Image Source: Mike Mozart

By Alex Poulos

The stock market can be a fickle creature, bestowing its affections seemingly upon random industries. As 2016 comes to a close, the financial and energy-related names are all the rage with many pundits gushing about their prospects in 2017. I have often found when the Street is waxing eloquently about a certain sector, most of the easy gains have been made. Often, a contrarian view is necessary to generate acceptable returns. An unusual opportunity is before us in a company that operates in one of the most unloved fields of all, healthcare.

CVS Health

CVS Health (CVS) is generally categorized in the consumer staples (XLP) sector of the S&P 500, yet over 85% of their revenue is healthcare related! The consumer staples and healthcare sectors were notable laggards in 2016 with healthcare posting a loss for 2016. The lack of momentum in these companies is exciting from a contrarian’s point of view; the industry lacks froth, unlike the 2015 period where healthcare was all the rage. The lack of momentum is a positive as multiples have shrunk allowing value-conscious investors to consider building positions at favorable prices.

CVS, unlike its nearest rival Walgreens-Boots Alliance (WBA) operates a hybrid model with a thriving healthcare distribution model backed by the ubiquitous stand-alone pharmacies in addition to the newly acquired long-term healthcare provider Omnicare. In addition to the delivery of pharmaceutical needs through various forms of pharmacy services (retail, mail order and long-term care), the Caremark division is one of the largest Pharmaceutical Benefits Managers (known by the acronym PBM) in the world. PBM’s handle the payment of pharmaceutical benefits at the point of sale of various pharmacy providers, in addition to aiding in lowering the cost of medications. The PBM’s manage cost through the mechanism known as a formulary, an exclusive list of products covered by the plan administered by the PBM. The PBM will extract favorable contract terms from the pharma/biotech to gain favorable placement on the formulary. Often, the savings manifest themselves in a direct rebate from the manufacturer based on volume sold. In CVS’ case, to differentiate itself from its nearest competitor, the pure play PBM Express Scripts (ESRX), CVS returns 90% of the rebates earned back to the providers (healthcare plans or individual companies such as General Electric).

The PBM industry remains one of the most effective in lowering the overall cost of healthcare. A notable recent example of the heft of the PBM’s is their ability to extract massive price concessions from the three large HCV (hepatitis C) players, most notably Gilead Sciences (GILD). Express Scripts was at the forefront of the move by inking an exclusive deal in December 2014 for the inferior Viekira Pak produced by Abbvie (ABBV), thus excluding Gilead Sciences’ Harvoni from their national formulary. The move set off a wave of dominos where Gilead management, in its own exclusive deal with CVS in January 2015, decided to sacrifice price for access thus lowering the overall cost per patient cured dramatically. In part due to recent FDA warnings regarding Viekira Pak, Express Scripts, however, welcomed Gilead’s Harvoni back into its formulary late 2016. In any case, drug-industry price rivalries will remain intense, and the PBMs are fighting to pit drug providers against each other to reduce prices.

Political Overview

The election of Donald Trump has done little to vanquish the fears of new regulations that will hamper overall profitability of the healthcare sector. The fear is that a repeal of the Affordable Care Act (ACA), otherwise known as Obamacare, would lead to disruption across the sector and a permanent reduction in profitability for many. The widespread consensus is there remains a notable lack of control mechanisms in place to combat runaway drug price inflation, and how might the back and forth of the implementation of Obamacare coupled with its potential partial repeal during a Trump administration impact business confidence in the sector – and if Trump is only a one-term President, will Democrats reimplement any repeals implemented during the previous four years? Such uncertainty has offered up compelling opportunities to consider adding a number of ideas in all ranges of the healthcare complex at favorable prices. The PBM model has proven to be an effective way to corral the price of medications, and since this is consistent with the political trajectory, we doubt meaningful changes will come down leaving CVS in an enviable position to thrive for years to come.

