Image Source: Jim Makos

“If you’re asking why you’re NOT getting a lot of email transaction alerts related to the newsletter portfolios, you’re finally recognizing the secret to portfolio outperformance: we don’t trade a lot, and we like to get our selections correct…the first time! Isn’t that how it’s supposed to be? Our best ideas for consideration are always included in the newsletter portfolios themselves. They’re in there.” – Brian Nelson, CFA

Brian Nelson, CFA

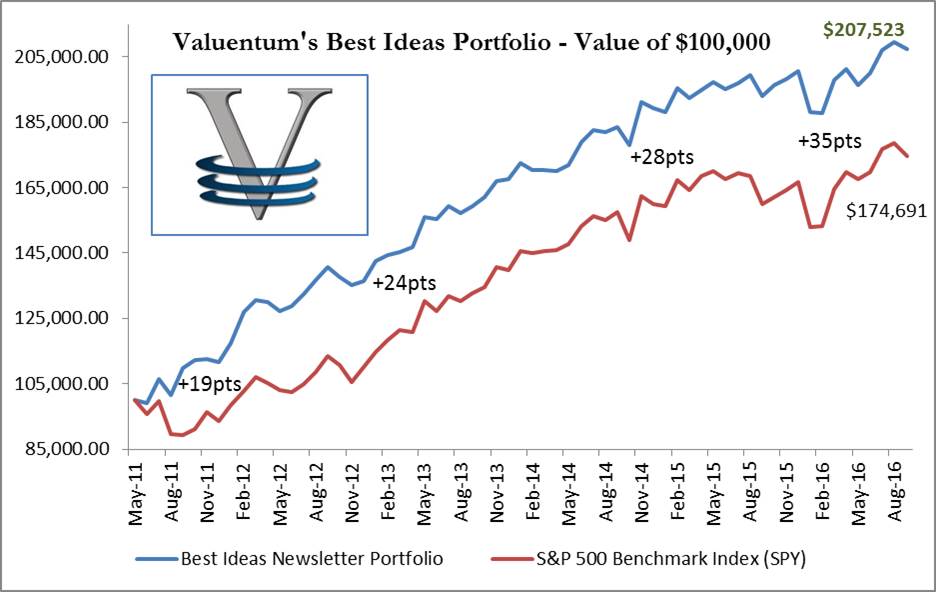

When I pat our team on the back by showcasing Valuentum’s performance, you have to know that I envision you doing as well or better. You’re a member. You mean the world to us. That’s why I’m excited about the performance Valuentum puts up. Because it means that we’ve done good for you! But how good? Well, crazy good. Unbelievably good. 99%+ percentile good? Yes, quite possibly.

This is what you need to know. Bloomberg recently noted that less than 10% of large cap money managers have beaten the market return during the past 5 years. That’s horrible. Are they getting their ideas from others on random crowd-sourced websites? Just kidding. Well…are they? I don’t know, but fund performance has been bad, and I think it has even gotten worse in recent years. But here’s why I am ecstatic for our members!

Valuentum’s Best Ideas Newsletter portfolio has not only beaten the market return during the past 5 years, but it has beaten it by 33 percentage points. Yes, that’s correct: 90%+ of large cap funds didn’t beat the market during the past 5 years (that’s just the market!), but we not only beat the market, but by 33 percentage points. That’s amazing. What’s more incredible though is that I think we made it look really easy; too easy? For example, we didn’t make hundreds of trades or do anything confusing or advanced. We even apologized for the few errors we did make.

I don’t know what imaginary world other websites are living in where they somehow advertise outperformance by picking one or two stocks each month, pointing to ultra-speculative, beta-driven ideas such as Netflix (NFLX) and Amazon (AMZN), for example, but we live in the real world, where we actually try to help investors. That means we care about what we put out. After all, real-life investors manage portfolios, not groups of stocks. We strive to manage newsletter portfolios to outperformance. I just couldn’t imagine holding Netflix or Amazon and calling myself an investor. I’d be a speculative trader, at best.

There was a recent study that showed CNBC’s Jim Cramer doesn’t appear to beat the market either. The Mad Money personality gets way too much flak than he deserves, but according to a working paper at the University of Pennsylvania’s Wharton School of Business, Cramer’s Action Alert Plus (TST) portfolio “has underperformed the S&P 500 index in terms of total cumulative returns since its 2001 inception.” According to the article, the Action Alerts Plus Portfolio cumulatively returned 64.5% over the past 15 years versus 70% for the S&P 500. Valuentum’s Best Ideas Newsletter portfolio, however, has returned nearly 110% cumulatively since May 2011, in a little over 5 years.

I can’t tell you who every individual investor and financial advisor is putting their trust in these days, but I’m glad that we connected. I’m glad you are here. I don’t know why other portfolio managers and authors are doing so poorly, but they sure like to talk on TV, blog on free websites, and tweet on Twitter. They think their advice is helping you. You have to understand—the NOISE wil never stop. However, what you’ve witnessed at Valuentum during the past 5 years (or any time between now and when you joined) has been nothing short of spectacular.

But what could be better than this? Well, I think the best times are still ahead at Valuentum! I’m proud of you.

Image is for informational and educational purposes only. Past results are not a guarantee of future performance. Not financial advice.

Thank you!