Industrial bellwether and newsletter portfolio holding General Electric’s acquisition of two European 3D printing companies has brought the budding technology back to the fore of investor’s minds. Let’s take a look at some of the major players in the space as well as how the market may develop in coming years.

By Kris Rosemann

3D printing may have once seemed like a technology we would only see in a futuristic sci-fi movie, but it is now a reality and has been so for some time. Though it will inevitably revolutionize the $12 trillion global manufacturing market and is one of the highest growth potential areas, plenty of questions remain surrounding the foundation of the industry that continues to be laid, among both participants and investors alike. How quickly will it be adapted? How will the technology continue to develop? Who will be the market leaders five years from now, and what business model will be the most successful in the space?

The 3D printing market in 2015 has been estimated to be a $5 billion market, a pie that is destined to grow drastically in coming years. There are currently a variety of technologies within the market including Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), Stereo Lithography (SLA), multi-material jetting, and others, which provide a degree of ‘natural’ segmentation within the market. Pricing serves as a market divider as well, and the successful development of varying technologies and pricing points within the market could very well facilitate the creation of a number of market leaders. The 3D printing market is not one likely to be dominated by one firm over the long haul.

Additionally, the 3D printing market is certainly expected to grow to a size large enough to allow for many successful operators. Some estimates are projecting the market to grow by 30% annually through 2030, a believable figure when considering the compound annual growth rate for the industry over the past three years was nearly 34%. Perhaps the most aggressive estimate has the 3D printing market mushrooming to $490 billion by 2025. Drivers of the ongoing adoption of the technology, and therefore the growth of the market, will be continued improvements in equipment cost and availability, advancing application engineering, increased sophistication of materials, and the speed and quality of the actual manufacturing process.

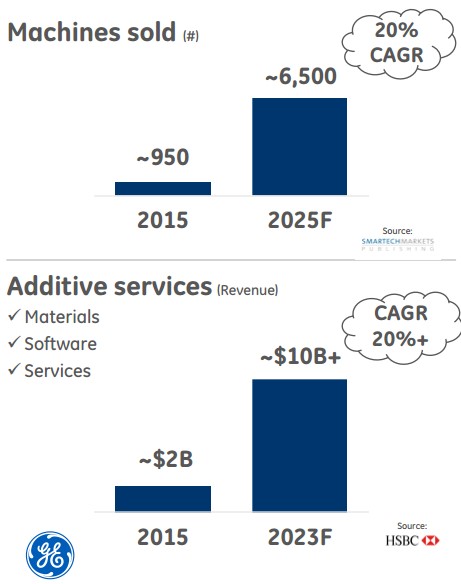

Image source: GE presentation

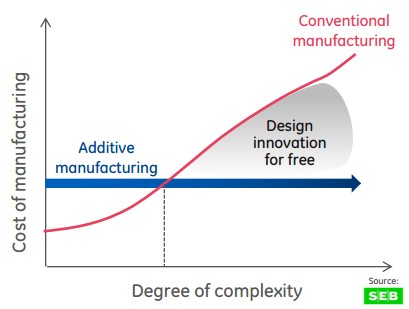

Many of the drivers of the growth of the 3D printing industry will also serve as differentiation possibilities for the players within the space. There will inevitably be a wide range of pricing points across the market once it develops into its full potential. Other upfront differentiation points will be similar to that of most other manufacturing processes: lower running costs, expanded capabilities of machinery, and higher performance and productivity. Vertical integration in the form of a controlled supply chain and economies of scale are two key competitive advantages that will likely be formed in coming years that are worth keeping an eye on.

The business models of participants in the 3D industry could vary drastically as well. The traditional 3D printing plays tend to operate razor-razor blade businesses. The sale of the hardware in the form of the 3D printing systems is not as profitable as the recurring sales of the input materials necessary for completion of the printing, and materials sales offer an annuity of sorts on each printing system sold. For example, all of HP’s (HP) material sales for its 3D printing systems come through the firm itself, even though it does not develop the materials itself. Firms that purchase HP’s hardware must then buy the materials necessary to complete the printing of the desired product from HP. The company describes the relationship as similar to an app store with app developers receiving incentives for developing successful apps, or in this case, materials.

Other companies are taking different approaches to the 3D printing space. Proto Labs (PRLB), for one, offers 3D printing services. The firm describes itself as “a technology-enabled company that uses rapid 3D printing, CNC machining and injection molding technologies to produce parts within days.” Its products offer unprecedented speed-to-market value for engineers and product designers instead of the sale of hardware to companies.

