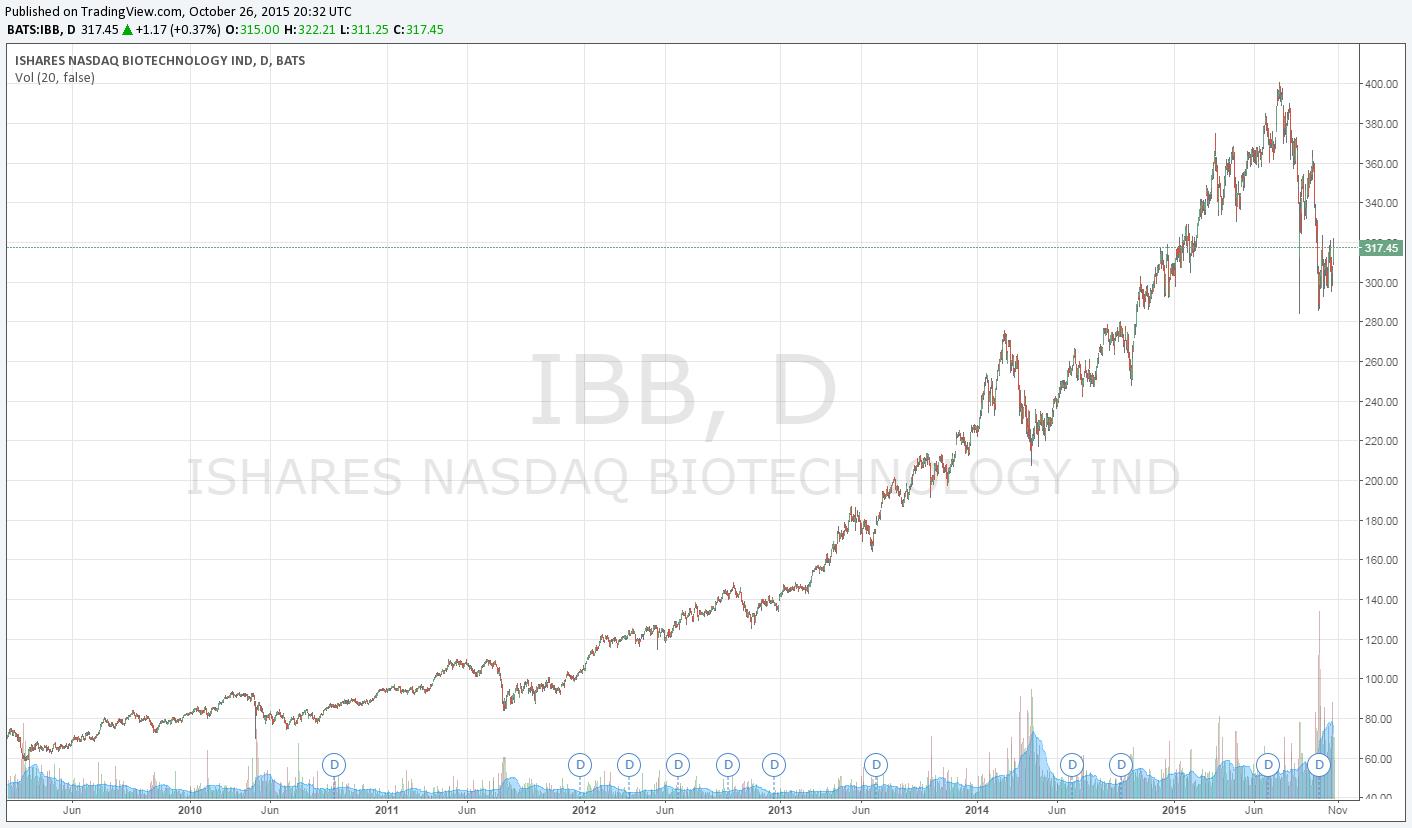

The biotech (IBB) and pharma (XLV) industries have been two of the strongest-performing segments of the market since the March 2009 panic bottom during the Financial Crisis, but the broader healthcare arena has been under siege as of late. New discoveries underscored by the development of a cure for hepatitis C with Gilead’s (GILD) Solvadi/Harvoni and a huge step forward in cystic fibrosis treatment with Vertex’s (VRTX) Orkambi have helped fuel the exuberance, but established pharma entities have also caught a bid as they successfully worked through the “patent cliff,” capturing the wave of dividend growth investors and acquiring budding new pipelines from smaller rivals along the way. The past few months haven’t been kind to biotech investors, however.

