Image Source: Brandon Giesbrecht

The final step of the drug approval process is the filing of a new drug application (NDA), when the FDA assesses trial results before deciding if the treatment warrants marketing approval. A delay or rejection can have a meaningful impact on the equity price, so let’s dig into a few notable upcoming decisions.

By Alexander J. Poulos and Kris Rosemann

Baricitinib

Baricitinib is a Janus Kinase 1&2 inhibitor that is being studied for the treatment of a wide range of inflammatory diseases, and clinical trials for the indication of rheumatoid arthritis conclusively demonstrated superiority to placebo–and Humira. The superiority to Humira, in our view, is a key differentiator in the crowded inflammatory disease market, a direct result of a significant and growing demand for treatment. According to Express Scripts (ESRX), the inflammatory disease market is the largest portion of fast-growing specialty drug budgets.

Baricitinib is owned by Incyte (INCY), a mid-stage biotech with an impressive pipeline, and Eli Lilly (LLY) under an exclusive global license and collaboration agreement dating back to 2009. Incyte currently has one approved product on the market, Jakafi for the treatment of Myelofibrosis and Polycythemia Vera. Even with a unique product in Jakafi that generated sales north of $800 million in 2016, earnings growth remains challenging for the firm. Incyte reported earnings of $0.54 per diluted share in 2016, as the focus of the company remains on its research pipeline.

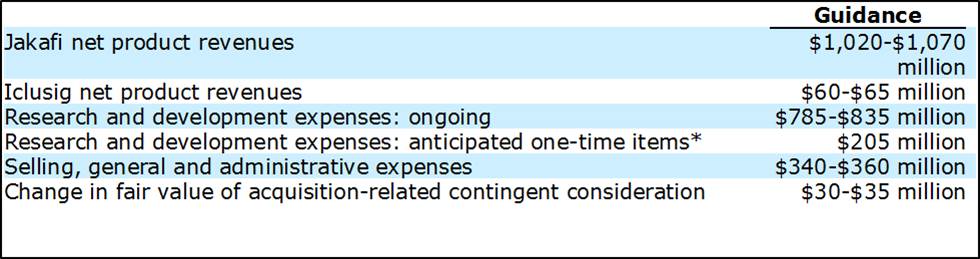

2017 Guidance

Source: Incyte 8-K Feb 2017.

Incyte expects R&D costs to virtually equal Jakakfi net product revenue—“net” is the key term, as Incyte is responsible for marketing the product in the US exclusively. The product is sold under the name “Jakavi” outside the US by Novartis (NVS), a move we applaud–the cost of marketing the product worldwide is outside Incyte’s area of expertise.

In a similar move with Baracitinib, Incyte has sought and found an able partner in Eli Lilly. Lilly will pay Incyte a tiered royalty of global sales in the 20%-29% percent range on an ongoing basis. In the near term, Incyte will receive milestone payments of $100 million if the US FDA approves the product, and it recently received an additional royalty of $65 million when the product was approved in the EU in February 2017. We believe the terms of the deal with Lilly are very favorable for Incyte, reflecting the global potential of the product.

Baracitinib has a few notable advantages over Humira, the current gold standard of the therapeutic class. Baracitinib is a small molecule that is dosed as a convenient oral dosage form, and it bypasses the need for injections, in our view, a notable advantage. Lilly and Incyte reps are armed with head-to-head data pitting Humira against the results obtained with the group treated with Baracitinib, which have been taken from the RA-Beam study, and we have no doubt the results will be used to push for greater access.

However, the challenge we see before Lilly and Incyte is payer acceptance. For the product to quickly gain market share, creative pricing schemes will be necessary, and a scenario may very well develop where either Lilly and Incyte or Sanofi (SNY) and Regeneron Pharmaceuticals (REGN), with its comparable treatment Sarilumab, compete aggressively on price.

Baracitinib’s original PDUFA date (deadline for a decision by the FDA) was pushed back by three months to allow the agency additional time to evaluate additional data, and we now expect a decision in the second quarter of 2017. Though the initial marketing ramp will likely take some time, we expect Baracitinib to become a blockbuster treatment.

Brineura (Cerliponase Alfa)

Biomarin Pharmaceuticals’ (BMRN) newest treatment, Brineura is targeted for the treatment of a CLN2 disease, a subsection of Batten disease, and it is poised to help expand the company’s stable of medication used for the treatment of rare diseases. Brineura’s current PDUFA is April 27th, 2017, after the FDA requested additional data from Biomarin this past September.

