By Kris Rosemann and Brian Nelson, CFA

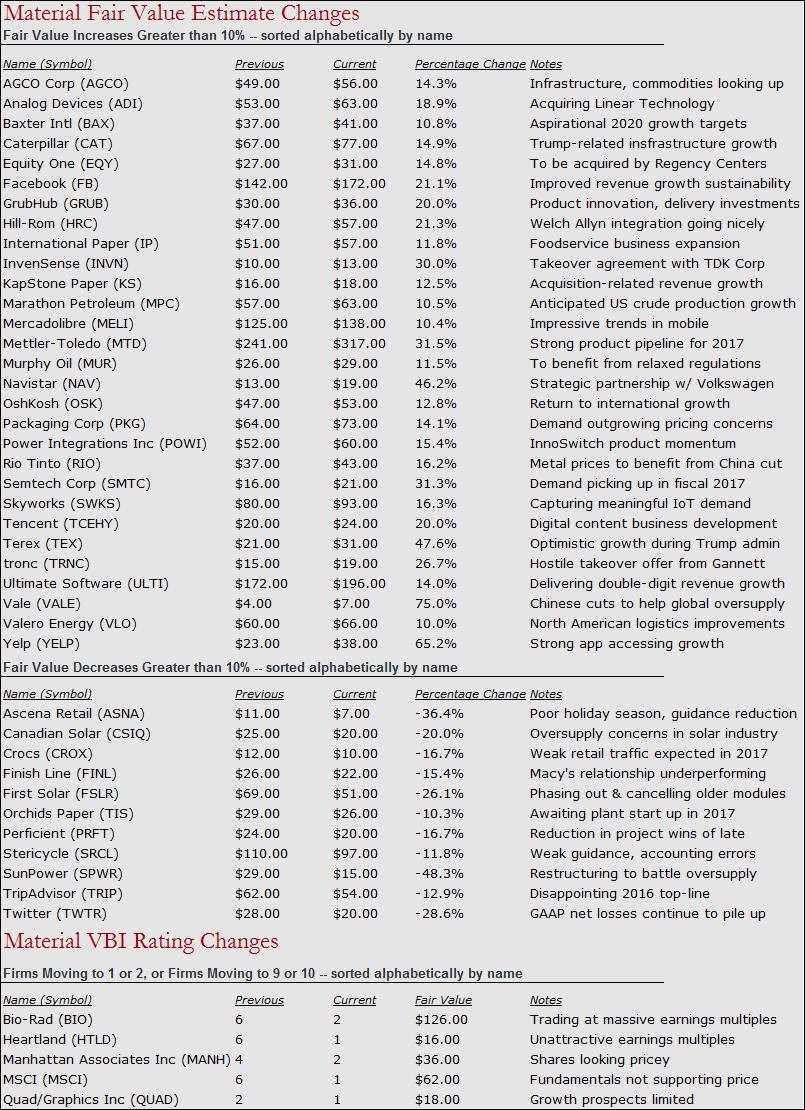

Let’s begin this edition of Recent Material Fair Value Estimate Changes’ with a discussion of some of the highest-profile names that made the list. If you require background reading on why we make changes to our valuation models, please see: What causes fair value estimates to change?

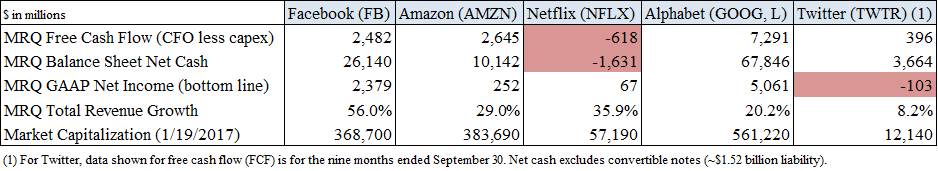

Best Ideas Newsletter portfolio holding Facebook (FB) continues to separate itself from other social media companies, and we continue to be impressed by its free cash flow generating prowess and net cash-rich balance sheet. Our most recent fair value estimate increase comes largely as a result of greater optimism regarding the sustainability of the company’s pace of revenue growth, reflected by a hike in our mid-cycle revenue growth assumption. We think the growing financial strength of the entity will allow for continuous investment in new products (e.g. Facebook Live) and new initiatives (virtual reality and the like) to further sustain top-line growth rates at a higher level than previously modeled, in our view. Shares are now changing hands just below the lower bound of our fair value range, indicating material interest on our part in augmenting our current position in the Best Ideas Newsletter portfolio. Stay tuned for updates on that front.

Facebook is not without its fair share of risks, however, not the least of which is related to the ever-evolving Internet landscape as well as cyclical trends in mobile advertising spending. For example, how the world uses the Internet could be completely different five or ten years down the road, as it was five or ten years previously, and this is a factor in why we apply a sizeable fair value range for Facebook’s fair value–but even our base case scenario implies considerable upside for shares. Social media peer Twitter (TWTR), which recently saw us cut our fair value estimate for shares as a result of weaker-than-expected performance, receives an even larger margin of safety. Unlike in the case of Facebook, we continue to struggle to see how Twitter fits in longer term in light of its weak profitability and the proliferation of other news services (Twitter has become more “newsy” than social). Many may like to lump all social media companies into one basket like the Global X Social Media Index ETF (SOCL), for example, but Twitter is not in the same “stratosphere” as Facebook when it comes to free cash flow generation, balance sheet health, and top-line growth. Such is the hazards of speculating in ETFs that basket stocks together based on themes unrelated to competitive profiles or valuation considerations. Be careful with these instruments – you may not get what you want.

