Image Source: HCP

Former Dividend Growth Newsletter portfolio holding HCP recently was forced to cut its dividend as a result of the spin-off of its beleaguered HCR ManorCare portfolio. We told you it would. That’s exactly why we removed it from the Dividend Growth Newsletter portfolio in February 2016.

By Kris Rosemann

As the only REIT in the S&P 500 Dividend Aristocrat Index and a former Dividend Growth Newsletter portfolio holding, healthcare REIT HCP (HCP) once boasted one of the most impressive dividend track records available on the market, where 2016 had marked its 31st consecutive year of dividend increases. We’ve worked tirelessly to explain to members that it is only the future that matters when it comes to investing, however. We hope that with HCP’s dividend cut today, November 1, we continue to gain your trust. There has never been a dividend cut in the Dividend Growth Newsletter portfolio.

Those that have been following our research, analysis and email alerts know that we had eliminated the position in HCP in the Dividend Growth Newsletter portfolio in February of this year, “Alert: Health Care REITs Whacked,” as a result of the REIT’s poor raw, unadjusted Dividend Cushion ratio (-0.67 at last check) and mounting concerns over the health of its HCR ManorCare portfolio, which was the ultimate undoing of its dividend. But our concerns with HCP began far before we removed the position, however. In fact, the story began developing in the spring of 2015, and we had our investors on notice as early as June 2015, “Maintaining Our Small Position in HCP:”

Shares currently yield 6%, and while the following may seem somewhat counterintuitive, we may “consider selling” if shares reach the 6.5%-yield threshold. At that level, the market, from our perspective, would implicitly be factoring in a potential dividend cut by this Aristocrat, and we certainly don’t want to stick around for that.

The takeaway from HCP is clear: we’re never going to let an entity’s historical dividend track record have such a high influence on our investment-making decisions anymore. We’re going to remain laser-focused on future fundamentals, where we’ve given great weight in every other case.

HCP’s issues stem from developments surrounding its HCR ManorCare portfolio, which began in early 2015 as HCP acknowledged that HCR ManorCare was under investigation by a number of government agencies related to HCR providing services to Medicare beneficiaries that were not medically reasonable or necessary. Three False Claims Act lawsuits were filed. HCP later amended its master lease with HCR ManorCare and reduced its full-year guidance as HCR ManorCare once accounted for nearly one-third of HCP’s net operating income. A number of whipsawing guidance adjustments in 2015 only hurt what little investor confidence was remaining in the REIT; we simply didn’t think management had a good handle on things, “Analyzing Healthcare REITs (August 2015)”

As the HCR ManorCare story unfolded, management found itself painted into a corner. In February 11, 2016, just after we removed the position in HCP, Moody’s revised the firm’s outlook to negative as a result of the operating challenges of HCR ManorCare. Months later, Moody’s downgraded HCP’s ratings to Baa2, still in investment grade territory, but raised its outlook to stable after the firm announced it would separate its HCR ManorCare portfolio. HCP’s net debt-to-EBITDA jumped to 6.2x in the first quarter of 2016 from 4.7x in 2013 as a result of the excessive amount of debt HCP was forced to raise to continue growing its operations. Evidence of the low quality assets included in the HCR ManorCare portfolio came with Moody’s rating for the new firm, Quality Care Properties (QCP), which was firmly in junk territory.

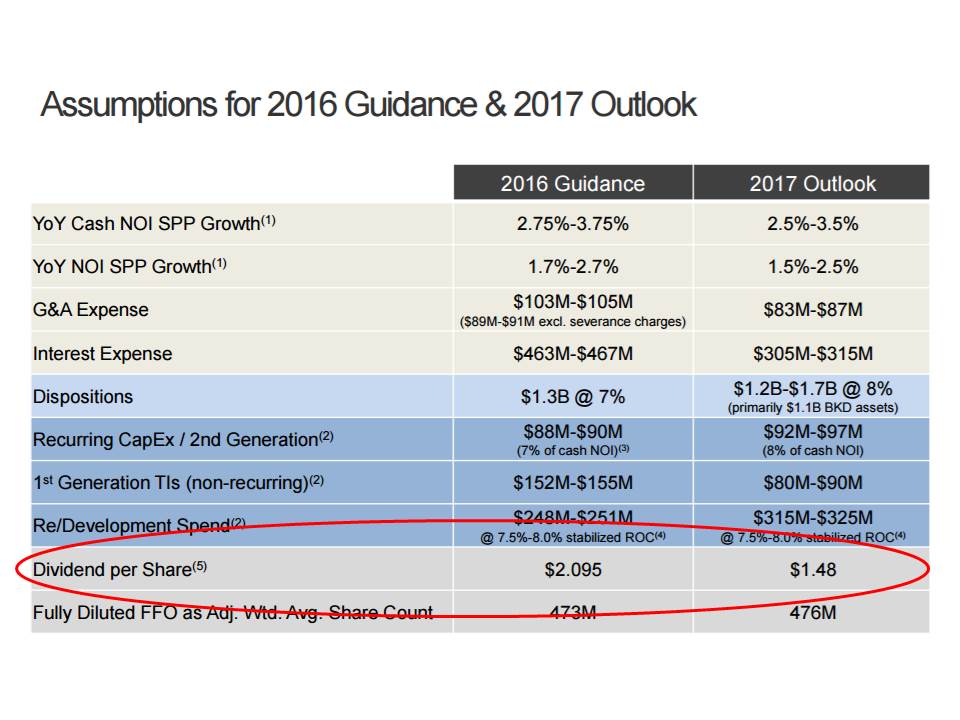

The spin-off of Quality Care Properties took place yesterday, Halloween 2016, and HCP investors were left without a treat as HCP slashed its quarterly payout by nearly 36% November 1. HCP also agreed to sell $1.125 billion of its Brookdale Senior Living portfolio to pay down debt, a move we view as prudent given its lofty leverage multiples. What a fantastic opportunity this presents us with to remind readers that, while history is important and we can learn a great deal from past experiences, what’s ahead is what truly matters. HCP’s poor raw, unadjusted Dividend Cushion ratio appropriately alerted us (and members) of the potential issues on its horizon, but nothing will be able to replace the due diligence that was necessary in uncovering the entirety of the HCP saga.

We at Valuentum continue to fight for the individual investor and financial advisor, and HCP is evidence of that, along with another recent distribution cutter, StoneMor (STON), “As Expected–MLP StoneMor Partners Slashes Distribution!.” Nobody wants to experience reduced income in their retirement nest egg, which is why the Dividend Cushion ratio is such a valuable tool. Our exposure to the REIT industry continues to be the Vanguard REIT ETF (VNQ). The primary reason is clear today – even REITs with tremendous dividend growth track records are not immune to dividend cuts!