Aluminum giant Alcoa (AA) recently ramped up its investments into 3D printing. In addition to the 2015 acquisition of RTI International Metals, which increased Alcoa’s 3D printing capabilities, the firm recently opened a 3D printing metal powder plant that will increase its focus on the production of proprietary titanium, nickel and aluminum powders designed for use in 3D printed aerospace parts. The developing business will be separated from Alcoa’s traditional commodity business in the second half of 2016 and form part of Arconic, which will be an independent, publicly traded company.

Alcoa has demonstrated leadership in the 3D printing industry over its 20-year history in the market, and it owns and operates one of the largest Hot Isostatic Pressing (HIP) plants in the world, which strengthens the metallic structure of 3D printed jet engine parts. As a result it recently signed multiple agreements with Airbus (EADSY) to provide 3D printed components for its commercial aircraft.

Industrial bellwether GE (GE) recently began its foray into 3D printing. The company paid $1.4 billion to acquire Arcam and ALM Solutions in its plan to enter the manufacturing equipment, materials, services, and software businesses of the 3D printing industry. The move seems to be a natural extension of its industrial history, and the market is young enough that GE’s massive scale advantages compared to other participants can be exploited. A meaningful near-term impact is not expected from the acquisitions, but management is anticipating 3D printing to generate $1 billion in revenue by 2020.

The expansion into 3D printing allows GE to enter a fast-growing industry where it can build a competitive position, expands its design capabilities to meaningfully reduce product costs, enables a more efficient model for services cost, and perhaps most importantly it leverages the significant capacity of the GE store, which already has key strengths in materials, software and product design. We have often praised Apple’s (AAPL) ability to create an ecosystem of apps that has found its way into the everyday life of consumers, and the GE Store has the potential to develop into a similar type of business serving multinational corporations and government entities instead of consumers. HP has parallel hopes for its business, but we like the scale that comes with GE’s existing industrial businesses.

The firm’s expectations for productivity in terms of cost savings is currently $3-$5+ billion, though putting a cap on savings potential at this point in time may be an exercise in futility. GE’s 3D printing investments are certainly a long-term focused strategy at this point in time.

Image source: GE presentation

Investors looking for a way to exploit 3D printing in the near term may be better off picking up some lotto tickets at their local convenient mart.

Two of the best known pure-play 3D printing firms, 3D Systems (DDD) and Stratasys (SSYS), continue to see high levels of volatility and short interest in their shares. Both firms also have provided concerning commentary on the near-term outlook for market demand. In its second quarter 2016 report, 3D Systems reported strong demand for its software and healthcare solutions and improved materials sales in industrial and healthcare applications. However, the positive momentum in select areas was not enough to offset the decline in demand for 3D printers and on-demand manufacturing, the former being far more concerning. Stratasys also reported weak market demand causing slow hardware sales in all of its regions served and business units.

The implications of falling hardware sales for firms like 3D Systems and Stratasys could continue to be felt well beyond the quarter in which the softening demand occurs. The razor-razor blade business model these firms operate is dependent on ongoing sales of the razor, or hardware, to drive continued growth in the higher margin razor blade, or materials, which has the potential to turn into an annuity-type revenue stream. The potential for such weakness in demand at this stage in the development of the market only increases the current risks associated with companies so dependent on the adoption of a budding technology. Other pure play options exist in the form of micro and small cap firms such as Voxelijet (VJET) and Materialize (MTLS).

We like the idea of exposure to a rapidly growing technology, but the near-term volatility and risk potential associated with a budding market do not fit our risk-averse investment philosophy. 3D Systems, for example, is not consistently profitable, even as it is one of the industry leaders, and its shares have fallen from nearly $100 as recently as 2014 to current levels in the mid-teens.

The best measure of exposure to the industry may have fallen directly into our laps in the form of GE’s recent acquisition of two 3D printing firms. We continue to reap the benefits of owning an industrial bellwether in the newsletter portfolios while gaining exposure to an evolving technology that has the potential to explode in terms of productivity and mainstream adoption. Further, we think GE’s manufacturing expertise and scale benefits will facilitate the development of its 3D printing portfolio in ways that smaller firms may not have the resources for.

HP may be another option to gain a level of exposure to 3D printing without having to place confidence in a pure play. The firm is aggressively going after the market and expects to push the limits with respect to pricing points to grab share. Management is anticipating the recognition of 3D printing revenue in fiscal 2016 with a material ramp coming in fiscal 2017.

3D printing is not going away anytime soon, and though hardware demand may feel some near-term pressure, we view any such dynamic as a transient one that will not inhibit the long-term proliferation of the technology as a core manufacturing process in many different verticals moving forward. At this point in time, the degree of exposure to the space investors choose to take on is largely dependent on their risk preferences. For those fond of the diversification factor of ETFs, The 3D Printing ETF (PRNT) may be an option as it “is composed of equity securities and depositary receipts of exchange listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D printing related businesses.” We’re sticking with GE as our preferred exposure, however.