It’s difficult to be patient with new ideas, and we understand. But the efficacy of the Valuentum Buying Index in picking winners continues to be a big head-turner.

The methodology’s batting average—or the number of ideas that “work out”—is among the best of any systematic process that we’ve seen (if not the best), and we point to the logic behind its conceptual underpinnings as to the reasons why. The Valuentum Buying Index, which combines valuation and technical/momentum indicators, hits at the heart of what makes a good equity investment idea. Companies that we think are undervalued and ones in which the market also believes are undervalued—i.e. stocks whose shares are moving higher—should, by definition, be top performers. After all, the market has to eventually agree with an idea—either ours or yours or your next-door neighbors’—to eventually work out.

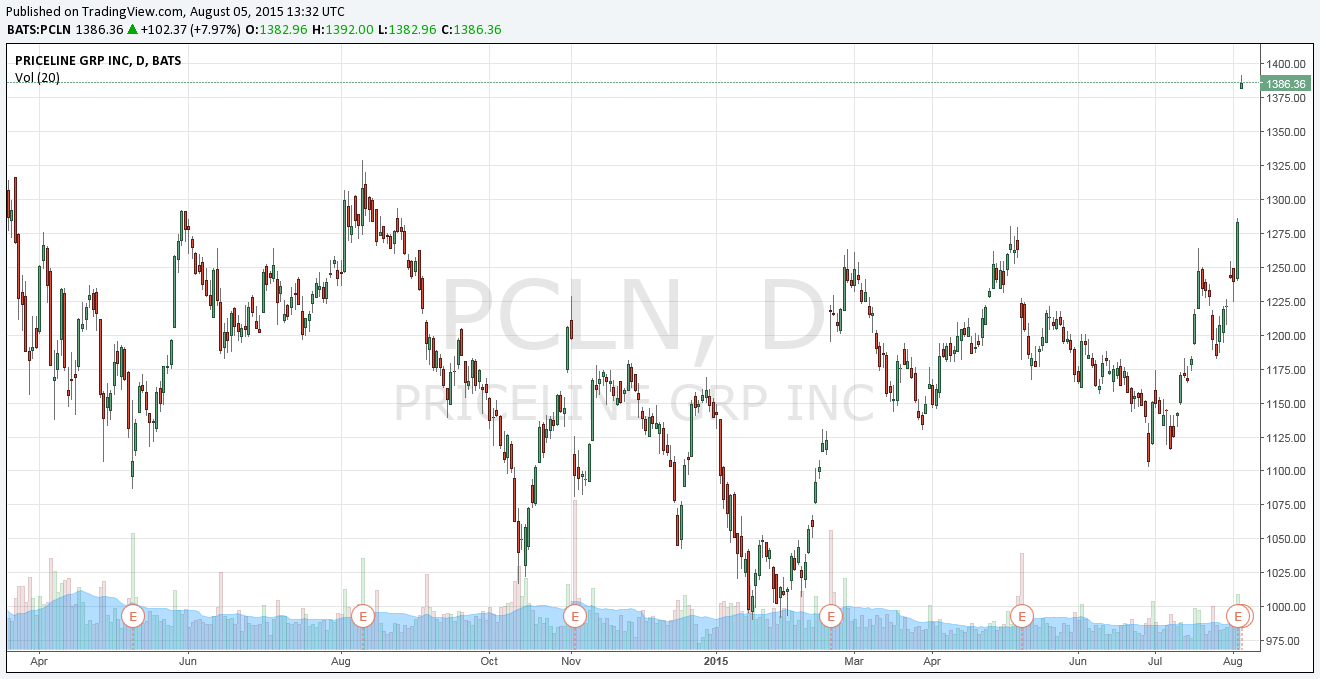

We hope that you’ve had a chance to look at the Valuentum Buying Index distribution since February of this year, as Priceline (PCLN) had been at the very top, a 10 on the Valuentum Buying Index, all the way through the middle of this month. That 10 rating (“we’d consider buying”) earned it a place in the Best Ideas Newsletter portfolio, and its current rating of a 7 (“we’d consider holding) means that we’re holding it in the newsletter portfolio until the price converges to intrinsic value, which we estimate is nearly $1,700 per share, or beyond (until its technical “roll over”). This is how we use the Valuentum process in the newsletter portfolios. Priceline closed at ~$1,284 yesterday, and its shares are surging at the opening bell.

What’s driving the big move higher today? Well, Priceline put up a fantastic second-quarter report and issued third-quarter guidance that came in better than expected. Total reported revenue leapt only 7% in the second quarter due to foreign-exchange headwinds, but second-quarter gross travel bookings jumped an incredible 26% on a constant-currency basis, which helped drive an equivalent increase in gross profit. Non-GAAP net income per diluted share came in slightly lighter than the year-ago period measure, but exceeded consensus numbers by nearly 6%. Wall Street is excited about the better-than-expected performance, and we think it should be.

Looking ahead, Priceline noted that the summer travel season has “got off to a strong start” and pointed to “accelerating growth in hotel room nights and rental car days booked.” International gross bookings advanced 30% on a constant-currency basis in the quarter, and we would expect the segment to continue to outperform. Gross travel bookings are expected to be up as much as 20% on a constant-currency basis for the third quarter of 2015, helping to drive non-GAAP net income per diluted share between $22.95-$24.45 in the period, the midpoint above consensus expectations.

Priceline has 1) fantastic bookings momentum, 2) is significantly undervalued on the basis of a discounted cash-flow process, 3) is showing strong momentum indicators, 4) is “breaking out” on a technical (chart) basis, and 5) holds a pristine balance sheet (its net cash position was ~$4.2 billion at the end of the second quarter). You got it–Priceline is a Valuentum stock. Hope readers are enjoying the ride!

Related firms: EXPE, TRIP