Batten Disease

Batten Disease is an autosomal recessive genetic disorder with 50 unique variants. The disease is classified as a lysosomal disorder which affects the body’s ability to transport and remove waste from the cells. The inability to properly remove unusable products leads to a buildup, with common side effects being seizures, dementia, and loss of vision.

The CLN2 subsection remains an area of significant unmet need. The disease will manifest itself in the late infantile portion of life, typically characterized by seizures that will become increasingly difficult to control. As the disease rapidly progresses, the child will lose the ability to see and speak, and by the age of 6, the child will become dependent entirely on the care of others. The prognosis for CLN2 is terminal, typically between the ages of 6-12.

Due to the lack of meaningful treatments to halt the progression of CLN2, we expect Brineura to become widely accepted with little in the way of reistance from payers via aggressive reimbursements. The cost of care for those with late stage CLN2 is enormous, and around the clock care is prohibitively expensive.

Biomarin’s Financials

Biomarin’s focus remains on commercializing numerous treatments for rare diseases, and as a result, the company remains devoid of profit, as R&D spending remains high. While we applaud the progress the company has made, we are not fans of its equity. The intense focus on rare diseases limits the competitive field, but it also reduces the size of the overall end market.

Further complicating matters is the wide geographic dispersion of the patient population. Biomarin needs to service the needs of clinicians–a costly endeavor–but can’t achieve efficiencies of scale due to the smaller, more dispersed patient population. Biomarin’s market cap is currently north of $15 billion, quite lofty when considering 2017 expectations for revenue in a range of $1.25-$1.30 billion and a GAAP net loss of $140-$180 million in the year.

Though its rare disease treatment portfolio could make it an interesting takeout candidate, Biomarin’s lofty price tag could keep potential suitors at bay for some time.

Keytruda in Non-Small Cell Lung Cancer

The critical need for innovative treatments in the field of oncology remains. One of the largest areas of need is Non-Small Cell Lung Cancer (NSCLC), the most prevalent form of cancer outside of prostate and breast cancer. Promising research in the field continues with the PD-1 class showing particular promise, and Bristol-Myers Squibb (BMY) initially garnered the bulk of the attention as its treatment Opdivo was the first of the class to reach the market. Opdivo racked up an impressive number of indications as the treatment consistently showed superiority over conventional therapies, and Bristol seems poised to leverage its first-mover advantage into a durable oncology franchise.

Quietly waiting in the wings, is Merck (MRK) with its own PD-1 marketed under the name Keytruda (Pembrolizumab). Keytruda also posted impressive results, but had been viewed as a distant second with Opdivo maintaining a commanding lead. However, fortunes changed abruptly this past summer when Opdivo failed to meet its primary endpoint in the CheckMate-026 study. Prior to that study, Opdivo proved efficacious in every indication it was tested, making the news even more of a shock. Bristol’s share price plummeted on the announcement. To further complicate matters, data released a few months later revealed Opdivo not only failed to meet its primary endpoint, but also failed to provide superior results when compared to a placebo.

Meanwhile, Merck methodically proved the value of Keytruda in tightly-controlled studies. The initial differentiating trial is Keynote-10, which was comprised of patients that were previously treated and possessed tumors that expressed PD-L1. Armed with positive results and the unexpected failure of Opdivo, Merck has a clear path to establish first line dominance in NSCLC. Thus far, Merck has proven Keytruda’s efficacy in “patients whose tumors expressed a high amount of PD-L1,” the goal is to gain approval for all patients.

The pivotal data needed for first line designation was recorded in the Keynote-21 cohort G trial with the key takeaway being that Keytruda improved the progression-free survival rate better than was expected. Based on the results of the trial, the FDA accepted Merck’s application and granted the product an “accelerated review” which will speed up the overall process. The FDA indicated its comfort with the use of Keytruda irrespctive of PD-L1 expression, a key differentiator. Should Keytruda be approved in first line NSCLC, we expect it to become Merck’s top selling product in a few years and inject new life in a rather uninspiring product lineup.

Conclusion

We continue to monitor the new drug approval process closely. Though larger pharmaceutical companies have diverse portfolios that can help mitigate the revenue erosion or changes in expectations associated with the approval and development process of a key treatment, we would be remiss if we did not warn investors of the potentially wild swings in equity prices of smaller entities whose outlook may rest on the success of a small number of drugs. Only you know your personal financial risk tolerance.

Disclosures: Healthcare and biotech contributor Alexander J Poulos is long Novartis (NVS) and Regeneron Pharmaceuticals (REGN).