Metrics

Image Source: CVS Health

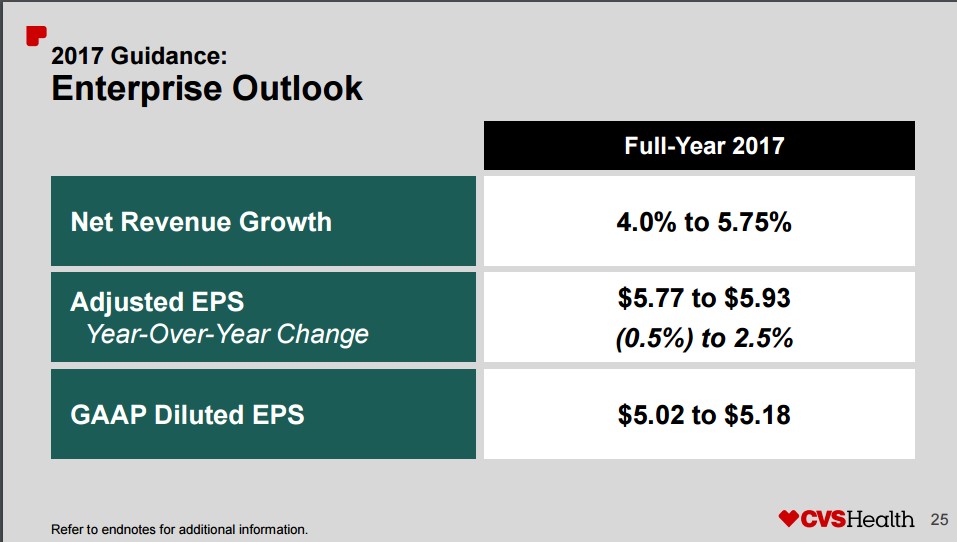

CVS Health sports a below-market multiple of less than 14 times 2017 earnings at the time of this writing, a level we find quite attractive, particularly in light of the frothy levels of the market. The issue plaguing CVS is its expense base, which is geared towards higher prescription volume. The loss of the Tricare contract leaves the company with a sub-optimal cost base that we expect will be rectified by management as 2017 progresses. A modern pharmacy has a certain amount of fixed costs namely labor, in addition to rent, equipment, benefits, etc. To drive profitability, each additional prescription filled above the number needed to breakeven is pure profit. Hence, the loss of volume adds an outsized impact on overall profitability. We call this negative operating leverage, or negative earnings leverage.

In essence, pharmacy remains a volume game — the higher the volume driven per location, the more profitable for the company. The greatest challenge facing management is the ability to grow revenue; yet in what is termed a poor year, CVS revenue growth will continue in 2017. Though the loss of prescription volume will negatively affect overall 2017 growth, as the year progresses, we expect the company’s expense base to be brought in line with the lower prescription volume, thus gearing CVS for a notable bounce in 2018. We’re excited about this.

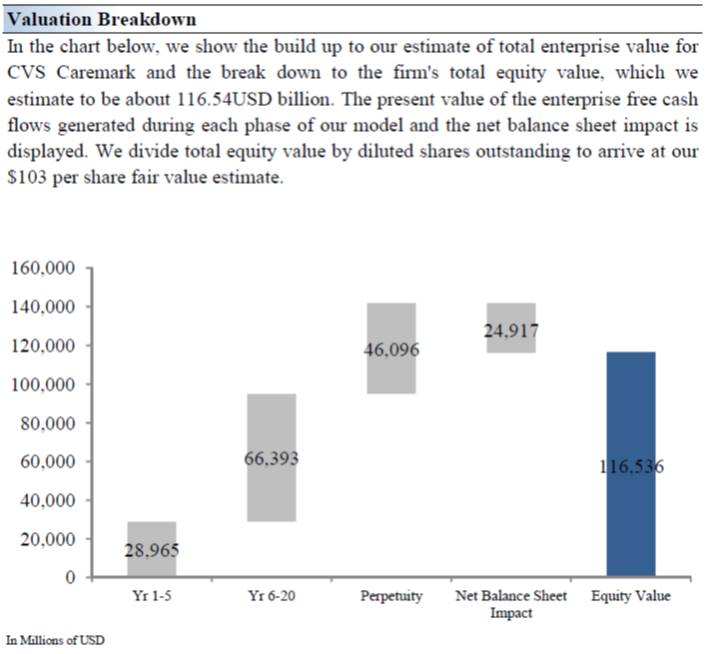

Image Source: Valuentum

We have incorporated the mid-point of revenue projections in addition to the higher end of capital spending and a ~39% tax rate to generate a fair value north of $100 per share. We are figuring a steep drop in EBITDA margin with a full recovery in 2019. Both the discount rate and exit multiple applied are reasonable. Though most are focusing on what we consider as the overblown fears of loss of healthcare sector profitability, the favorable change in domestic tax rates should provide a positive tailwind for CVS. We view the drop in corporate tax rates a much more likely event than healthcare reform that would permanantly destroy provider profitability. A drop in the US corporate tax rate to 25%, for example, would generate a nice boost in future earnings and push CVS’ fair value estimate higher than what we are currently modeling. CVS, in line with other US-based corporations, pays a tax rate north of 35%, one of the highest in the industrialized world. The projections do not take into account CVS’ expected share repurchase scheme, which we believe would be value-added in light of the price-to-fair value consideration.