What otherwise would have been a “normal” pullback, not unlike those of years-past, turned into a breakdown in the chart with the August 24 market “crash.” Hillary Clinton’s planned “war on the price of drugs” and widely-publicized bear thesis on roll-up Valeant (VRX) have only made investors more skittish of the long-term health of some of the riskiest equities on the market. The hazards of blindly investing in biotech entities, fairly or unfairly, have been revealed in Valeant’s share price performance, which was simply thrown to the wolves the past few weeks. Even if the short-selling research ends up being rebuffed, it is going to take a lot for Valeant to restore confidence in shareholders, in our view. As technicians say, Valeant’s chart is “broken.”

Though “biotech” and “pharma” are sometimes used interchangeably these days in light of the deep pipelines at some of the more established pharmaceutical entities, we’ll go around the horn in this article, addressing key developments in the quarters of several that operate across the biotech and pharma spectrum.

Abbott (ABT)

Abbott’s third-quarter report, released October 21, revealed the continuance of its international sales momentum, which drove worldwide sales growth of nearly 11% on an operational basis. Excluding the impact of currency headwinds, Abbot grew total international revenue 15.4% through strong performance in the international portions of its ‘Nutrition’ and ‘Established Pharmaceuticals’ businesses. Adjusted diluted earnings per share from continuing operations as reported were flat on a year-over-year basis despite currency headwinds and a 2% fall in operating earnings. Gross margin expansion in the quarter was offset by higher operating expenses, including the increase of research and development spending by more than one percentage point of net sales from the third quarter of 2014.

Keys to the Quarter: Abbott’s pediatric nutrition portfolio continued its momentum in China thanks to continued traction from infant formula Eleva, and domestic pediatric nutrition will benefit form the launch of two new Similac infant formula products. The international sales growth of ‘Established Pharmaceuticals’ was nothing short of spectacular, led by India, Russia, Brazil, China, and a number of Latin American markets. Abbott strengthened its ‘Medical Devices’ segment in the quarter with the agreement to acquire heart valve maker Tendyne Holdings. The continued rollout of TECNIS Symfony Extended Range intraocular lens across multiple international markets is expected to continue momentum in the company’s ‘Diagnostics’ segment. We like the increase in research and development spending, particularly when considering the minimal impact made on the firm’s bottom line; management tightened its adjusted earnings per share from continuing operations guidance for 2015 to $2.14-$2.16 from $2.10-$2.20. Shares are yielding well over 2% at current levels, near our fair value estimate of $45.

Biogen (BIIB)

Biogen’s third-quarter results, released October 21, were underscored by the announcement of a corporate restructuring that will do away with more than 10% of its workforce. The company’s performance during the third quarter wasn’t that bad, however. Revenue at the biotech advanced 11% from the year-ago period, while non-GAAP diluted earnings per share jumped 18% from the third quarter of 2014. Total multiple sclerosis product sales came in at $2.2 billion compared to $2.1 billion in the year-ago period. Tecfidera revenues advanced to $937 million compared to $787 million in the same quarter last year. Interferon revenues were modestly higher, while Tysabri sales fell due to reduced traction outside the US.

Keys to the Quarter: The termination of a number of pipeline programs and the elimination of a large portion of its workforce isn’t the best of news, but Biogen did up its revenue growth and non-GAAP diluted earnings per share guidance for 2015 in the press release, the latter now expected in the range of $16.20-$16.50. We think shares, however, will be tied to the upcoming study results of its potential game-changing drug for Alzheimers disease, aducanumab, which in early September was entered into Phase III studies. We talked quite a bit about the promise of aducanumab in this note here. Biogen’s recent issuance of $6 billion in senior unsecured notes in September could be a precursor to some deal making.

