Image Source: Realty Income (used with permission)

By Kris Rosemann

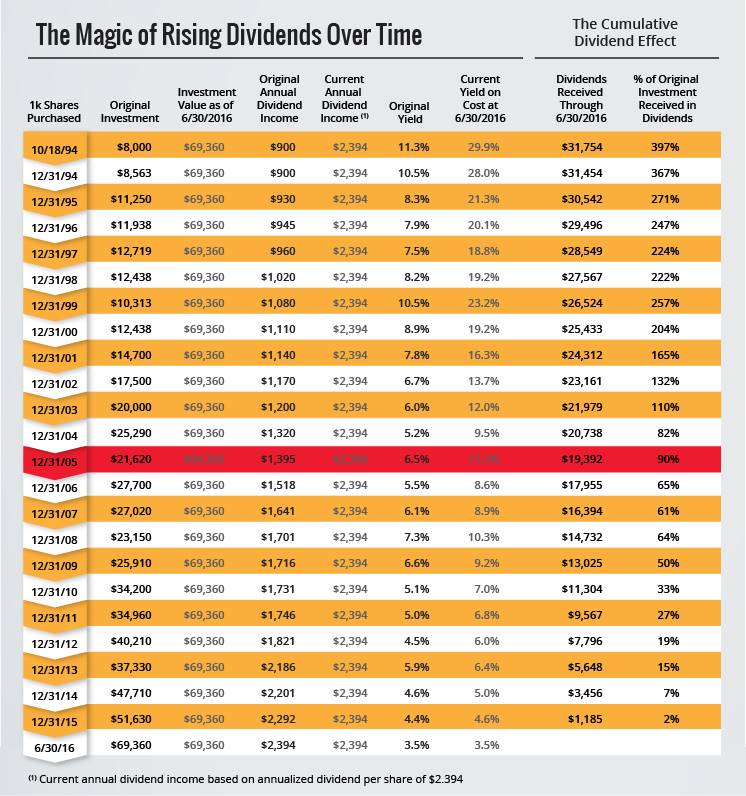

Dividend Growth Newsletter portfolio holding Realty Income (O), or ‘The Monthly Dividend Company,’ increased its monthly payout for the 75th consecutive quarter in June 2016 during yet another solid quarter of operating performance. The cumulative monthly payouts in the June quarter of 2016 reflect 4.9% growth over the cumulative payouts in the comparable period of 2015.

Backing such an impressive dividend track record has been Realty Income’s steady portfolio of long-term lease agreements. Occupancy rates in its portfolio continue to hover around 98%–the metric ended the quarter at exactly 98%–helping revenue advance nearly 7% in the second quarter of 2016 from the year-ago period, thanks in part to same-store rents increasing 1.4%. Adjusted funds from operations (AFFO) per share grew 4.4% in the second quarter of 2016 on a year-over-year basis to $0.71.

Realty Income’s per share growth rates were impacted by equity issuances in the quarter that will be used to fund acquisitions throughout the remainder of the year. The company is taking advantage of the current low cost-of-capital environment and has already completed the equity issuances that will fund the majority of its property acquisition activity this year. Thanks to a first half in which management completed $663 million in acquisitions at record-high investment spreads relative to its weighted average cost of capital, the firm increased its annual acquisition guidance for the second time in as many quarters in 2016 to $1.25 billion from previous guidance of $900 million.

In addition to its solid operating performance, Realty Income received some welcome news from the credit rating agencies in the second quarter of 2016. Moody’s (MCO) cited the firm’s “strong balance sheet and liquidity profile, supported by consistently stable cash flows…” as factors behind its decision to raise Realty Income’s outlook to ‘positive’ from ‘stable.’ Standard & Poor’s (SPGI) issued a similar upgrade, and Realty Income’s credit rating remains investment grade.

With a steady, recession- and competition-resistant portfolio of long-term lease agreements and a management team that is able to continually return capital to shareholders via a growing stream of monthly dividends, how could one not love Realty Income? Additionally, we like what we’re seeing from management, as it takes advantage of historically-low costs of capital and a solid pipeline of potential acquisitions, which should only put it in better position when interest rates inevitably begin to rise. Realty Income has been a wonderful performer in the Dividend Growth Newsletter portfolio for members, and we expect to continue to hold it for the foreseeable future.

Related tickers: VNQ