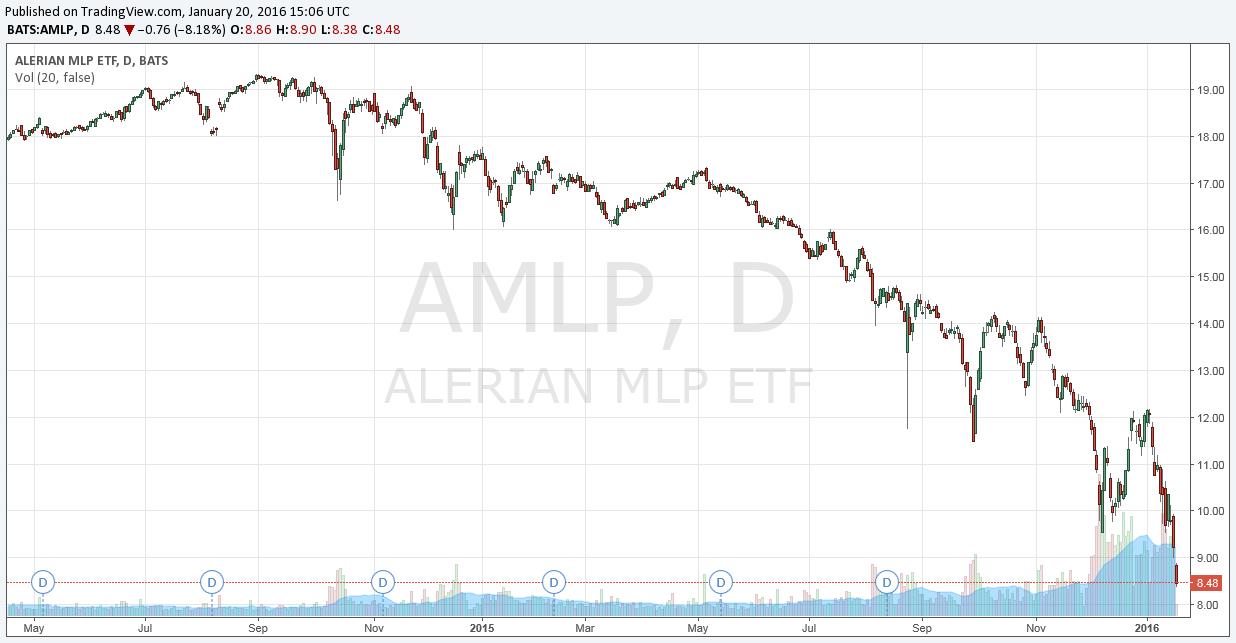

Energy master limited partnerships (AMLP, AMZ) continue to be in a world of hurt as investors reevaluate the sustainability of distribution streams and reassess the fundamentals on a pure traditional free cash flow basis.

Many, however, continue to point to uncertainty related to the completion of the deal between Energy Transfer Equity (ETE) and Williams Partners (WMB) as reason for the sharp drops, but if you recall, both stocks collapsed on the announcement of the deal in October, both stocks collapsed when speculation grew a deal would not be completed earlier this month, and both stocks collapsed when the deal was reiterated last week. Instead, we think the market is focused on tangible long-term fundamentals, free cash flow generation, leverage concerns, and customer concentration risk, as well as the increased likelihood that financially-engineered payouts will not continue.

