By Kris Rosemann

In July 2015, Dividend Growth Newsletter portfolio holding Procter & Gamble (PG) announced it signed an agreement to merge 43 of its beauty brands with Coty (COTY) for an estimated $12.5 billion, “Procter & Gamble Continues Transformation Plan (July 2015).”

Procter & Gamble announced September 1 its plan to complete the separation of 41 of the agreed upon brands—two others will have already been divested—via a Reverse Morris Trust transaction. Procter & Gamble will transfer the assets of the brands to a newly created Galleria Co before merging the subsidiary with Coty. The deal will be tax-free for shareholders that choose to participate for US federal income tax purposes.

Procter & Gamble shareholders have the option to exchange their shares of the firm for shares of Galleria Co, which will then be exchanged for shares of Coty. No actual shares of Galleria will be delivered, nor will there ever be a market for such shares. The exchange offer has been designed such that Procter & Gamble shareholders will receive a ~7% discount for shares of Galleria, or that $1 in shares of Procter & Gamble will equate to $1.075 in shares of Galleria Co. Shares of Galleria will convert to Coty shares on a 1-to-1 basis.

The exchange offer is limited on the upside to 3.9033 shares of Galleria Co for 1 share of Procter & Gamble, and the number of Procter & Gamble shares accepted in the offer will depend on the final exchange ratio and the number of shares tendered in the offer. The exchange offer is subject to pro rating if oversubscribed, and shares of Galleria will be distributed on a pro rata basis to all Procter & Gamble shareholders if undersubscribed. The prices of the exchange will be determined by the daily volume-weighted average prices of Procter & Gamble and Coty stock during the 3 consecutive days ending on and including the second clear trading day before the last day of the exchange offer. The offer expires at midnight Eastern Daylight Time on September 29.

Procter & Gamble expects to issue nearly 410 million shares of Galleria Co in accordance with the deal, which puts the equity value of the transaction at just over $9.7 billion based on Coty’s closing price on September 22. The deal is also inclusive of $2.9 billion in debt, which is subject to a $1 billion adjustment within a collar based on the trading price of Coty stock prior to closing. Before the deal closes, JAB Cosmetics, the sole owner of Coty Class B shares, will exchange all of its Class B shares for Class A shares of Coty, resulting in Class A shares being the only class of stock of the firm. Following the close of the deal, Procter & Gamble shareholders are expected to own ~55% of the newly combined company.

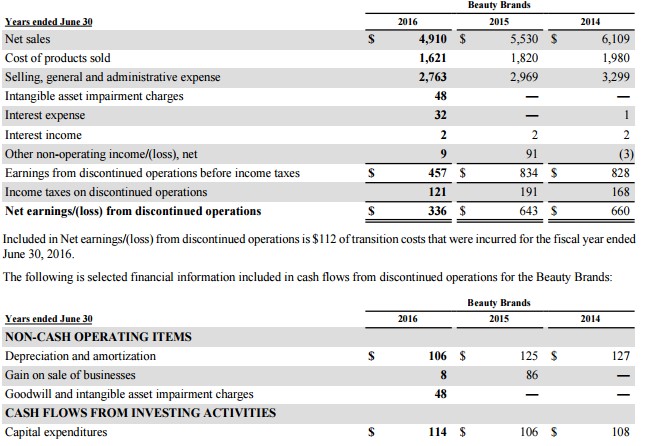

All of these details sound enticing for Procter & Gamble shareholders, but let’s dig a little deeper into the valuation side of things, as well as consider the recent trajectory of the brands being separated. The consumer staples giant’s beauty brands have not been performing all that well as of late. Sales have declined steadily, materially pressuring net earnings and cash flows, as can be seen in the snapshot of page 61 of Procter & Gamble’s fiscal 2016 annual report below.

Image source: Procter & Gamble Annual report

The brands included in the transaction are not Procter & Gamble’s strongest and include: Wella Professionals (and its sub-brands), Sebastian Professional, Clairol Professional, Sassoon Professional, Nioxin, SP (System Professional), Koleston, Soft Color, Color Charm, Wellaton, Natural Instincts, Nice & Easy, VS Salonist, VS ProSeries Color, Londa/Kadus, Miss Clairol, L’image, Bellady, Blondor, Welloxon, Shockwaves, New Wave, Design, Silvikrin, Wellaflex, Forte, Wella Styling, Wella Trend, Balsam Color, Hugo Boss, Gucci, Lacoste, bruno banani, Escada, Gabriela Sabatini, James Bond 007, Mexx, Stella McCartney, Alexander McQueen, Max Factor and Covergirl.

In addition to the declining attractiveness of the brands to be included in the transaction, we’re not particularly fond of Coty’s recent performance. In its fiscal 2016, ended June 30, the firm reported a 1% decline in net revenue, a 36% drop in operating income as reported, and a 31% decrease in diluted EPS as reported. A large portion of the revenue growth in the year came from recently completed acquisitions, and the firm’s like-for-like revenue fell 1% from the prior fiscal year. Cash provided by operating activities fell to $501 million in the fiscal year from over $526 million in the fiscal 2015. Shares of Coty currently yield ~1.15%.

However, Coty is expecting material improvements across its business as a result of the transaction. The deal will double the revenues of the firm, and it expects to realize ~$550 million in total cost savings, consisting of $400 million in Procter & Gamble costs that will not transfer and $150 million in incremental cost synergies, the latter of which are expected to be recognized by the end of the third year following closing. Coty’s net debt-to-EBITDA is expected to be 3.0x immediately following the closing of the deal.

When completing our valuation analysis of Procter & Gamble’s departing brands, we include the $150 million in incremental synergies in our calculation of expected free cash flows (an addition of $50 million per year). Such an adjustment results in a projection for adjusted free cash flow in year 1 of just under $570 million–Procter & Gamble’s fiscal 2016 adjusted free cash flow came in at $496 million. In order to get this free cash flow stream to reach the expected $9.7 billion equity value in the transaction, we are forced to assume a ~4.2% growth rate in perpetuity, assuming a 10% discount rate is in place.

This is where we believe the deal begins to fall apart in terms of the amount of sense it makes for Procter & Gamble shareholders. Given the recent trajectory of the beauty brands, we have a difficult time believing the free cash flow stream they produce will continue to grow at a 4%+ rate for the foreseeable future. Even though shares of Procter & Gamble have run past the upper bound of our fair value range, we prefer the higher-yielding shares of the consumer staples giant over Coty–PG shares currently yield ~3% compared to the ~1.2% yield of COTY shares–especially in the Dividend Growth Newsletter portfolio.

Now having said all of this, we continue to view shares of Procter & Gamble as a potential source of cash themselves in the future, perhaps sooner than later. Dividend-paying consumer staples entities are among the most expensive equities on the market today, but have shown little signs of slowing. We’re going to continue riding the wave of the market, with a keen eye on the potential for the seemingly ever-inflating dividend growth bubble to pop. Stay tuned for developments. It’s great to make money — but we’d like to keep it, too!