The recent market volatility seemed to have had little impact on auto sales for the month of September. Amid a wild ride in the stock market that began near the conclusion of August, the US auto industry posted its best month in September since July 2005 in terms of seasonally adjusted annual rate (SAAR) of sales, which came in at 18.17 million. Consensus estimates were not nearly has high as the actual figure, as sales were initially expected to be closer to 17.6 million.

A number of factors helped drive the strong sales numbers across the automotive industry. Consumer confidence remains high, as does disposable income; unemployment is at its lowest point since April 2008, and gas prices have fallen. Pent-up demand for large ticket items remains from the lapse of the Great Recession, as the prolonged economic prosperity, genuine or Fed-induced, in the US has enabled consumers to splurge on that brand new SUV or pick-up truck they have been wanting. Consumers continue to rush to dealer lots to make large purchases while rates remain near-zero. Another factor that cannot be ignored is the impact of Labor Day weekend. 2015 marks the first year since 2012 when the entire holiday weekend fell in the month of September.

Though the remainder of 2015 is likely to be full of continued success for the auto industry, some of the above factors may have run their course, or close to it. An interest rate hike by the Fed is coming at some point; perhaps not until 2016, but it is coming. We don’t think a long-term recovery in crude oil prices to the $100+ levels will happen, but a short-term bounce is an increasing possibility and could be enough to slow the trajectory of auto sales growth in late 2015 and into 2016. The subsequent potential rise in gas prices and the potential for continued slowing job growth–jobs added and wage gains were lower than expected in September–could also pressure the willingness of consumer to go out and acquire one of the latest car models.

Nevertheless, the solid sales growth in the month of September is hard to dismiss. The only major automaker supplying the US auto market to not experience double-digit growth was Volkswagen (VLKAY), which continues to face pressure from the widely-publicized emissions scandal. Ford (F), General Motors (GM), Toyota (TM), Honda (HMC), and Fiat Chrysler (FCAU) all reported sales growth greater than 12% compared to September 2014. In this piece, let’s take a look at each individual automaker’s sales performance in the month of September.

Car Sales Growth Returns at Ford

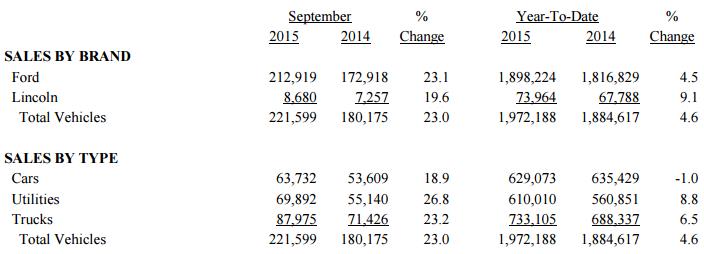

Ford reported unit sales of 221,599 in the month of September, an increase of 23%. The firm’s retail sales also grew 23% to its best September retail sales since 2004. The sales growth was spread relatively evenly compared to recent months in which cars experienced weak demand; in September, car sales grew nearly 19%, SUV sales advanced just under 27%, and truck sales jumped over 23%. Both the Ford and Lincoln brands experienced solid sales growth, at ~23% and nearly 20% respectively.

Despite the significant growth in car sales in the month of September, Ford has still experienced a slight loss in car sales year-to-date. This speaks to the incredibly strong demand that has prevailed throughout the year for trucks and SUVs as a result of falling gas prices; many other automakers have experienced a similar trend. The drastic turn in car sales has been driven by the Mustang, which tripled its sales from the year-ago period, as well as vastly improved numbers from the Fiesta and Fusion.

The Ford F-Series continues to be the company’s best-selling vehicle. The newly renovated line of pick-ups has hit full scale production, and its sales numbers have increased accordingly. It grew sales by over 16% to nearly 70,000 units sold. The relatively new Ford brand SUVs have also continued their solid sales performance in 2015. The Escape, Edge, and Explorer all had sales growth of greater than 30% in September compared to the year-ago period.

