“Auto is clearly a little stretched, in my opinion…Someone is going to get hurt…We don’t do much of that.” — JP Morgan CEO Jamie Dimon, Yahoo Finance, June 2016

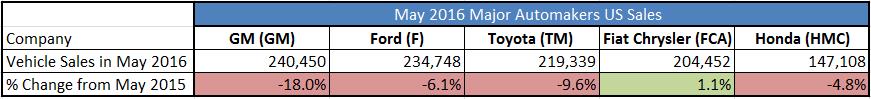

The month of May saw many major automakers report significant declines in sales in the US. Could the effect of pent-up demand for autos finally be slowing? An overheated loan market is adding concern to the situation.

By Kris Rosemann

Major automakers will be forced to make some important decisions in coming months.

The US auto market is clearly slowing from the breakneck pace it set last year, particularly late last year, as total US auto sales fell 6% in May 2016 from May 2015. The strength of the rally in recent periods has been largely based on pent-up demand from the Great Recession, as well as falling gas prices supporting demand for larger, more expensive vehicles, but as we move farther away from the 2009 bottom, the dynamic of pent-up demand is beginning to fade. Overall US personal consumption expenditures have shown signs of decelerating in recent quarters as well, suggesting that US consumers may not be spending as freely as they had in the recent past. Last year’s record annual sales mark will be very difficult to match, even if 2016 sales figures are healthy by historical standards.

As the US auto market continues to show signs of plateauing, automakers may begin cutting back production to mirror consumer demand. Alternatively, and perhaps more likely in the near term, they could ramp up fleet sales (sales to rental companies, government agencies, etc., typically offered at a bulk discount), which some had been looking to avoid in 2015 as higher-margin consumer demand ballooned. Fleet sales in May 2016 jumped 13% from the year-ago period, a dynamic that could prop up sales in the short-run, but is not likely a sustainable strategy.

Meanwhile, auto dealers are doing everything they can to continue driving demand for new vehicles. Sales incentives exceeded $3,000 per vehicle in the month of May, representing 11% growth on a year-over-year basis. Things may be getting increasingly more tenuous, however, as the high number of new vehicles leased in recent years are coming back and will continue to come back to dealer lots in the form of late model used cars, further saturating the US auto market. Automakers will eventually have to face the music and reduce production, at least it would seem. This is not unlike the nature of the business, however.

The cyclical nature of the auto market will be on full display in coming years, as the industry will face downward pressure from the pace of sales set in late 2015. Adding to the potential list of future worries is the current shape of the US auto loan market. The total amount of auto loans in the first quarter of 2016 jumped 10% from the first quarter of 2015 to more than $1 trillion, and the percentage of these loans that are delinquent is growing as well. Though delinquent loan rates remain below historical averages, the rising percentage of delinquencies on a rising percentage of overall loans is certainly not a positive sign for the industry. Keep in mind the shape of the current US economy when considering the idea that delinquent loans are on the rise (it’s extremely healthy, all things considered). Further, the percentage of auto loans that are of the subprime and nonprime varieties has grown as well, as has the average term and amount of said loans. The average credit score of borrowers in the new auto loan space continues to fall as well.

Despite the fact that the auto loan market is becoming worrisome to those involved, the broader financial markets should not be fretting potential danger in the industry as a parallel to the housing crisis of late last decade. Auto loans are not traded as investment vehicles as widely as mortgages (mortgage backed securities) were leading up to the Financial Crisis, meaning the fallout from loan troubles should be more easily contained. The growing pressure in the auto loan market does have the potential to impact the future of the auto industry, however. As consumers may be overextending themselves due to the ease of access to loans, similar to the way they did prior to the housing crisis, they will dampen the potential for future buyers and borrowers, themselves included, to receive attractive and appropriate auto loans.

More specifically, the growing length of loans (the average loan term for subprime and nonprime new auto loans has reached 6 years) will materially impact the auto market 5 or so years from now when those consumers are looking to upgrade their vehicles once again. Key drivers behind the tremendous peak the auto industry has only recently achieved may very well become significant factors in an amplified downturn in demand in coming years.

If the growing number of low quality auto loans begins to underperform in a meaningful way, lenders such as Ally Financial (ALLY), Santander Consumer (SC), Credit Acceptance Corporation (CACC), and many regional banks offering auto loans to lower-quality borrowers will be forced to begin increasing restrictions on the availability of such loans. This then has the potential to impact the pace of auto sales in a much shorter time horizon than the aforementioned 5 year “trade-up” cycle. The vast majority of new cars are purchased on credit (over 86% in Q1 2016), meaning the consumer credit and auto markets will be forever linked.

