The drug industry is a global market with an impressive array of competitors headquartered outside the US. The quest to bring forth novel treatments continues. We continue to focus on the large-cap traditional pharmaceutical companies for their defensive characteristics, and many also pay a generous dividend.

By Alexander J. Poulos

Novartis Poised to Cycle Through Loss of Patent Exclusivity on Gleevec

Shares of European heavyweight Novartis (NVS) jumped sharply after posting first-quarter earnings April 25. Growth in the pharmaceutical segment remains hampered as the company lapses the loss of patent exclusivity of one of its top-selling products Gleevec. We are looking past the patent cliff and remain focused on the growth products currently in Novartis’ lineup.

Cosentyx, a treatment for inflammatory diseases, continues to ramp, as product sales totaled $410 million in the first quarter, a jump of over 100% compared to the same period last year. We continue to have high expectations for Cosentyx–we feel it can steal significant market share from Stelara, thus augmenting the bottom line for Novartis.

We remain bullish on the prospects for Entresto, too, a new class of treatment for heart failure. The initial uptake has disappointed many, but we do not see a cause for alarm at this point. The product has the potential to become a multi-billion dollar treatment. We think clinicians are initially hesitant to prescribe the product as they await better data coupled with patient feedback. The parallels with top-selling A-Fib treatment Eliquis are warranted. Eliquis took a few years before it morphed into a multi-billion-dollar per year product. Though we do not expect Entresto to match the sales level of Eliquis, a multi-billion dollar product is feasible, in our view.

The Oncology division continues to innovate, garnering two marketing approvals thus far in 2017. We are very bullish on the prospects for Kisqali (Robociclib) for post-menopausal women with hormone receptor positive, human epidermal growth factor receptor-2 negative (HR+/HER2-) advanced or metastatic breast cancer. Kisqali’s main competition is Ibrance which generated over $2 billion in sales for 2016. Kisqali’s prescribing label does require additional monitoring versus Ibrance, which may limit the initial uptake. We think Ibrance will retain its formidable lead, but we would not be surprised if Kisqali grows into a blockbuster product, too. Novartis’ formidable presence in Oncology was expanded with the recent approval of Rydapt for Acute Myeloid Leukemia and three types of systemic mastocytosis

We remain constructive on the shares of Novartis, but they’re not included in the newsletter portfolios. At this juncture, we continue to prefer shares of Johnsons and Johnson (JNJ). We view Novartis in the same league as J&J, however, namely in that it is a solid blue-chip company with a rock-solid balance sheet. Novartis retains the financial capacity to pay a higher yearly dividend, too. Its Dividend Cushion ratio is 1.8 at the time of this writing.

Lantus Continues to Weigh on Sanofi’s Results

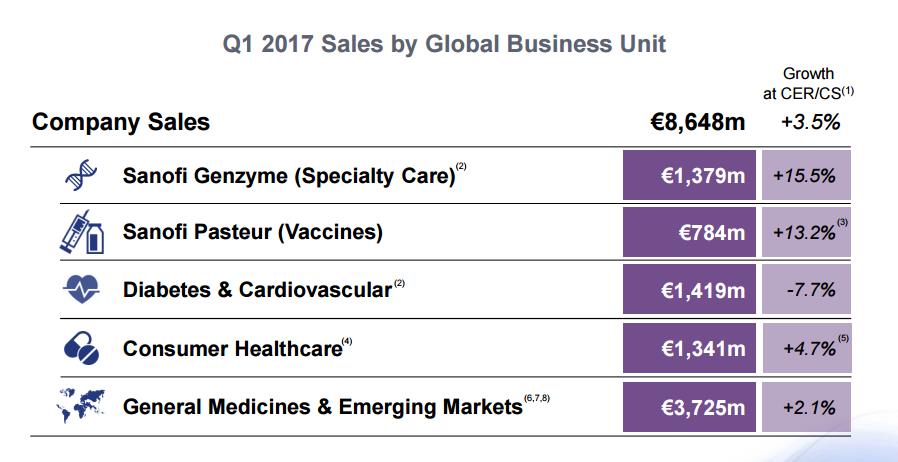

The share price of Sanofi (SNY) continues its recent stellar run as the market cheered the company’s latest earnings release, issued April 28. Sanofi is an interesting paradox; the group’s top-selling product Lantus continues to face a biosimilar challenge while its specialty group continues to post double-digit revenue growth.