By Brian Nelson, CFA

As emerging markets around the world suffer from commodity-price-led economic weakness, capital continues to find a safe-haven in US government bonds (TLT, TBT), but for those equity-oriented funds that mandate a fully-invested status, not something we’re particularly advocates of, assets within US equities have favored “lower-beta” utilities (XLU) and consumer staples (XLP) sectors while cyclically-dependent and credit-levered sectors such as the financials (XLF) and materials (XLB) have suffered thus far in 2016. The industrials (XLI) and energy (XLE) sectors have also encountered higher-than-normal selling pressure in the first few weeks of the New Year, as investors evaluate the global economic landscape and what a prolonged period of low energy prices may mean for the lowest quality operators.

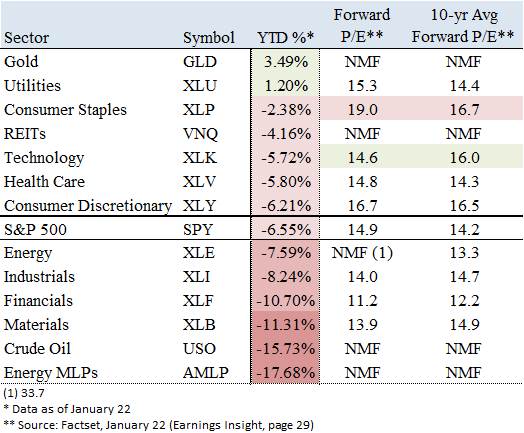

We caution, of course, not to pay too much attention to daily or even weekly movements in equity prices, but we think it is informative to take a look at broader sector valuations to glean incremental insight regarding both opportunities and risks. There are two observations in this regard that we want to point out. First, the consumer staples sector, while certainly full of resilient business models–such as Constellation Brands (STZ), Philip Morris (PM), and Coca-Cola (KO)– aggregate valuations are starting to get stretched (19 times forward earnings versus 16.7 over the immediate 10-year period). Equity money managers may continue to increase their allocation to these “recession-resistant safe-havens,” stretching their valuations further, but disappointments as in Kimberly-Clark’s (KMB) latest, for example, could send shares tumbling.

Second, the technology sector looks quite attractive from a forward price-to-earnings standpoint relative to the broad market benchmark (14.6 times versus 14.9 times for the S&P 500), but these equities, fairly or unfairly, have traditionally traded more in lock-step with new product iterations and broad emerging-market sentiment than anything else. In light of the fact that many constituents including Apple (AAPL) and Microsoft (MSFT), however, have enormous net-cash-rich balance sheets, a source of value not considered in the traditional multiple analyses provided above, one can even say valuations in “Big Tech” are incredibly attractive. Said differently, if we ignore the tremendous net cash balances in the technology sector, some $150+ billion at Apple and ~$60+ billion at Microsoft alone, for example, the group is still attractively priced relative to an S&P 500 (SPY), which includes some rather heavily-leveraged (debt-heavy) entities. Near-term oriented investor “bases” and concerns regarding emerging market strength could still drive multiple “compression” across the tech sector, but we like the balance sheets of several.

Market news flow as of late hasn’t been great, but the recent “let-up” in commodity price pain has breathed some life into some of the most beaten down sectors, not the least of which is the energy MLP space (AMLP, AMZ). A move in crude oil prices from ~$25 to over $30, for example, has helped the equity prices of many midstream “players” in a magnitude that continues to surprise even the most die-hard “perma-bulls.” Equity moves in the 15%-30%+ range, even on a daily basis, have started to become commonplace across the midstream sector, as investors whipsaw in preparation of either further weakness or a short-term bounce in energy resource pricing. We continue to be skeptical that the energy MLP business model will survive to the other side of this energy downdraft, which may still last a few more years in duration. There will be a lot of ups-and-downs along the way, but we fear the “end game.”

As for other key news, newsletter holding Intel (INTC) upped its dividend payment 8%+ January 22, to $0.26 per share on a quarterly basis, and we were very pleased with the company’s commitment to income investors. For those that missed our take on its latest quarter, please see, “Lots to Like About Intel’s 2016: 3D XPoint and Altera!” On the other hand, Potash (POT), continues to face abnormal pressure over concerns about a dividend cut, and our Dividend Cushion ratio for shares implies considerable risk. Read our latest, “Potash Miners Digging Themselves a Hole.” Trouble also continues to brew at Caterpillar (CAT), with shares dipping to ~$58 from over $110 as recently as mid-2014; our latest from September, “Caterpillar Prepares for Continued Pressure; Slashing Our Fair Value.” Merger and acquisition activity continues with Johnson Controls (JCI) and Tyco (TYC) tying the knot; our latest piece here: “Johnson Controls and Tyco Announce First Major Merger of 2016.” We continue to exercise caution on McDonald’s (MCD) on the basis of a stretched valuation and extended “technicals,” despite rather strong performance on the heels of “all-day breakfast” initiatives.

Of the “less-important” news, irrelevant chatter regarding the “brain drain” at Twitter (TWTR) continues, with reports January 24 indicating that several top executives would be jumping ship. Clearly, the social media firm is in a whole lot of trouble and has been for some time, and we continue to point to valuation efforts on the equity as fraught with uncertainty. There’s more downside to come in shares, in our view, and we maintain our view on shares: a lotto ticket not likely to pay off. “Twenty-First Century Fox’s (FOX, FOXA) Revenant topped the box office this weekend, and say what you want about whether Leonardo DiCaprio will win an Oscar for his role, but the “wrestling with the bear scene” is a first on film, in my eyes. If you haven’t yet seen the picture, it’s worth seeing, if only for those 5-10 minutes alone. To each, his or her own.

We continue to evaluate equities that we may add to the newsletter portfolios in light of the market’s weakness to kick off 2016. That said, however, we think it is very important to note that we retain a hefty 35%+ cash position in both newsletter portfolios, as we also encourage investors to embrace the idea that some of the very best ideas may already be held in your portfolio! It’s often a good rule of thumb not to overlook your favorites for the sake of adding “new” and less-compelling ideas — just for the sake of doing so. Some of our old favorites, shares of Intel, Buffalo Wild Wings (BWLD) Priceline (PCLN), Michael Kors (KORS), Cisco (CSCO), and Gilead Sciences (GILD), look like bargains on both a discounted cash-flow basis and relative valuation basis, “Stocks That Are Cheap on Both a DCF and Relative Value Basis,” but we’re watching them very closely for technical improvement.

As it relates to potential “new” additions, we may look to add exposure to Chipotle (CMG), PVH Corp (PVH), Macy’s (M) and Ford (F) and/or General Motors (GM), among others, in the Best Ideas Newsletter portfolio, but consistent with the Valuentum process, we’re waiting for some equity price stabilization in shares, if not the beginning of a defined “uptrend.” We call this aspect of our process the “technical margin of safety,” an added layer beyond the fundamental “margin of safety” we employ in the form of a fair value range around our discounted-cash-flow-derived fair value point estimate. Those wishing to add gold (GLD) to your portfolio, please read “Gold Is But a Shiny Yellow Metal” and “Sorry Gold Bugs.” The yellow metal has some unique risks you should be aware of. Our favorite income ideas for consideration reside in the Dividend Growth Newsletter portfolio, though Cracker Barrel (CBRL) is high on the list of “new” ideas for consideration, “Free Cash Flow Feeds Cracker Barrel’s Dividend Growth.”

We’re available for any questions. My best wishes for health and happiness!