Image Source: War History Online, June 22

Brexit may or may not be a big problem. Time will tell.

But what matters and eventually becomes its own catalyst, however, is valuation. The forward price-to-earnings multiple on S&P 500 companies (SPY) is currently ~16.5 times, above its 5-year (14.6) and 10-year averages (14.3). This is the real story. Assuming a reversion to the 10-year average multiple, for example, the S&P 500 can be considered “fairly valued” at $1,811, a drop of another 10% from ~2,000 levels. You don’t need us to tell you that the markets have practically gone straight up the past seven years from the March 2009 panic bottom through today, with the S&P 500 effectively tripling since that fateful day. We haven’t yet begun to see the froth come out of the US stock markets yet, and it’s very important that readers understand that markets overshoot to the downside all the time.

We’re not worried. Our newsletter portfolios are positioned nicely. We hold rather lofty cash balances in both, approximately 15% in the Best Ideas Newsletter portfolio and approximately 25% in the Dividend Growth Newsletter portfolio. We love “dry powder,” so when Mr. Market starts having a panic attack, we can increase exposure to areas that we like. The biggest challenge for investors seeking to put new money to work, however, is that most equities in the US have reached “bubble” proportions. You know this–we’ve been saying it for months. Consumer staples (XLP) equities are trading at nearly 21 times forward earnings, and cyclical equities, the consumer discretionary (XLY) sector and the industrials (XLI) sector, for example, are trading at peak multiples on cyclical peak earnings. Most market observers know that when investors are paying peak multiples on cyclical peak earnings, trouble may be around the corner.

Of course the markets are setting up for a nice shake out, but that’s okay, and it’s not because of Brexit. The market will always be a weighing machine, and valuation will always be the ballast that ties equity prices to intrinsic values over time. Those that forgot this recently may now be selling their positions aggressively. We’re not doing anything. We love that two of our largest weightings in both newsletter portfolios, Altria (MO) and Johnson & Johnson (JNJ), continue to ratchet to new all-time highs! We love that the Utilities Select SPDR (XLU) continues to offset weakness in several holdings in the Best Ideas Newsletter portfolio. We love the resiliency of Realty Income (O). With every percentage point fall in the S&P 500, we add 15 basis points and 25 basis points of relative outperformance in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, all else equal, respectively. Nobody likes it when the markets go down, but we run the newsletter portfolios to achieve the goals of them.

There will be some winners and there will be some losers, but we’ve been expecting a broad market sell-off even as we’ve added some incremental exposure to the newsletter portfolios recently — in fact, we just closed our put option positions. We expect broader markets to continue to be choppy, and while we continue to expect alpha generation from both newsletter portfolios, we wanted to provide an incremental add-on feature that gives members more individual stock-selection options, outside of our coverage universe. This is why we launched our brand new publication, the Nelson Exclusive. I think it’s a fantastic way to get more from Valuentum, while not blending the goals of newsletter portfolio management with individual standalone security selection, which are two different dynamics. What may be best for a newsletter portfolio may not be best on an individual basis. Though we can never provide personalized advice or recommendations, the Nelson Exclusive meets this need for members. You asked, we answered.

To reserve your membership to the Nelson Exclusive: /20160505

What a difference a couple weeks make. If Microsoft (MSFT) had just been a bit more patient, it probably wouldn’t have leapt head-first into the LinkedIn (LNKD) deal following the Brexit news. Of course Microsoft is focusing on the long term, but focusing on the long term doesn’t mean prudence should be thrown out the window. Microsoft significantly overpaid for LinkedIn as is, and it probably would have been able to save a couple billion dollars, given that LinkedIn’s equity would have assuredly faced abnormal selling pressure in light of existing market conditions. This isn’t about Monday morning quarter-backing or hindsight being 20-20, but it’s more about common market sense. We’re not sure what the board of Microsoft was thinking, and we’re still comfortable with our decision to have removed half of its position in the Dividend Growth Newsletter portfolio. After all, if the board agreed to spend up for LinkedIn, what other mistakes could the board be making…right now?

We’re paying the most attention to the equity market activity of the European banks (XLF, KBE). Our thesis on the banking sector is a unique one, but it’s also tried-and-true. That the market values of Barclays (BCS), Royal Bank of Scotland (RBS), and Lloyds Banking (LYG) are dropping another 15%-20% on the trading session June 27 is flat-out significant, as their market capitalization is incredibly important when it comes to gauging counterparty, dealer and credit risk, not to mention their ability to raise incremental equity capital, should that be necessary. The global financial system operates on confidence, and when confidence is shattered for reasons that may be fair or not (real or perceived), the implications are far reaching. Those that experienced the Financial Crisis first-hand know that when it comes to banking perception is reality, and if market participants start to think the European banks are in trouble, the very activity by such market participants (selling their equity, reducing exposures, calling in positions, etc) will make it so.

From our ETF report on the Banks & Financials Services sector (pdf):

The Banking Industry Is All About Confidence

The financial sector, and the underlying banking industry in particular, is distinctly different than most other sectors like industrials, retail, or healthcare, for example. Unlike the latter industries, banks use money to make money (net interest income), instead of using operating assets like property, plant and equipment (PPE) and raw materials to drive revenue and resulting free cash flow. This means that continued access to money and credit is the primary source of banks’ economic returns and more specifically their survival.

