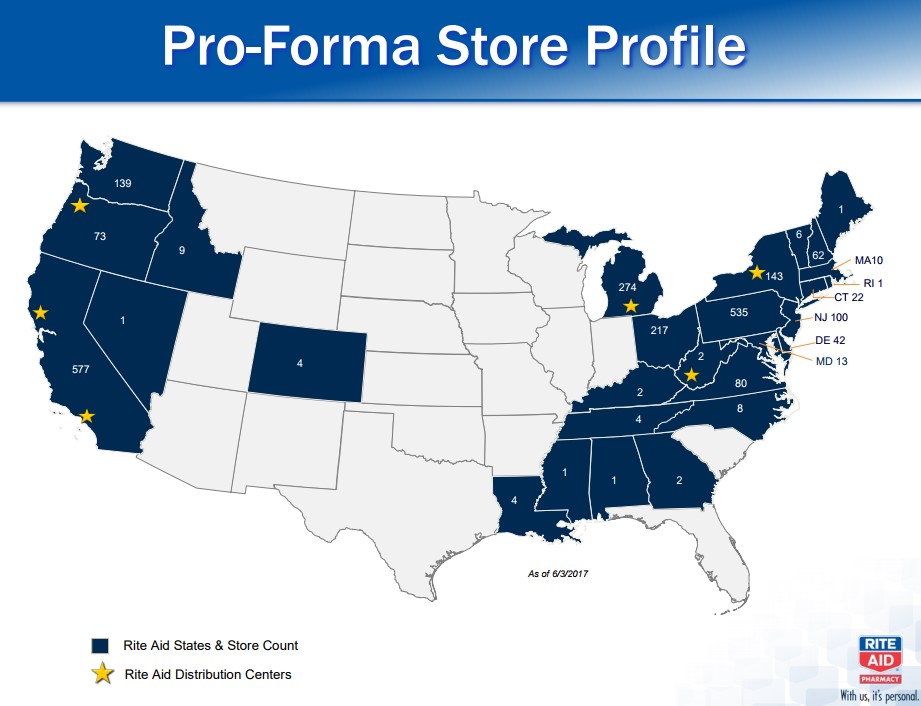

Image Source: Rite Aid

We believe Rite Aid does hold some value for a strategic buyer due to its significant presence on the Eastern seaboard of the US. Due to its dense cluster of stores in the northeast, CVS would likely be unable to make an attempt to purchase Rite Aid in its entirety on antitrust grounds. The market share concentration would be far higher than the government would be comfortable with, from our perspective. We had also been skeptical the ambitious purchase of Rite Aid by Walgreens would be allowed to go through as Walgreens’ market share in certain markets would also become problematic. Walgreens agreed to divest a significant amount of stores, yet clearance remained elusive.

A New Deal Emerges

That said, we are very pleased to see a new deal struck June 29 that would net Walgreens a boost to its market share in the northeast US, and that the agreement is structured in a way such that it would pass an antitrust review. Walgreens has agreed to purchase 2,186 stores from Rite Aid along with four distribution centers for $5.175 billion dollars. Rite Aid is also entitled to a break-up fee of $325 million for the termination of the original deal.

The bond holders of Rite Aid rejoiced on the news as the cash infusion will significantly aid the balance sheet. We would like to highlight a little-mentioned tidbit of the deal that has widespread implications for Rite Aid as an going concern. As part of the deal, Rite Aid will be able to purchase generic drugs at virtually the same cost as Walgreens. In essence as a side effect of the transaction, Rite Aid’s buying power is on par with Walgreens’, a significant strategic advantage.

Transforming Walgreens

From a strategic perspective, the deal significantly augments Walgreens’ market share in the northeast US. The importance of gaining access to real estate in the northeast cannot be understated, in our view; with the continued consolidation in the health care insurance sector, a few well-capitalized national companies are emerging, too. The payers control costs by setting up a network of preferred providers. With the escalating cost of healthcare, consumers often feel they have no choice but to utilize the in-network providers to keep costs under control. The Affordable Care Act paved the wave for payers to institute a restricted network in the name of reigning in health care costs.

With the Rite Aid transaction, Walgreens is aiming to bolster its ~20.5% retail pharmacy market share. Outside from the apparent market share gains, the transaction should augment Walgreens’ bargaining clout with payers. Walgreens can now state it has significantly bolstered its overall network, thus making exclusion very difficult.

For the 2012 plan year, Express Scripts (ESRX) made an attempt to reign in drug costs by excluding Walgreens from its nationwide network. The argument made was Walgreens demanded a premium over what other pharmacies received as a reimbursement for services. Express Scripts mentioned the premium in some instances could exceed 20%. Both parties engaged in a protracted battle with the decision made to allow Walgreens access once again. While terms of the deal are confidential, a similar conflict has yet to emerge since, leading us to conclude Walgreens’ expansive network has far more staying power than Express Scripts realized.

The Amazon Threat

As detailed in a recent post “Opinion: Is Amazon Prepared to Tackle the Pharmacy Market?” we discussed our view of the Amazon (AMZN) threat on the retail pharmacy market. We concluded the next move for Amazon is to build out its own internal pharmaceutical benefit management (PBM) unit before entering the market, if it so chooses. We continue to feel the most likely outcome is an Amazon PBM not Amazon popping up drugstores at every corner. We are pleased to report Pessina echoes our views.

“I don’t believe that Amazon will be interested in the near future, in the next few years in this market because they have so many opportunities around the world and in many other categories, which are much, much simpler than health care, which is a very regulated business. And also it’s a business, which — where — an industry where the consolidation has been really quite significative. So there are not a lot of new things that they could do. Of course, they could, but not so many as they could do in other markets. So as they are a very good team and very rational team, I believe that at the end, this will be — will not be their priority. Having said so, if we were wrong and our belief was wrong, I believe that at the end of the day, we could find our role in the new environment. We wouldn’t exclude to partner with them.”

We found the last sentence the most compelling. A partnership with Amazon would be exciting. We could easily envision a scenario where Amazon provides PBM services with Walgreens on the other end offering fulfillment in addition to other clinical duties.

Conclusion

We are big fans of the new WBA-RAD deal, as we feel it addresses the deficiencies in Walgreens’ network. The share price of Walgreens, however, remains locked in a near two-year sideways trading pattern with a recent breakdown post the Amazon announcement of its intention to purchase Whole Foods (WFC). We will continue to monitor the dynamics of the pharmacy industry closely—especially the plight of Best Ideas portfolio member CVS Health. Stay tuned for ongoing updates.

Healthcare and biotech contributor Alexander J. Poulos is long CVS Health.