By Kris Rosemann

The recent decision to add Johnson & Johnson (JNJ) to the Best Ideas Newsletter portfolio is beginning to look like a very timely one, as the company is looking poised to use its recent quarterly report and guidance increase to drive a rally in shares. Meanwhile, its performance in the Dividend Growth Newsletter portfolio, where it was added at ~$66 in late 2011, speaks for itself at this point as it continues to be one of the most dependable and competitive dividend payers on the market.

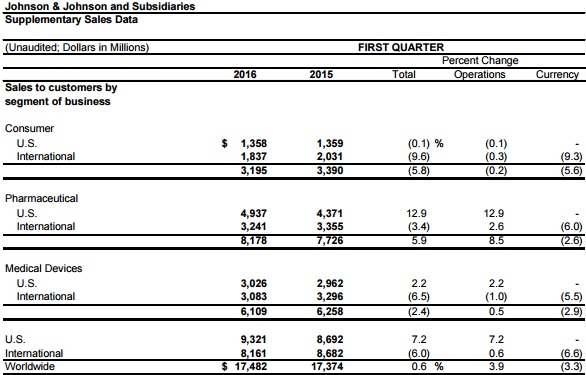

Though reported top-line growth in the first quarter was a paltry 0.6% on a year-over-year basis, operational sales growth came in at 3.9% after backing out the negative currency impact of 3.3% compared to first quarter 2015 results. Domestic sales registered the highest growth mark among the firm’s geographic regions with a 7.2% increase on a reported basis, but when excluding the impact of acquisitions, divestitures, and hepatitis C sales, worldwide sales also grew a solid 6.9% on an operational basis from the year-ago period.

Net diluted earnings per share of $1.54 were relatively flat compared to the first quarter of 2015 due in part to increased research and development spending and restructuring costs related to the Medical Devices segment. However, when excluding the impact of after-tax intangible amortization expense and special items, adjusted diluted earnings per share came in at $1.68, representing 7.7% growth on a year-over-year basis and a 10.3% increase on an operational basis from the year-ago period.

Johnson & Johnson’s Pharmaceutical business continues to be the main driver behind its success. The segment reported sales growth of nearly 6% in the quarter after factoring in a negative 2.6% impact from currency headwinds. Domestic sales growth was even more impressive in the period, advancing 12.9% from the first quarter of 2015. Johnson & Johnson measures the segment’s underlying strength by reporting growth excluding the impact of acquisitions, divestitures, and hepatitis C sales on an operational basis, which came in at an impressive 12.3% on a year-over-year basis.

Competitive entrants continue to weigh heavily on the sales of the firm’s hepatitis C treatment, but strong growth in new products including its blood/lymph node cancer treatment, its oral anticoagulant, its type 2 diabetes treatment, and its multiple myeloma treatment more than picked up the slack. These new products added onto operational sales growth from more established products such as its treatments for immune-mediated inflammatory diseases, its treatment for plaque psoriasis and arthritis, and its treatment for schizophrenia in adults. The company appears to be well on its way to surpassing last year’s mark of 10 different treatments with over $1 billion in individual annual sales, as it reported 11 treatments having individual annual run-rate sales greater than $1 billion. We continue to be impressed by the firm’s ability to bring highly-demanded pharmaceutical products to market.

Johnson & Johnson reported multiple key updates in its Pharmaceutical business in the quarter as well. The FDA approved an additional indication for Imbruvica, its blood/lymph node cancer treatment, for the treatment of chronic lumphocytic leukemia, and the Committee for Medicinal Products for Human Use (CMHP) issued two positive opinions for marketing authorizations for two other treatments as well. The firm expects to continue to ride its strength in pharma for the foreseeable future, and such strength in the first quarter of the year certainly should reassure investors.

Though pockets of strength could be found, Johnson & Johnson’s Medical Devices and Consumer segments continue to lag behind the performance of its Pharmaceutical business. The Medical Devices segment reported sales falling 2.4%, and the Consumer segment reported sales falling 5.8% on a year-over-year basis. Each was able to find solace in the fact that when excluding acquisitions and divestitures on an operational basis, worldwide sales grew 3% and 1.9% for Medical Devices and Consumer, respectively. The high points in each segment came from domestic sales, as is shown in the chart below from the company’s first quarter report.

The key contributors in the Consumer segment continue to be Johnson & Johnson’s well-known over the counter products, including Tylenol and Motrin, as well as allergy treatment Xarelto and Listerine oral care products. Electrophysiology products in Cardiovascular, joint reconstruction products in Orthopaedics, energy and biosurgical products in Advanced Surgery, and international contact lenses in Vision Care were the main drivers of growth in the Medical Devices segment, and the firm recently completed the acquisition of NeuWave Medical in the early going of the second quarter. NeuWave produces minimally invasive soft tissue microwave ablation systems, and its products are used in over half of the top cancer centers in the US.

Management used the firm’s underlying strength and an updated read on foreign currency exchange rates to increase its sales guidance for the full-year 2016 to $71.2-$71.9 billion from previous expectations of $70.8-$71.5 billion. The company also increased the upper and lower bounds of its adjusted diluted earnings per share guidance for the year by $0.10 each to a range of $6.53-$6.68.

While US multinational corporations are clearly not out of the woods yet with respect to currency headwinds, we like what we’re seeing from Johnson & Johnson. The firm’s Pharmaceutical business continues to drive results, even as its Consumer and Medical Devices businesses offer little additional growth. We continue to point to its well-known Consumer portfolio as a source of steady revenue, even if it does not offer the same growth potential as its Pharmaceutical business. The ongoing restructuring of the Medical Devices segment has yet to pay off, but underlying operational growth is a positive sign for potential once the restructuring is complete.

We’re quite pleased with our recent addition of Johnson & Johnson to the Best Ideas Newsletter portfolio, and we’re sure members have benefitted handsomely from the firm’s dependable dividend stream since it has been a core holding in the Dividend Growth Newsletter portfolio since the portfolio’s inception more than four years ago. Nothing material has changed in our thesis surrounding Johnson & Johnson from our last update, and that’s a good thing.