The resurgence of Ford cars is a particularly promising sign for the company, as it will help alleviate one of the potential coming pressures outlined at the top of this article. If gas prices do in fact rebound, Ford has built a solid foundation on which to continue building its sales should the demand for its popular SUVs and F-Series be pressured by rising gas prices. The redesigned F-150 is one of the best equipped full-size trucks currently on the market to handle fluctuations in gas prices, as it is one of the most fuel-efficient models available.

General Motors Continues to Grab Truck Market Share

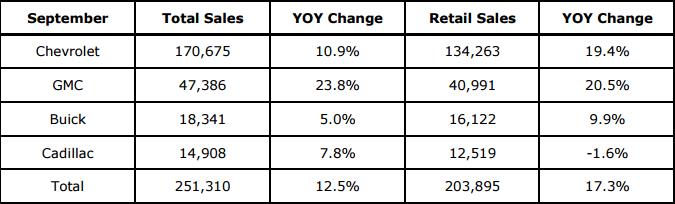

Despite posting the lowest growth of the major automakers, General Motors advanced sales by 12.5% to 251,310 vehicles in September. The company grew retail sales by over 17%, representing the sixth consecutive month of retail sales growth, perhaps lessening the notion that the firm has been channel stuffing. GM’s average transaction price grew nearly $800 per vehicle, thanks in part to incentive spending falling 1% from August, a much more favorable number than the industry average of incentive spending decreasing 0.2%.

Each of the company’s four divisions grew sales by 5% or greater in the month of September. The charge was led by its GMC division, which advanced unit sales by nearly 24%, followed by the Chevrolet brand, where vehicle sales increased ~11%. The Cadillac division grew its number of vehicles sold by nearly 8%, and the Buick division’s sales growth came in at an even 5%.

GMC has been a large beneficiary of the suppressed gas prices, as the division consists of trucks and SUVs. The Yukon and Terrain SUVs have experienced solid growth above 20% each, and the all-new Canyon mid-size pickup has been performing well. GMC’s full-size pick-up, the Sierra, has had a tremendous year thus far, and September was no exception. The Sierra and the Chevrolet Silverado, which also experienced solid growth in September, continue to drive GM’s push in the full-size pickup market. The firm advanced its full-size pickup market share to 39.2% in September, up 0.4% sequentially and 3% from September 2014.

Despite the resurgence of the Chevy Malibu, which grew sales by 38% in September, GM’s sales may suffer in the near term if gas prices make a comeback. The firm’s recent success has been based on the solid demand for its trucks and SUVs. Its sports cars, the Camaro and Corvette, have been outperformed by Ford’s Mustang thus far in 2015. Though a rebound may be short-lived, we would prefer Ford’s vehicle lineup should crude oil prices recover.

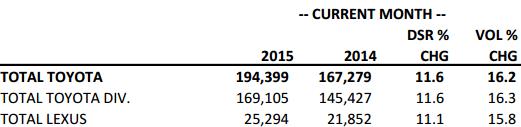

Toyota reported sales of 194,399 vehicles in September 2015, growth of 16.2% from the year-ago period. The Toyota and Lexus brands experienced sales expansion of 16.3% and 15.8%, respectively. The Toyota RAV4 and Highlander both experienced their best-ever month of sales and have been performing splendidly thus far in 2015 as Toyota reaps the benefits of strong SUV demand.

Toyota was also able to translate its solid performance in SUVs to its car lineup in September, where it has been having a much more difficult year. Led by its two most popular models, the Corolla and the Camry, Toyota car sales grew over 19% in the month. This is quite the reversal of the past trend. Including September’s sales numbers, Toyota car sales have still fallen by 2% in the first nine months of 2015, indicating the difference in the division’s performance compared to the most recent month.

Toyota truck and SUV sales have remained strong all year. In the month of September, the company realized truck and SUV sales growth of 13.2%, slightly above the year-to-date sales growth pace of 11.5%. The newfound balance in sales growth bodes well for Toyota moving forward, as we now see what management had been so confident in while its car sales remained suppressed in recent months.

