Teva remains confident in its combination with Allergan Generics. Image source: Teva quarterly presentation.

In July 2015, Best Ideas Newsletter portfolio holding Teva Pharmaceuticals (TEVA) announced it had agreed to acquire the generic drug portfolio of Allergan (AGN). It was expected that the firm would have to divest certain assets in order to clear the increasingly unpredictable US regulatory requirements, as is common with most acquisitions of its size. The deal was originally anticipated to be completed by the end of the first quarter of 2016, but it was announced March 15 that the transaction would be delayed.

However, the process continues to take longer than foreseen, and Teva will have to sell more than the $1 billion in assets it was in the process of divesting in December 2015 in order to please the Federal Trade Commission (FTC). The company expected to complete the divestiture of its US assets by January, which it thought would have cleared the merger by US antitrust requirements if everything had gone according to plan. But as we are now in early May, everything has not gone according to plan, and the company has announced that it is currently finalizing another $2 billion in asset sales, a good amount of which are pipeline products.

Part of the reason the process is taking an extended amount of time is due to the FTC requiring the sale of assets still in Teva’s pipeline, which means that it was required to wait on information from the US Food and Drug Administration (FDA) to properly rule on overlapping products. Negotiations between Teva and the FDA and FTC have been a thorn in the firm’s side, but the deal remains on track to be closed in June. Regardless of whether or not that is accomplished, recent developments have shaken investor confidence in the transaction, which was approved by the European Commission on March 10. Though the uncertainty of meeting regulatory demands of this massive $40.5 billion acquisition remain, fundamental operating performance continues to be solid, however.

On May 9, Teva reported financial results for its first quarter of 2016. Revenue fell a slight 1% on a constant currency basis from the year-ago period mostly due to a sharp decline in the firm’s Generic Medicines segment, specifically in the US, as the loss of exclusivity on Nexium and Pulmicort led the decline in sales. GAAP gross profit margin expanded by more than 1 percentage point in the quarter, and reductions in selling and marketing and general and administrative spending as a percentage of revenue helped the firm more than offset growing research and development costs as a percentage of revenue. GAAP operating income leapt 56% on a year-over-year basis.

Earnings fared much better. GAAP diluted earnings per share increased to $0.62 in the first quarter of the year, compared to $0.52 in the first quarter of 2015. Non-GAAP diluted earnings per share were impacted materially by the increase in shares outstanding as a result of the firm’s equity issuance in December 2015 but remained flat when adjusted for the equity offering. The solid bottom-line performance led to a slight improvement in cash from operations and relatively flat free cash flow on a year-over-year basis, something that we like given the distractions that come with any large acquisition.

Teva’s cash and investments shrunk by approximately $1.2 billion in the quarter ended March 31, 2016, mostly due to the funding of its acquisition of Rimsa, which closed in the quarter. The number of moving parts in Teva’s business at the moment are giving analysts heartburn. Its Specialty Medicines segment remains on solid ground, but in the time leading up to the closing of the Allergan acquisition, the need for strategic action has only become more apparent as it fends off continued price erosion among its generics lineup. Teva selling some of its US generics pipeline assets to appease regulators won’t help either. The segment could do without the loss of key products expected to contribute to growth in coming years.

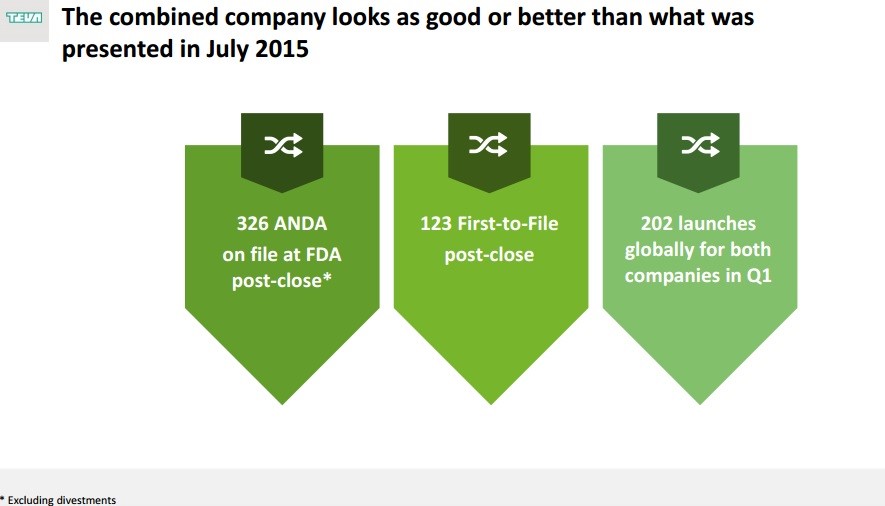

That said, opportunities are still running rampant. The company retains confidence in the growth and synergy expectations from the planned merger with Allergan, and it included a number of slides in its quarterly presentation dedicated to highlighting the potential of the deal and the progress it has made against an unfavorable regulatory environment. In particular, Teva reiterated its commitment to achieving ~$1.4 billion in annual cost and tax synergies by the third anniversary of closing. All in, we’re maintaining our cautious view on Teva from February of this year, “Growing Cautious on Teva Pharma.” The amount of change expected to take place at the company over the coming months will require a watchful eye. Teva hopes to have the Allergan deal closed in June and expects to provide a combined company outlook along with its second quarter report towards the end of the summer. As September comes, the firm will release a business and financial outlook for the next two years. Investors holding Teva should mark these dates on their calendars.