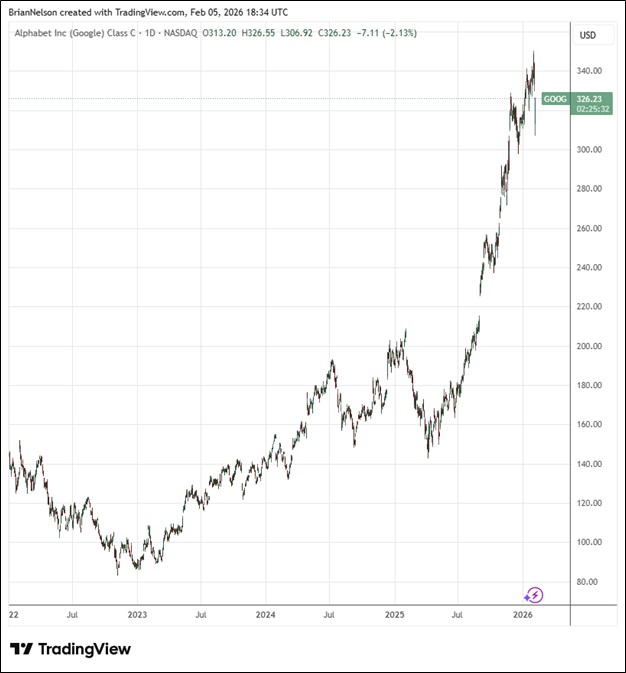

Image Source: TradingView

By Brian Nelson, CFA

On February 4, Alphabet (GOOG) (GOOGL) reported better than expected fourth quarter results with both revenue and non-GAAP earnings per share exceeding the consensus forecast. Consolidated Alphabet revenues increased 18%, or 17% in constant currency, to $113.8 billion. Management noted that it experienced strong momentum across the business and acceleration in growth in both Google Services and Google Cloud. Google Services revenues increased 14%, to $95.9 billion, led by 17% growth in Google Search & other, 17% in Google subscriptions, platforms, and devices, and 9% in YouTube revenue, which exceeded $60 billion for the full year 2025. Google Cloud revenue increased 48%, to $17.7 billion.

Management had the following to say about the results:

It was a tremendous quarter for Alphabet and annual revenues exceeded $400 billion for the first time. The launch of Gemini 3 was a major milestone and we have great momentum. Our first party models, like Gemini, now process over 10 billion tokens per minute via direct API use by our customers, and the Gemini App has grown to over 750 million monthly active users. Search saw more usage than ever before, with AI continuing to drive an expansionary moment.

We continue to drive strong growth across the business. YouTube’s annual revenues surpassed $60 billion across ads and subscriptions; we now have over 325 million paid subscriptions across consumer services, led by strong adoption for Google One and YouTube Premium. And Google Cloud ended 2025 at an annual run rate of over $70 billion, representing a wide breadth of customers, driven by demand for AI products.

We’re seeing our AI investments and infrastructure drive revenue and growth across the board. To meet customer demand and capitalize on the growing opportunities we have ahead of us, our 2026 CapEx investments are anticipated to be in the range of $175 to $185 billion.

Consolidated Alphabet operating income increased 15%, to $35.9 billion, and its operating margin was 31.6%. Google Services operating income came in at $40.1 billion, while Google Cloud operating income came in at $5.3 billion. Other Bets operating income was a negative $3.6 billion. Net income increased 30% and earnings per share increased 31%, to $2.82. Alphabet declared a quarterly cash dividend of $0.21 payable on March 16. Alphabet ended the quarter with $126.8 billion in cash and marketable securities versus long-term debt of $46.5 billion. Management noted that it expects capital expenditures to be in the range of $175-$185 billion; by comparison, operating cash flow was $164.7 billion in 2025. Though capital spending for 2026 will be steep, we continue to like Alphabet as an idea in the Best Ideas Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.