Precision Castparts has long been a favorite of ours. The firm’s investment cast products segment (about 34% of sales) makes the structural castings (metal blocks) and the rotating airfoils (blades) that form aircraft jet engines. Though a structural casting has a longer useful life, a jet engine’s airfoil components frequently need to be replaced upon maintenance (think razor, razor-blade model). The firm’s forged products (about 41% of sales) are used in landing gear, bulkheads, and other airframe components, while its fasteners (about 25% of sales) are used in such critical applications as wing-to-fuselage and engine-to-wing connections. Precision’s components are crucial to flight safety, particularly its metal castings, which preserve engine integrity during intense thermal conditions.

Plus, and perhaps most important, Precision Castparts makes these castings for every jet aircraft engine program in production or under development by its key customers — GE, Pratt & Whitney (a unit of United Technologies), and Rolls Royce. Its products are ubiquitous and do not depend on future market share of airframe manufacturers or on which jet maker delivers more planes in any given year. The firm is also a trusted, low-cost supplier — it has been delivering castings to the above jet-engine makers for over 20 years (40 years in GE’s case) — and is one of a few manufacturers in the world that can produce the largest metal castings in sufficient quantity to satisfy demand. Further, Precision Castparts’ dollar content per engine has increased significantly in recent years due to more advanced technology in the powerplants used by the 787, A350, and A380. And thanks to greater throughput and continuous cost reductions, the firm’s operating margins are among the best in the aerospace supply chain — after all, GE or Rolls, for example, wouldn’t want to seek out unproven suppliers just for the sake of cutting costs (as you can imagine, the consequences of jet engine failure could be disastrous).

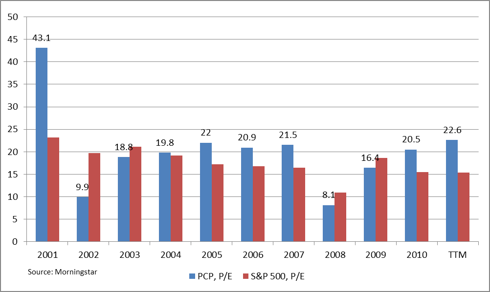

With that backdrop, let’s examine Precision Castparts’ potential upside. As outlined in Boeing Has Upside, Suppliers to Benefit From Boom, commercial OEMs and aircraft suppliers often benefit from the market’s short-sidedness, which results in the application of a hefty multiple on future earnings, assuming the near-term picture remains bright at that time. As the commercial aircraft delivery upswing ensues–when the major OEMs achieve near-term targets for 737/A320 production and the first customers of the 787 and 747-8 take delivery–look for the market to eventually place an inflated multiple on future earnings of most participants at some point during this upswing. In Precision Castparts’ case, we’re already there, with this low-cost metal bender garnering an earnings multiple consistent with historical peaks. Therefore, most equity appreciation for the firm will most likely be driven by earnings expansion during the next several years.

After viewing the chart above, Precision often garners a multiple in the high-teens / low 20s on trailing earnings during strong times in the aerospace sector. Interestingly, during the peak of the previous aerospace delivery cycle (in calendar 2007), the firm garnered roughly a 20x multiple on forward earnings for fiscal 2009 (which turned out to about $7.50). So, with this ballpark 20x multiple in mind (on a forward basis), let’s examine Precision’s earnings trajectory during the next few years.

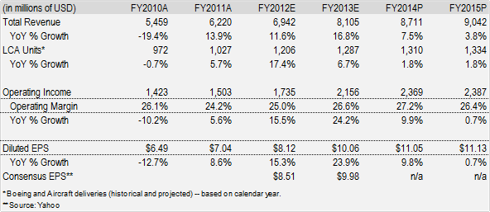

Assuming metal price pass-throughs do not generate material gyrations in revenue (a base-case forecast), the firm’s top-line should expand roughly in step with large commercial deliveries (with some adjustment for lead time) in coming years– the aerospace end market generates about 60% of the firm’s total revenue with power and general industrial accounting for the balance). Also providing additional tailwinds to revenue expansion are share gains via previous acquisitions and higher dollar content per aircraft. Further, the firm’s operating margins should expand in coming years thanks to higher throughput (operating leverage) and continued cost-containment.

In fiscal 2013 (ending March 2013), Precision is expected to earn roughly $10 per share, with significant earnings expansion expected in the following year (fiscal 2014). Based on historical market tendencies and the trajectory of the firm’s growth, it would not be surprising to see Precision trade up to near $200 per share (20 x 10) within the next couple years.

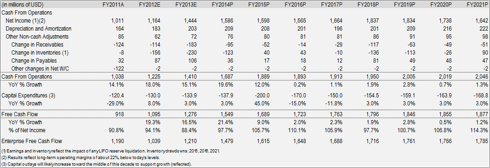

But how attractive is Precision on a discounted cash-flow basis? Using the same forecasts that resulted in the table above and expanding the horizon to 10 years (an appropriate period given that commercial aerospace cycles last about 7 years from peak to subsequent peak; view the delivery chart above), Precision’s shares are worth between $130 to $140 (assuming a discount rate in the high-single-digits), representing little downside risk from today’s levels. Importantly, utilizing a discounted cash-flow process is one way to sort out or dismiss claims regarding earnings quality.

In all, Precision’s shares have substantial valuation support at the $130 level and could rise to as much as $200 during the coming upswing. Investors should pick an entry point that best suits their given level of risk.