On October 13, SABMiller (SBMRY) and AB-InBev (BUD) announced that they have agreed in principle on the key terms of a possible recommended offer to be made by AB-InBev. The deal consists of an all cash offer of £44 (~$67.90) per share for ~59% of all SABMiller shares, not owned by the company’s two largest shareholders, Altria (MO) and the Columbian Santo Domingo family via BevCo. This represents approximately a 50% premium to SABMiller’s closing price on September 14, the last day before speculation of a takeover reemerged. All calculations have been made using October 12 closing prices.

The remaining 41% of SABMiller shares, approximately 27% of which is owned by Altria with the balance being owned by the Columbian Santo Domingo family via BevCo, are subject to these two entity’s election of a partial share alternative (PSA). The PSA consists of .483969 unlisted shares of the newly-formed company, “NewCo,” and £3.788 (~$5.85) in cash per share, the equivalent of £39.03 (~$60.23) per share, or a 33% premium to SABMiller’s closing price on September 14. The premium allows these two shareholders to receive a higher stake in the combined AB-Inbev-SABMiller transaction than they otherwise would have in the event of a merger-of-equals where no premium was granted at all.

As for why the offer for the PSA was not as large as that granted to the other SABMiller shareholders, we suspect Altria and the Columbian Santo Domingo family via BevCo waived part of the premium such that a sweeter offer could be given to the remaining SABMiller shareholders in order to iron out any dissenters to facilitate the transaction, while not requiring the higher offer to come directly from AB-InBev shareholders, which may not have happened. It stands to reason that Altria and the Columbian Santo Domingo family via BevCo believe that they will recoup the “missed” premium over the long haul, as competitive strengths and synergies resulting from the transaction offer a more enticing long-term picture than that of a standalone SABMiller, a view in which we agree.

The structure of the PSA also speaks to a long-term focus by the two largest SABMiller shareholders. The shares distributed to Altria and the Columbian Santo Domingo family via BevCo will become restricted shares of the newly-formed company, “NewCo,” which is expected to be incorporated in Belgium. Unlike the shares of “NewCo” that will belong to former AB-InBev shareholders, converted on a one-to-one basis, the PSA shares will have the following characteristics: the PSA shares will be unlisted and not admitted to trading on any stock exchange; shares will be subject to a five-year lock-up after the deal closes; the shares will be convertible to ordinary shares of the newly formed company on a 1-for-1 basis at the end of the five-year lock-up; and the shares will have equivalent voting, dividend, and director nomination rights as ordinary shares.

In order for a formal transaction to be agreed upon, the board of SABMiller must unanimously recommend the all-cash offer, shareholders accept the deal, and SABMiller’s two major shareholders–Altria and BevCo–elect for the PSA. In the proposed transaction, AB-InBev has agreed to a reverse break fee of $3 billion payable to SABMiller, should the transaction fail to close as a result of the failure to clear regulations or not receiving approval from AB-InBev shareholders. In addition, the UK Takeover Panel has extended the relevant Takeover Code deadline to October 28 to enable both parties involved to continue to discuss the terms of the deal, as requested by SABMiller.

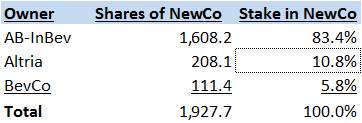

Altria has said that it is pleased with the development and looks to work constructively with both parties moving forward. We’re viewing it as a win for the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio holding. Altria not only is getting a heightened stake in “NewCo” thanks to the premium offered by AB-Inbev, but the stronger “NewCo” will be able to garner increased pricing power and operational synergies simply unavailable on a global stage by the standalone SABMiller. Altria will hold approximately 11% of “NewCo,” by our estimates, and while its stake will be tied up for at least 5 years, the company’s financial flexibility continues to be augmented by its holdings in the alcoholic beverages space. Altria remains one of our favorite dividend-paying corporates.

Altria has said that it is pleased with the development and looks to work constructively with both parties moving forward. We’re viewing it as a win for the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio holding. Altria not only is getting a heightened stake in “NewCo” thanks to the premium offered by AB-Inbev, but the stronger “NewCo” will be able to garner increased pricing power and operational synergies simply unavailable on a global stage by the standalone SABMiller. Altria will hold approximately 11% of “NewCo,” by our estimates, and while its stake will be tied up for at least 5 years, the company’s financial flexibility continues to be augmented by its holdings in the alcoholic beverages space. Altria remains one of our favorite dividend-paying corporates.

Beverages – Alcoholic: BF.B, BUD, SAM, BORN, CCU, STZ, DEO, FMX, TAP