The “5 Cs of credit” — character, capacity, capital, collateral, and conditions — is a widely-followed framework and generally-accepted guideline for lending to consumers, but for corporate entities, we think another C is much more important: confidence. In almost every situation where a bank has encountered trouble, it has resulted from a loss of confidence in the sustainability of the entity as a going concern. The loss of confidence could originate from counterparties, intermediaries, depositors or clients, or from any other core stakeholder. Lack of confidence typically spreads quickly.

Lehman Brothers’ bankruptcy filing in 2008, for example, was accelerated by clients leaving the firm and credit rating downgrades that completely obliterated market confidence in the sustainability of the entity. Barclays now owns Lehman, which had been a staple in American society since its founding in 1850. Washington Mutual had its foundation rocked that same year when its customers, over a period of just 9 days, withdrew ~$17 billion in deposits, or about 10% of its total deposits, in the modern-day equivalent of a bank run. The Federal Deposit Insurance Corporation seized Washington Mutual and sold the 120-year-old company to JP Morgan (JPM) shortly thereafter. In both cases, the loss of confidence prompted disaster, leaving shareholders with only a fraction of their invested capital.

Quite simply, if the market does not have confidence in a banking entity, that banking entity will cease to exist. Though other business models such as master limited partnerships and real estate investment trusts depend on continuous access to the credit markets and incremental capital, a run-on the-bank dynamic is a risk that is almost entirely unique to banks. FDIC insurance does not cover the financial products that a bank offers, including stocks, bonds, mutual funds, and life insurance, and the standard FDIC insurance amount is $250,000 per depositor, per insured bank. Because the government cannot insure everything and plan for all risks, traditional run-on the bank dynamics can never be completely hedged away, no matter how advanced or regulated the banking system becomes.

An insufficient capital position brought about by excessive risk-taking (leverage), poor lending standards, and under-water loans as a result of asset declines may be more tangible operating reasons for a bank’s failure, but without confidence, even strong banks cannot survive.

The Financial Crisis of 2008 and the Great Recession

During the past three decades alone, there have been three significant banking crises: the savings and loan crisis of the late 1980s/early 1990s; the fall of Long Term Capital Management and the Russian/Asian financial crisis of the late 1990s; and the Great Recession of the last decade that not only toppled Lehman Brothers, Bear Stearns, Washington Mutual, and Wachovia but also caused the seizure of Indy Mac, Fannie Mae and Freddie Mac.

We believe that an investment in a bank must come with the acknowledgement of the distinct possibility that another financial crisis may occur at an unknown time in the future. The primary reason for this view rests on the fact that banks do not keep a 100% reserve against deposits. Our good friend George Bailey, played by actor Jimmy Stewart, in the movie It’s a Wonderful Life knew this very well when he tried to discourage Bedford Falls residents from making a “run” on the famous and beloved Building and Loan. It’s a movie that some of us have watched a dozen times or never at all, but it’s a scene that’s unforgettable.

Washington Mutual fell prey to this very dynamic in 2008.

In the testimony of Mr. JP Morgan before the Pujo Committee of 1912-1913, character is the only thing that matters in banking—or said differently, perceived confidence that the banking system will continue to work is really the duct tape that holds the financial markets together. Once this perceived confidence breaks down as it has many a time before, a “run on the bank dynamic” occurs. Stakeholders can’t get their money fast enough. Such a unique risk will always be present for banking-firm investors relative to investors in general operating corporations.

To continue reading our ETF report on the Banks and Financial Services sector (pdf) >>

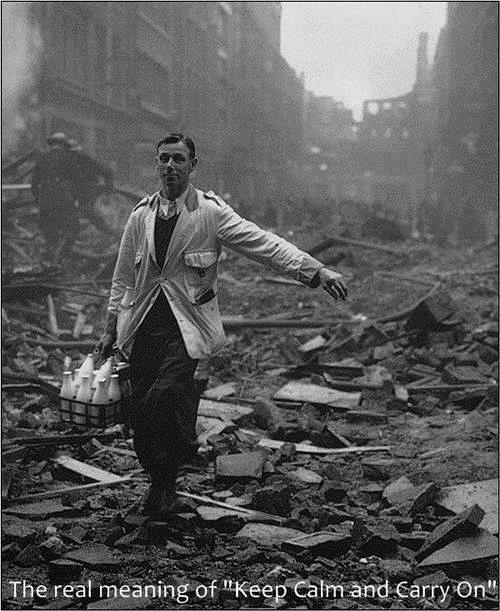

What to expect from us in the coming days? It’s important that you know that we’re not in any rush to do much of anything in the newsletter portfolios. We may look to add to the position in Priceline.com (PCLN), which has experienced considerable selling pressure in light of the expected decline in air travel in Europe and across the Atlantic from Brexit, but we’re still watching shares. We’ll be removing the position in Talen (TLN) from the Dividend Growth Newsletter portfolio in coming days – the spin-off of PPL Corp (PPL) was bought out recently, and we expect to clean out the position when the July edition of the Dividend Growth Newsletter portfolio is released July 1. We’re only a few percentage points from all-time highs in the S&P 500. It’s still too early for bargain hunting, in our view. We could be in store for much more selling. Keep calm and carry on!