Average auto loan amounts continue to move upward, in tandem with the previously mentioned loan term length, both of which recently set records. The average loan amount for a new vehicle now sits above $30,000, an all-time high, and the average monthly payment for new vehicle loans has also reached an all-time high, at just over $500. As the average payment and loan term increases, it will likely follow that the growing number of subprime borrowers could face increasing trouble meeting their obligations at some point in the multi-year period following the origination of their loans.

Though the number of 30-day and 60-day delinquent loans has grown in recent periods, the overall rate of delinquent loans remains low compared to pre-recession levels. However, the number of auto loans and leases held by nonprime and subprime borrowers jumped 9.5% and 10.9%, respectively, in the first quarter of 2016 on a year-over-year basis, while loans to prime borrowers grew 8.9%. The robust growth in low-quality credit loans suggests less stringent policies from lenders in the loan approval process, which inevitably has the potential to hurt the auto loan market as careless lending comes back home to roost. History has shown that borrowers are all too willing to overextend themselves in order to gain the material possessions they desire; it is human nature in a sense.

So what does all this potential danger mean for investors?

The cyclicality of the auto market is not a recent development, but that does not make such risks any less prevalent. Investors must be aware of the supply and demand dynamics currently taking place in the industry and their potential to impact the future of the space. The US auto market is growing to its peak, if it hasn’t already, and the time to gain exposure to the pent-up demand of the industry has likely passed. This is not to say that automakers and related firms will not continue to prosper in the near term, but rather a warning of the mounting potential pitfalls that lie ahead, which we’ve been pointing to for some time now, “Debt, Debt, and More Debt (April 2016).” Valuations will become more and more to pay attention to, if they weren’t prime consideration in the first place.

Major automakers may be facing yet another obstacle in the form of the United Kingdom’s exit from the European Union, as the material weakening of the British pound (FXB) is expected to have a significant impact on the UK (EWU) auto market. The uncertainty in the country’s economy is anticipated to pressure investments, both in human capital and physical capital, as businesses, including car manufacturers in the nation, await greater economic clarity. The UK car industry has been advancing nicely in terms of production in recent years, but approximately 80% of vehicles made in the country are exported, with nearly 60% of these exports going to Europe. Conversely, roughly 80% of vehicles sold in the UK are produced in EU member nations.

Currency moves may provide challenges as well as opportunities (from which side of the English Channel one looks at it), but such large import-export dynamics open the door for potential trade restrictions with the remainder of Europe as a result of ‘Brexit.’ The full implications of which remain uncertain at this point, but it could severely impact the auto sector that supports ~800,000 jobs and contributes ~£15.5 billion to the UK economy. Some early observers are expecting both the European Union and the UK to impose tariffs on vehicles imported from the at-odds entities, making a large portion of the UK and European auto markets materially more expensive for average consumers. Early projections are estimating UK auto sales could fall 15% in 2018, representing the loss of almost half a million vehicle sales from expectations based on the UK staying the EU.

For the time being, however, the UK auto market exports reached record levels in 2015, a record that may very well remain for some time following Brexit. Major contributors to the record production, companies that may feel the worst impact from the changing political landscape, include Tata Motors (TTM), Nissan Motor Co. (NSANY), Toyota (TM), and Honda (HMC), among others. As it relates to potential top-line erosion from the expectations for falling car sales in the UK, Ford (F) could be at risk in coming years due to it generating nearly 8% of total 2015 sales in the country. General Motors (GM), despite having over 10% share in the nation’s auto market, is less exposed to the country’s auto market, as it sold just over 3% of its total vehicles sold in 2015 in the UK.

Investors that are hungry for exposure to the auto market in coming years despite the growing risks related to new car buying may consider auto parts retailers, AutoZone (AZO) and O’Reilly Automotive (ORLY), which can offer a defensive play to the declining attractiveness of the new car market in the US as consumers attempt to stretch the life of their used cars past their typical life cycles. We don’t dislike GM and Ford, however, as there valuations are still quite attractive and both continue to perform well in China. We’re not against exposure to the group, but we’re most comfortable on the sidelines for the time being. We’ll continue to monitor developments related to the supply and demand of the auto market and the corresponding loan market, not to mention the impact of Brexit on intra-European demand.

Retail – Auto: AAP, AN, AZO, CPRT, GPC, KMX, MNRO, ORLY, PAG

Image Source in teaser: Ally Financial