Read more about the definition of a financially-engineered payout in the context of Energy Transfer Partners (ETP) here >>

In the midst of the collapse of the energy MLP space, we have been working diligently to help investors make better decisions. Of considerable importance, Valuentum continues to emphasize that in the event all future growth capital spending is factored into a systematic enterprise free cash flow valuation process (and not only the benefits of such investment via incremental contributions to the industry’s definition of “cash flow”), our published fair value estimates of the group would be substantially lower. It’s very important to access all of our research on our website at valuentum.com/ to get our complete views. For example, here is the language we disclose in every single one of our 16-page energy master limited partnership reports, for example:

For MLPs, our valuation considers only maintenance capex (as opposed to total capex) in the derivation of enterprise free cash flow, consistent with the definition of ‘distributable cash flow’. This peculiarity results in MLPs’ fair value estimates receiving a boost for future operating cash flow growth without organically subtracting the growth capital associated with driving such expansion. This is a valuation imbalance that exists as a result of the inherent structure of an MLP (for MLPs, growth is typically funded via new capital as opposed to organically). Investors should be aware that, under a scenario in which all capex is deducted, our fair value estimate would be considerably lower.

We continue to point our membership to the low end of the fair value ranges for energy MLPs as an approximate of a valuation that would capture future expected growth capital spending as well as such spending’s incremental contribution to the industry’s definition of “cash flow” (and not just the latter); many MLPs have now approached the low end of the fair value range, and some have breached that level to the downside as of late. Upon the next update to our valuations, we would expect a downward bias to the low end of our fair value range across the group on account of still-higher cost of capital assumptions and an increased probability of an adverse event within the upstream customer base, not the least of which is Chesapeake (CHK) and implications on Williams Partners (WPZ) and Plains All American (PAA).

We continue to emphasize that we do not include any energy MLPs in the newsletter portfolios. Critically, here is how we think about how the space fits into our current line of thinking, as it relates to our methodology, the Valuentum Buying Index:

We not only look at the intrinsic valuation of equities, but we also evaluate the market’s conviction in the company’s undervaluation via pricing information, more commonly applied via technical and momentum work.

So, in short, we like stocks that have both good value and good momentum indicators, hence our name Valuentum, and we’d only view the top tier of our ranking system 8-10 as ideas for consideration (generally), but only after the ones in the newsletter portfolios (the Best Ideas Newsletter portfolio and the Dividend Growth Newsletter portfolio), of course.

Importantly, if a stock’s price has dropped considerably, we simply won’t be interested in it, and we’ll likely not be interested in it until it bases and then establishes an uptrend, if, and only if, we believe shares are still underpriced after the drop. In many cases a falling stock will warrant a lower Valuentum Buying Index rating upon a subsequent update.

The biggest challenge new readers have to overcome is the idea that we like stocks that are going up, and we generally do not like stocks that are going down. It is something that many of our members have had to unlearn — the urge to think something is cheaper because its price has fallen. A falling stock doesn’t necessarily mean it is cheaper; it means the market has less confidence in its valuation at previous levels. A company whose stock has fallen could still be overvalued.

Importantly, it’s critical to view valuation as a range of fair value outcomes, not a single point estimate. Only when shares, for example, cross through the low end of the fair value range would we consider them to be a significant bargain, and only when undervalued shares have established a strong uptrend would we consider adding them to the newsletter portfolios, and even then many that make the cut won’t be included due to portfolio considerations or overall macro/market views.

Our process facilitates watching the fall and not considering the idea until it bottoms, but only if shares are still underpriced at that time, something that can be evaluated upon the next update. A 3-4 month period is something that we think adds a layer of discipline to our process, and while it opens up the possibility that we may miss a “dead cat bounce” every now and then, we’re not interested in catching those either.

At the moment, we continue to believe providing 1) a fair value estimate that excludes growth capital spending (but captures future “cash flow” related to it) and 2) the low end of the fair value range, which includes all future growth capital spending as shareholder capital and tangible cash outflows (a more balanced approach), remains helpful. To reiterate, we do not include any energy MLPs in the newsletter portfolios, and we won’t consider them as ideas until substantial support from the market exists. Our process has not only highlighted the significant valuation risks of these entity’s near “the top,” but what we call our technical “margin of safety” has kept us away for all the drop.

We’re proud to have been called a “Survival Guide for Oil Investors” by Barron’s. We sincerely hope you have benefited from our work and due diligence.