Bristol-Myers Squibb (BMY)

In its third-quarter report, released October 27, Bristol-Myers reported solid top-line growth and a series of positive announcements concerning its immuno-oncology portfolio. Total revenue advanced 4%, while non-GAAP earnings per share fell 13%. The firm’s hepatitis C franchise and lung cancer treatment Opdivo were main sources of growth in the quarter. Increased advertising and product promotion and research and development spending were the key contributors to the falling bottom line.

Keys to the Quarter: Bristol-Myers’ immuno-oncology portfolio continues to be a source of excitement surrounding the company. In the third quarter, the firm received approval for two additional uses for its drug Opdivo, which has already been a solid provider of growth. The company’s efforts continue to transform cancer treatment, and the designation of Opdivo as a breakthrough therapy speaks volumes to that notion. Despite the drop in non-GAAP earnings per share in the period, management raised its full-year guidance for 2015 to $1.85-$1.90 from $1.70-$1.80. There is potential for growth in Bristol-Myers’ dividend, which appears to be on solid ground, but there is not much valuation opportunity present based on our fair value estimate of $63.

Eli Lilly (LLY)

Eli Lilly’s third-quarter results, released October 22, revealed solid operational performance. Reported revenue grew 2% on a year-over-year basis, which includes a ~8% negative impact from foreign currency. The revenue gain was driven by higher volumes of several key products, including recently-launched Cyramza and Trulicity, as well as the inclusion of recently acquired Novartis (NVS) Animal Health. Expense management continues to impress at Eli Lilly, as non-GAAP earnings per share grew 22% to $0.89 from the year-ago period thanks in part to operating expenses falling 7%.

Keys to the Quarter: The performance of Cyramza and Trulicity in the third quarter is an example of the potential of the Eli Lilly’s pipeline. It also launched Synjardy, a new treatment for type 2 diabetes in the quarter, and a promising phase III intranasal glucagon and multiple oncology collaborations were acquired. Management is high on the encouraging news in its pipeline from treatment baricitinib, which is currently in phase III testing, and the firm’s potential breast cancer treatment abermaciclib received breakthrough therapy designation in the quarter. After the dust settled, management raised its non-GAAP earnings per share guidance for the full-year to $3.40-$3.45 from $3.20-$3.30. Though its dividend has growth potential and boasts a solid yield, Eli Lilly’s share price has been quite volatile in recent months. Since the firm’s earnings report, its price has advanced far past our fair value estimate of $70.

Gilead (GILD)

The company that announced the first cure for hepatitis C released third-quarter earnings October 27. It was truly a blockbuster quarter, in our view. Total revenue came in at $8.3 billion compared to $6 billion in the year-ago period, while net income advanced to $3.06 per share from $1.67 in last year’s quarter. Harvoni sales continue to grow at a breakneck pace, and we think the runway for the cure to hepatitis C is a long one. We outlined as much in this note here. Other product sales, including Letairis, Ranexa, and AmBizome, collectively performed well in the period for Gilead.

Keys to the Quarter: Fresh off the newly-issued warning on competing hepatitis-C drug, Viekira, from AbbVie (ABBV), investors likely were expecting more from Gilead’s third-quarter results and conference call. The long-term remains bright for the company, however, and its recent news to raise $10 billion in new debt in September suggests that it, as with Biogen, may be looking to scoop up a promising pipeline in an area of focus in the not-too-distant future. Management increased its net product sales guidance for the full-year 2015, now $30-$31 billion (was $29-$30 billion), and fundamentals continue to move in the right direction. The company’s dividend remains solid, and we maintain our view that investors are essentially getting Gilead’s pipeline for “free” on the basis of its equity undervaluation.