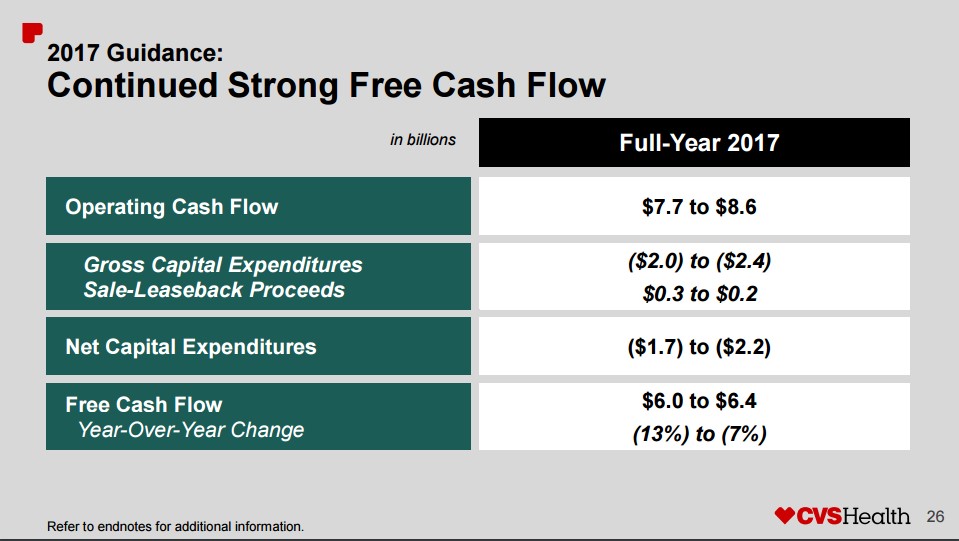

Image Source: CVS Health

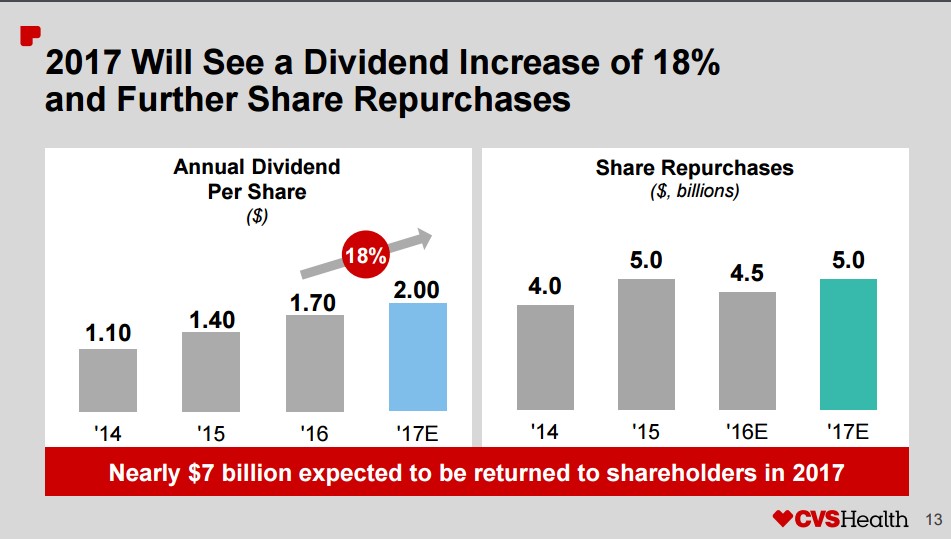

One of our favorite metrics is free cash flow yield. CVS’ free cash flow yield is over 7% on the basis of its market capitalization at the time of this writing. We continue to like companies that generate an abundance of cash above the needs required to fund their business, and we think CVS is setting up to make above-average shareholder gains through a combination of dividends and share repurchases in coming years. True to form, CVS is following a time-tested playbook returning cash to shareholders, as shown below. The share repurchase scheme at CVS current market cap would retire nearly 6% of the overall market capitlaization in addition to a yield of ~2.5%.

Image Source: CVS Health

Dividend Growth

In addition to an unjustified below-market multiple, CVS’ ample cash flow should allow for an ever-rising dividend, which is sweet music for the dividend growth investor. CVS’ dividend accounts for less than one third of free cash flow generated, thus offering ample room for significant hikes as the years progress. The company’s ability to retire a notable amount of shares over the next year at bargain-basement prices should aid in the overall payout of the dividend as the reduction in share count leaves additional funds for those leftover. A virtuous cycle is forming where CVS generates an abundance of cash well above the needs of the existing business. A well-timed share repurchase plan can add significant value for long-term shareholders. Even though we’re not big fans of its net debt position, which weighs on its Dividend Cushion ratio, we very much like its valuation and dividend growth prospects.

Disclosure: Alex Poulos is long CVS.