Where will consumers keep spending their money? This is a question that investors will always be trying to answer, no matter where we are in the economic cycle (during good times and bad). It is not always easy to predict the spending patterns of any demographic with any sort of precision, but let’s see how things shook out with some of the best-known department stores in the US during the third quarter of 2015.

During the latter part of last decade, department store equities had been strong performers; shares of companies such as Macy’s (M), Kohl’s (KSS), and Nordstrom (JWC), for example, more than tripled from their respective bottoms during the Great Recession, but all three have witnessed their share prices decline significantly in 2015. At this point in the economic recovery, have consumers finally gained the confidence to start putting that disposable income into big ticket items, shying away from the heavy discounting at big box department stores? Or is the weakness an ongoing extension of the effect of the ever-increasing popularity of e-commerce proliferation from the likes of Amazon (AMZN) and eBay (EBAY)?

Even as consumer shopping patterns ebb and flow with the changing times, calendar third-quarter reports across the department store industry left much to be desired. For one, there were guidance cuts at traditional department stores, Macy’s and Nordstrom, and while not a department store, worth mentioning was that there was even a strange attempt to gain exposure to another industry from Urban Outfitters (URBN)—it jumped into the pizza business (can you believe that?). We highlighted the significant opportunities in fast-casual pizza and pizza, in general, in this note here, but we’d never peg Urban Outfitters as a candidate to buy Pizzeria Vetri.

By including pizzerias in new stores, could Urban Outfitters do to apparel shopping what Barnes & Noble (BKS) did with Starbucks (SBUX)? For example, will we associate picking up the latest pair of jeans with grabbing a delicious slice of pizza as we do with sitting down with a cup of joe and cracking open the latest best-business seller. It’s far too early to see if this trend proliferates, but food courts in malls have been a staple of society for some time. We think it might work for Urban Outfitters, even as we say we don’t think pizza giants Domino’s (DPZ) or Papa John’s (PZZA) have to worry much.

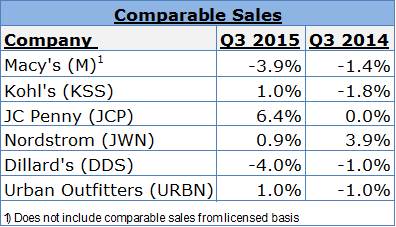

Top-line performance in the department store industry was less-than-spectacular in the third quarter, generally speaking, though JC Penney (JCP) and Nordstrom reported total sales growth of 5% and 6.6% on a year-over-year basis, respectively, which wasn’t terrible. Nordstrom’s comparable store sales, however, advanced less than 1% in the period, effectively damping any positive spin we could give it related to its top-line growth, and many others across the industry reported similarly disappointing comparable store numbers. Macy’s same-store sales during the third quarter fell nearly 4% in the period, a shocker to many onlookers. Dillard’s (DDS) performance wasn’t great either.

Top-line performance in the department store industry was less-than-spectacular in the third quarter, generally speaking, though JC Penney (JCP) and Nordstrom reported total sales growth of 5% and 6.6% on a year-over-year basis, respectively, which wasn’t terrible. Nordstrom’s comparable store sales, however, advanced less than 1% in the period, effectively damping any positive spin we could give it related to its top-line growth, and many others across the industry reported similarly disappointing comparable store numbers. Macy’s same-store sales during the third quarter fell nearly 4% in the period, a shocker to many onlookers. Dillard’s (DDS) performance wasn’t great either.

JC Penney was the leader of the group when it came to the pace of comparable store sales expansion in the quarter, with more than 6% growth and all of its division reporting positive comparable sales. The company, however, is lapping abysmal performance in previous years and is still recovering from the self-inflicted wounds of the failed Ron Johnson experiment in 2012 and 2013, so we can’t applaud the “dead cat bounce-like” recovery. We don’t want the department store to go the way of Montgomery Ward, which failed in the late 1990s, but JC Penney’s bottom-line performance and cash flow generation haven’t been great thus far in 2015.

Our biggest concern with J.C. Penney is that the beleaguered department store is significantly under-investing in its stores, as evidenced by accounting depreciation and amortization being a multiple of total cash capital outlays. We’re still awaiting the all-important holiday selling-season, but cash flow from operations at J.C. Penney has been decidedly negative through the first three quarters of 2015 (-$416 million versus -$454 million in last year’s period), even as more cash went toward capital spending ($234 million versus $202 million in last year’s quarter). We think this imbalance will come back to bite J.C. Penney once consumers get a taste of the underinvestment, which could eventually lead to a deteriorating shopping experience. Management expects free cash flow to be near $0 (breakeven) for full-year 2015.

Though Nordstrom has generated positive free cash flow in the first three quarters of 2015, its guidance cut and weakened outlook caused its shares to drop precipitously. Earnings per diluted share guidance for 2015 has been reduced from $3.70-$3.80 to $3.40-$3.50 after the weaker than expected third quarter. Sales and comparable-store sales growth targets for the full year have also been reduced. Macy’s also cut its earnings per diluted share guidance for the full year from a range of $4.70-$4.80 to a range of $4.20-$4.30, and increased the magnitude of the expected decline in comparable store sales. Macy’s plans to close 35-40 stores in early 2016, which will pressure on its underperforming top line even more.

Falling crude oil prices and the corresponding reduction of prices at the gas pump should offer some benefit to the whole pie of consumer discretionary spending during this holiday season, but retail rivalries have only grown more intense, in our view, and discounting may be prolonged during the holiday season, hurting industry-wide gross margins. It may be more appropriate to say that material reductions in equity share prices across the department store arena are more an indication of even more tough times to come than anything else. Are there bargains? Perhaps. But we’re not going to place our bet on any in the group. We’re hopeful that the holiday season will be a good one for department stores, but we’re not going to include any in the Valuentum newsletter portfolios.