Valuentum is moving to neutral on Kinder Morgan (KMI). An updated 16-page report will be available on our website Monday morning.

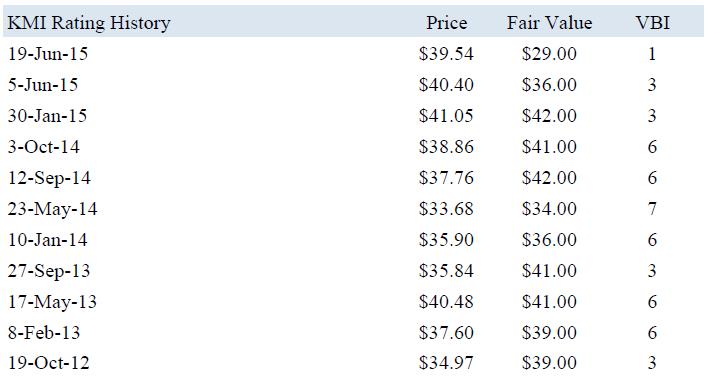

On June 11, 2015, we published an article “5 Reasons Why We Think Kinder Morgan’s Shares Will Collapse” when shares of the pipeline giant were trading at ~$40. Without reaching out to us first for questions or comments, Barron’s picked up the scoop, and on websites in which we frequently publish a small sample of our content including Seeking Alpha, Valuentum was repeatedly blasted and “attacked” for its unique and differentiated view. Many of our members were appalled by the public (and anonymous) commenters because our members have been aware of our fair value estimate on Kinder Morgan since October 2012.

On June 19, Valuentum wrote a follow up “5 More Reasons Why We Think Kinder Morgan’s Shares Will Collapse” to address the hundreds of mostly inappropriate and derogatory comments directed at our independent research firm and analyst team. We offered our follow-up piece to Barron’s for publishing. To our surprise, the “attacks” on our firm’s credibility and reputation continued. Valuentum then published its updated $29 fair value estimate of Kinder Morgan on June 30, 2015, with fully-transparent valuation analysis. This still did not stop the repeated “attacks” to our business.

From ~$40 per share, Kinder Morgan’s shares collapsed to a 52-week low of $31.09 per share on August 6, 2015. Barron’s and others, however, did not report the collapse, as a follow up to our work. The 20%+ drop in an $85 billion “steady” entity over two months is a big move, and one might think a follow-up would have made sense given the attention that others brought to our differentiated work. If it was worth highlighting when the concerns were made, it was probably worth highlighting after the drop. Given the repeated abusive comments towards us, it has been an unfortunate situation.

The time for any sort of acknowledgement has since passed…for now, because today, we’re moving to neutral on Kinder Morgan.

Shares no longer trade at a fantastic mispricing as they had when they were ~$40, and from what we can tell, many well-respected brokerages have now thrown their full backing behind the company’s equity in the low $30s, going “all-in” so to speak. Though we maintain our view that Kinder Morgan has significant downside risk for the many reasons we’ve outlined in the past, in light of its share-price collapse over the past couple months and subsequent price stability in the low-$30s, the company’s Valuentum Buying Index rating will improve upon the next update (shares now trade within our fair value range, even if they are still at the high end). This is how our process works – when shares converge to our fair value range and show signs of stabilization, they no longer deserve our lowest rating.

We know all of the reasons why investors like Kinder Morgan. How can we not? We read about them everywhere, in almost every article. We, as well as others, know the company has a great, mostly fee-based business model, and it pays an outsize dividend yield. These facts are not in question and don’t bear repeating in every article, at least in our view. What we do question, however, is 1) the value placed on the business via the market price, 2) the sustainability of the corporate’s dividend, and 3) the “true” quality of the firm’s investment-grade debt. Rehashing the firm’s toll-road-like business model and that it pays a large dividend is simply irrelevant to the thesis we have provided on shares.

As Henry Fonda’s character in Twelve Angry Men may have stated in such a situation, let’s think:

(1) Isn’t it possible that with a price target of ~$50 per share, which represents an implied price-to-earnings ratio and EV/EBITDA multiple of 50+ times and 18+ times 2015 numbers, respectively, that maybe, just maybe, something is missing? Isn’t it more likely that the reason for the outsize multiples is that such an estimate is not incorporating large cash outflows such as growth capex? “We’ve always done it this way,” and “This is how pipeline companies are valued” don’t seem like adequate reasoning to us.

(2) Isn’t it possible that with a company that has reported net-debt to EBITDA of ~6 times (see KMI’s second-quarter press release) and has burned through $1.38 billion in free cash flow after dividends during the first half of the year, and that collectively holds $44.4 billion in net debt on the books, that its dividend may not be safe? If so, then how can analysts value the corporate on the basis of a dividend that is not completely secure, or on an price-to-distributable-cash-flow ratio, which is effectively the inverse of the dividend yield (as dividends approach distributable cash flow).

The industry’s definition of distributable cash flow, itself, is a misnomer, in our view. We have already given three reasons for this in a previous post. In addition to those, we’d add that under the loosest definitions that we can create, for example, even revenue can be considered a measure of distributable cash flow before any and all expenses. In our view, sound valuation principles should not be abandoned because contractual agreements between two parties use particular language in them. Special exceptions should not be made in the valuation context. Cash in one industry is the same as cash in another industry. Cash is cash.

(3) Isn’t it possible that under an analysis where a company registers “junk” credit status across a multi-variate cross-section of its ratios with respect to peers that maybe, just maybe, the firm’s credit isn’t all that others make it to be? Kinder Morgan is now a corporate, so the analysis should be much more straightforward than when it was an MLP. There are no subordination concerns or other items that muddy the waters. Kinder Morgan is 6-7 times leveraged, depending on how one looks at it, and bleeding cash after dividend payments. As energy resource pricing continues to fall, don’t the risks continue to mount?

We take a holistic approach to our analysis at Valuentum, so we know the in’s and out’s of a great many industries. This is why we’re puzzled that analysts are excited about Kinder Morgan’s $22 billion backlog on its enterprise value of ~$120 billion, when others such as Boeing (BA), for example, have a backlog of ~$450 billion on an enterprise value under $100 billion. We’re puzzled that analysts believe Kinder Morgan is a strong financial entity given the levels of cash deterioration and balance sheet leverage in the midst of a declining energy resource pricing environment. The massive cash flow generation and huge net cash positions on the balance sheets of companies such as Apple (AAPL) or Microsoft (MSFT), for example, are what we consider attributes of strong financial entities.

From comment sections on other websites to insults on publicly-available conference calls, it seems like we’ve endured more of our fair share of abuse in trying to help. Investors continue to question our intellectual honesty and the “motives” behind our work, but helping others understand valuation principles and getting to the right answer is all that we’re after. There’s nothing more than that. Given the recent “doubling down” behavior by some investment banks as we had predicted in the first ‘5 Reasons’ piece, we reiterate that it may take a while before the valuation paradigm is finally overhauled.

In wrapping things up, we very much like Kinder Morgan’s business model. This has never been in question. We also acknowledge that the company currently pays a growing dividend. This is true, even if we believe it to be financially-engineered and at risk in the coming periods. We’ve already made our case, it has helped readers, and our members have thanked us many times over. But as Henry Fonda’s character did in Twelve Angry Men, we’re now walking away from the table in the face of unanimous opposition…for now. The vote has always been yours.

Image Source: 7th Street Theatre