The market seems to be unforgiving these days.

The threat of rising interest rates continues to weigh on everything REIT-related. The healthcare REITs are tied to the most favorable long-term trend within our coverage universe (the aging population), but that may not be enough to completely offset worries. With many REITs priced on “cap” rates, or the discounting mechanism for future adjusted funds from operations, a looming increase in this measure means that REITs are worth less, all else equal. For some, higher net operating income and funds from operations will help mitigate inevitably higher cap rates, while others may feel ongoing pressure. Let’s walk through the second-quarter performance of three of the best healthcare REITs on the market today.

HCP

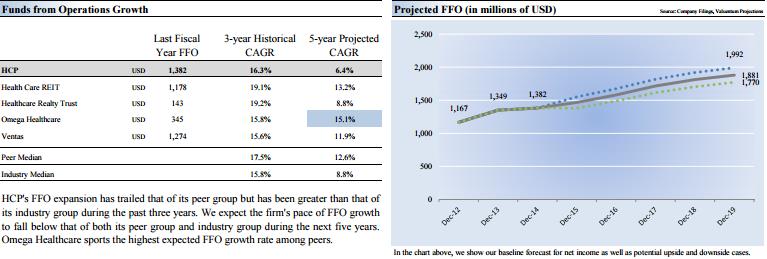

Dividend Growth Newsletter portfolio holding HCP’s (HCP) shares haven’t been performing all that well recently. Shares were nearing our fair value estimate of $46 just before management cut its adjusted FFO per share outlook near the end of the calendar first quarter due to the legal troubles–and potential resulting financial difficulties–of its largest tenant, HCR ManorCare. HCR ManorCare accounts for over 26% of HCP’s properties and over 32% of its net operating income (NOI), and in late March, HCP announced an amendment to ManorCare’s master lease, reducing its annual net rent by $68 million.

However, after reporting adjusted FFO per share growth of 5% in both quarters in the first half of 2015, HCP raised its full year adjusted FFO per share guidance to a range similar to which it was at before the cut in March. The firm now expects adjusted FFO per share to be in the range of $3.14-3.20. In the second quarter, HCP reported funds available for distribution (FAD) per share advancing 10% to $0.69, compared to its planned quarterly dividend of $0.565 per share. HCP’s payout appears to be on solid ground, but uncertainty surrounding its major tenant HCR ManorCare has muddied the waters a bit.

Despite reporting healthy operating results and the raising of guidance August 4, HCP’s shares have not bounced back. The fact that the firm lowered its guidance, only to raise it to a range within a penny of its original guidance can be spun as troubling news. For one, management doesn’t seem to have a good handle on the situation taking place with HCR ManorCare, and the lack of news concerning the issue causes us to be very cautious on the subject. We continue to hold a very small position in the company in the Dividend Growth Newsletter portfolio, but we’re monitoring the situation closely.

Omega Healthcare

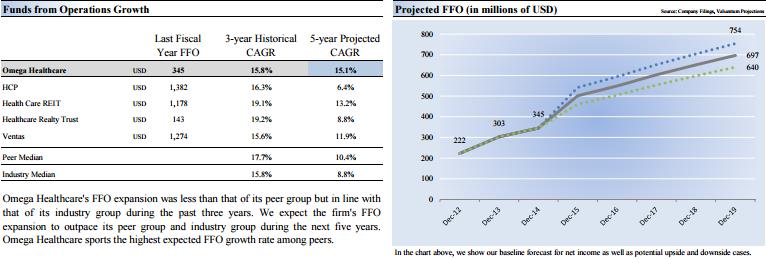

Early in the second quarter, Omega Healthcare (OHI) completed the acquisition of Aviv REIT and subsequently restructured the manner in which it holds its assets. The company is now an umbrella partnership real estate investment trust (UPREIT), which allows it to avoid capital gains tax liability when selling an asset. It now has over 900 properties in 41 states operated by 81 different operators.

In the second quarter of 2015, Omega Healthcare reported adjusted FFO per share of $0.77, a growth rate of nearly 12% from the year-ago period. We think it has quality FFO growth ahead of it, as shown in the above image taken from our 16-page report on the firm, driven by its steady occupancy rate and the aging US population. FAD per share also advanced nearly 12% in the second quarter, as Omega reported $0.70 FAD per share, compared to the increase of its quarterly dividend to $0.55 in the quarter. We think its dividend is relatively safe when considering the inherent risks associated with REITs.

Omega Healthcare is one of our favorite healthcare REITs on the basis of its fundamentals and consistent operating results. We recently updated our opinion on the company and now find it to be undervalued and trading at attractive adjusted FFO multiples compared to its peers, leading Omega to register a 9 on the Valuentum Buying Index.

Health Care REIT

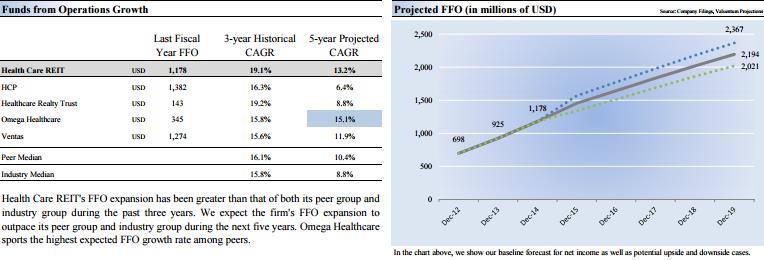

Health Care REIT (HCN) benefits from its long-term customer relationships, which provide a solid base for future growth through investments to supplement its consistent same-store NOI growth. In the first half of 2015, 80% of the firm’s investments were with existing partners, helping the potential to improve on same-store cash NOI growth of 3-3.5% in 2015, which is consistent with 3.2% growth in the second quarter. Also, over 84% of its leases will not mature until after 2025, and the company has a weighted average lease maturity of ~11 years, giving it a solid revenue base well into the future.

In the second quarter of 2015, Health Care REIT reported normalized FFO per share of $1.09 and normalized FAD per share of $0.95, advances of ~3% and ~1%, respectively. The firm’s non-normalized FAD per share declined in the quarter to $0.82, however, and its quarterly dividend payout was raised to $0.825. Though this is not a major cause for concern, as it is known that REITs support their dividends in part via capital-market issuance, it further illustrates the risks associated with the dividends of REITs.

For the full year 2015, Health Care REIT is expecting normalized FFO in the range of $4.25-$4.35, and normalized FAD in the range of $3.83-$3.93, representing increases of 3%-5% and 5%-7%, respectively. Despite solid normalized FFO and FAD and same-store cash NOI growth expectations, the coming credit tightening cycle continues to give us pause.

Wrapping Things Up

We think the healthcare REIT industry is well structured, and those covered in this article are some of our favorite ideas in it. Though we continue to hold a small position in HCP, we continue to cautiously monitor the situation, and any sort of bad news concerning the HCR ManorCare situation could send investors running for the hills. We think Omega Healthcare may be the best-positioned in the group, as is evident in its high VBI score, but we already have exposure to the only Dividend Aristocrat in the segment, HCP. But no matter how much we like REITs and their promising income streams, share prices will inevitably be sensitive to the looming interest rate hikes. Buyer beware.