Honda Sets September Sales Record

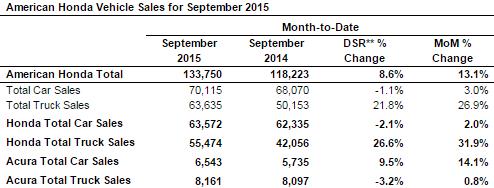

Honda set a new September sales record with 133,750 vehicles sold, representing over 13% growth. The Honda brand also set a September sales record, as did Honda brand trucks and SUVs and Acura brand trucks and SUVs. Trucks and SUVs have been the main source of sales growth throughout the first three quarters of 2015 for Honda.

The company’s car sales experienced slight but promising growth of 3% in the month, driven by 27% growth in the Honda Civic and 2% growth in the most popular Honda car, the Accord, which is on track to have 13% less sales in 2015 than in 2014. The Acura car division has been performing well for all of 2015, but the company’s car sales as a whole have fallen nearly 5% year-to-date compared to the same period in 2014.

Despite the growth in its car division, the clear driver of overall growth at Honda is its trucks and SUVs. The division grew vehicle sales by ~32% compared to September 2014, which was driven by significant increases in sales of the CR-V, HR-V, and Pilot. This division has grown sales by 13% year-to-date when compared to the year-ago period. The demand for SUVs and pickup trucks, along with the growing stature of the Acura brand as a luxury option has fueled growth for Honda, but we expect to see a more even spread of growth across its product lines moving forward.

Fiat Chrysler Records Best September Since 2000

Fiat Chrysler recorded sales of 193,019 vehicles in the month of September, its 66th consecutive month of monthly sales growth on a year-over-year basis. This month’s sales growth rate was ~14%, well above the company’s year-to-date sales growth of 6%. Jeep brand sales continue to impress, as the number of Jeep vehicles sold grew by 40%. The company also had seven different models record their best Septembers in history.

Each of the firm’s four brands posted sales gains in September. Jeep brand sales continue to fly high on the back of strong SUV demand, and it has now set a sales record in every month dating back to November 2013. The Ram Truck brand grew sales by 4%, slightly lower than its year-to-date growth of 6%, but the brand realized its best September in terms of units sold since 1996.

Though growth of the Chrysler 200 has cooled significantly from earlier this year, the model set its September record for number of vehicles sold. Strong growth in the Chrysler 300 sedan nearly offset large losses in sales of the Chrysler Town & Country, as Chrysler sales fell 5% in September. The company’s Dodge brand performed well compared to the rest of 2015, growing sales by 3% thanks to strong performance from the Challenger muscle car and mid-size crossover Journey. Year-to-date, the Dodge brand had experienced a sales decline of 14%. The firm’s second worst performing brand thus far in 2015 also experienced slight growth, as the Fiat brand grew sales 1% in September. The performance of its new 500X model provides hope for the brand moving forward as its other models have experienced sharp declines in volume.

The strength of Fiat Chrysler continues to be the Jeep brand. We cannot reasonably expect the brand to continue to set monthly sales records as it has been doing now for nearly two consecutive years. The Americanization of its Fiat brand continues to be a struggle, as the compact car brand has yet to take off on American soil. If the brand is able to gain traction–the eventual rebound in oil will help–Fiat has the potential to be a major source of growth in the US for Fiat Chrysler.

We continue to be of the opinion that Tesla provides a glimpse of the future of automobile technology. The firm continues to grow deliveries at an outstanding pace. Tesla Motors reported the delivery of 11,580 vehicles in the third quarter of 2015. This represents 49% growth from the year-ago period and is the company’s sixth consecutive quarter of deliveries growth.

The brand new Model X was launched near the end of the quarter, so the increase in deliveries can be expected to continue. However, earlier this year Tesla’s supply chain came into question as the company lowered its delivery guidance. It expects to deliver 50,000 vehicles total in 2015. We think the firm and its innovative products in both the automotive and energy storage markets have tremendous upside, but its operations have yet to be tested on a large scale.

Tesla remains a speculative bet at this point.