Caterpillar (CAT) is a company that jumps off the page and one that hopes to be a major beneficiary of Trump’s infrastructure initiatives in 2017. We’ve increased our fair value estimate for shares as a result of our expectations for the heavy equipment giant to benefit from the Trump administration’s spending plans, but management continues to take a cautious approach to the year, and as Chairman/CEO Doug Oberhelman plans to resign in March. Caterpillar’s business is not without challenges, such as our ongoing (but lessened) concern over Cat Financial’s exposure to weak credits in the energy and mining arenas. Even after the increase in our fair value estimate, however, shares still don’t look terribly cheap, and our views on its dividend are mixed in light of a rather less-than-exciting Dividend Cushion ratio, despite strong free cash flow generation. We’ve also increased our fair value estimates for a few other operators in the Agricultural Equipment industry, AGCO Corp (AGCO) and Terex (TEX) to be specific, as a result of more optimistic growth assumptions during the Trump administration. These companies will now have to deliver.

We’ve increased our fair value estimate for Rio Tinto (RIO). The London-based miner expects to benefit from higher metal prices in 2017 after reports that the Chinese province of Hebei, the country’s top steel-making province, plans to more than double steel- and iron-making production capacity cuts in 2017 compared to those of 2016. We’ve now factoring this into our modeling assumptions. Global oversupply has plagued Rio via lower metal prices of late, namely iron ore, and while the reduction in global capacity is certainly welcome news, we’re well aware of the risks of other producers failing to meet their stated production capacity cuts. Rio Tinto has long been one of our favorite miners, and its ongoing debt reduction initiatives are noteworthy, but we’re not ready to jump back into the mining space just yet. We removed Rio Tinto from the Best Ideas Newsletter portfolio in January 2016. We’ve made tweaks to our valuation models to other mining entities and have also materially raised our fair value estimate of mining rival Vale (VALE), the world’s largest producer of iron ore and iron ore pellets, following the reports of Chinese capacity cuts.

We maintain our view that shares of medical instrument manufacturer Mettler-Toledo (MTD) are trading at frothy levels, even after we substantially increased our fair value estimate. Our new fair value estimate reflects a discount rate that it more appropriate of its fundamental risk profile and increased contributions from its product pipeline in 2017 and beyond. Despite the higher fair value estimate, however, shares of Mettler-Toledo continue to trade well above the upper bound of our fair value estimate range. Relative to the market, we’re taking a more cautious view given its material exposure to China, and the company’s cautious comments on the call regarding near-term performance of its Chinese and European operations. With shares trading at roughly 26 times, the midpoint of 2017 adjusted earnings per share guidance, we’re comfortable saying Mettler-Toledo’s price continues to be stretched.

The Integrated Circuits industry found itself on the receiving end of multiple fair value estimate increases as demand for the group continues to benefit substantially from the proliferation of the Internet of Things, as integrated circuits form the building blocks used in electronic systems and equipment. In the third quarter of 2016, Power Integrations (POWI) recently surpassed $100 million in quarterly sales for the first time, and the company’s InnoSwitch product line has begun penetrating markets beyond the mobile-device market (above our previous expectations), which has led us to increase our near-term expectations. Semtech’s (SMTC) management indicated strength in “exciting growth markets,” which include the Internet of Things, hyper-scale datacenters, and mobile devices, as contributors to its improved financial outlook, and we have now incorporated more optimistic forecasts in our valuation model. One of our favorites, Skyworks (SWKS) continues to be a beneficiary of the increasing level of connectivity in society, and the company is well-positioned to help resolve massive demand issues in mobile data and connectivity speeds. The increase in our fair value estimate for Skyworks’ shares is a result of our expectations for demand to remain at recent, more robust levels for longer than previously anticipated. For more reading on the Internet of Things, please consult: “The Next Industrial Revolution – Internet of Things (December 2016).”

We’ve reduced our fair value estimates for a number of companies in the Solar industry. Industry-wide oversupply concerns have severely impacted near-term expectations across the group after a period of rapid capacity expansion. What’s more concerning is the potential for an extended supply glut. SunPower (SPWR) recently announced a restructuring plan in which it will reduce its global workforce by 25% and halve its capital expenditures in 2017 compared to 2016 while pursuing aggressive expense reductions. We’ve reduced our fair value estimate for Canadian Solar (CSIQ) largely due to the aforementioned supply concerns. The company’s pipeline of developments has become substantially less attractive given the current operating environment and may become even less so should a prolonged downturn take place. Our opinion of First Solar’s (FSLR) intrinsic value has declined after the company decided to completely phase out its Series 4 module and cancel its Series 5 module while accelerating production of its Series 6 module. The combination of inventory and production-related issues that will result from this decision and industry-wide concerns resulted in a rather material cut to our estimate of its intrinsic value.

Within the Specialty Retail (shoes) industry, we’ve reduced our fair value estimates for Crocs (CROX) and Finish Line (FINL). Both have been subject to the widespread traffic pressures prevalent across the broader retail space. Though Crocs’ brand is unique, we’re not anticipating a material resurgence in retail traffic anytime soon, and such traffic weakness doesn’t bode well for a retailer whose growth continue to require a degree of increased awareness and market penetration. Finish Line has also suffered from the significant weakness, and its agreement to operate a shop-in-shop format in ~400 Macy’s (M) stores has tightened the traffic squeeze on the firm. For our latest commentary on the woes of department stores, please read, “Department Stores Limp Across Finish Line In 2016 (January 2017).” We’ve also reduced our fair value estimate for Ascena Retail (ASNA) due to the pressures it’s encountered in the current retail environment, but on the plus side as it relates to a unique undervalued, dividend growth idea, Hanesbrands (HBI) may be worth a look. Opportunities are starting to surface in the beaten-down retail sector, and we’re watching very closely.

—————–

Recent Material Fair Value Estimate Changes – December, 17 2016