GlaxoSmithKline (GSK)

UK pharma giant GlaxoSmithKline reported third-quarter results October 28. Sales grew 11% on a constant exchange rate basis from the year-ago period, driven by a 32% increase in ‘Vaccine’ sales. New products in the firm’s Pharmaceutical and Vaccine segments accounted for ~13% of the total sales between the two segments. The company’s HIV portfolio was the standout performer in the quarter, growing sales 65% on a year-over-year basis. Core earnings per share fell 13% on a constant exchange rate basis from the year-ago period due to dilution from a three-part transaction with Novartis and structural benefits from the comparable period in 2014.

Keys to the Quarter: Solid performance from new products in GlaxoSmithKline’s ‘Pharmaceutical’ and ‘Vaccine’ segments provides the basis for the firm’s confident outlook for 2016 and the remainder of 2015. The company also has ~40 new molecular entities currently in phase II or III development. It received positive news on a number of late stage developments in the third quarter, including positive European regulator opinion for severe asthma treatment Nucala, positive data to support filing in Japan of pulmonary disease treatment Relvar Ellipta, and positive phase III efficacy data for shingles vaccine Shingrix. Management is now expecting 2015 core earnings per share to decline at a high-teen percentage rate on a constant exchange rate basis before growing at a double-digit rate in 2016. Though GlaxoSmithKline’s dividend offers a high yield, we aren’t sold on the safety of its payout; our fair value estimate of $39 causes us to see little opportunity in shares at this point.

Merck (MRK)

Merck’s third-quarter results, released October 27, revealed in many ways the company has turned the corner with respect to the “patent cliff” and the expiration of exclusivity on its blockbuster Singulair and Nasonex. Worldwide sales, adjusted for currency and acquisitions and divestitures, grew 4% in the quarter as non-GAAP adjusted earnings per share advanced to $0.96 per share from $0.90 in the year-ago period. Januvia/Janumet and Gardasil/Gardasil 9 sales were strong, advancing 17% and 7% on a year-over-year basis in the quarter, respectively. Merck continues to face headwinds from Remicade, sales of which fell 13% on a currency-adjusted basis in the quarter.

Keys to the Quarter: Merck continues to advance its late-stage pipeline, and we think it has a handful of promising potential therapies in “cancer, antibiotic resistance, cardiometabolic disease, hepatitis C, and Alzheimers disease.” That worldwide sales are advancing at a mid-single-digit clip is a notable positive, and we continue to expect its recent acquisition of Cubist to pay dividends. Keytruda, an anti-PD-1 therapy, and Belsomra for insomnia are just two promising candidates in Merck’s pipeline that were recently launched. Merck upped its full-year 2015 non-GAAP earnings per share guidance, to the range of $3.55-$3.60 per share.

Pfizer (PFE)

As with Merck, Pfizer has had to deal with the impact of the “patent” cliff on recent performance, specifically from the loss of exclusivity of blockbuster Lipitor, but also from other key drugs including Celebrex and Zyvox in the US and Lyrica in Europe. Recently-launched products such as Eliquis, Xeljanz, Xalkori, and Inlyta continue to gain traction, however, and Merck showcased 6% operational growth in the third quarter as it increased the midpoints to its 2015 financial guidance for reported revenue and adjusted diluted earnings per share. ‘Innovative Products’ growth was 21% on an operational basis in the quarter, helping to offset an 8% decline in sales of ‘Established Products.’

Keys to the Quarter: We remain encouraged by potential new therapies in Pfizer’s pipeline (see here) and have no qualms with its decision to IPO its Animal Health business and sell its Nutrition operations. Bringing Hospira (HSP) into the fold should help stem the rapid declines in its ‘Established Products’ portfolio, particularly with respect to sterile injectables and biosimilars. That Pfizer raised the midpoint of its 2015 revenue guidance by $1 billion and its adjusted diluted earnings per share guidance by more than $0.10 suggests the company’s fundamentals are moving in the right direction.

Note: We include Gilead and the Healthcare Select Sector SPDR in the Best Ideas Newsletter portfolio and Johnson & Johnson (JNJ) and Teva Pharma (TEVA) in the Dividend Growth Newsletter portfolio.