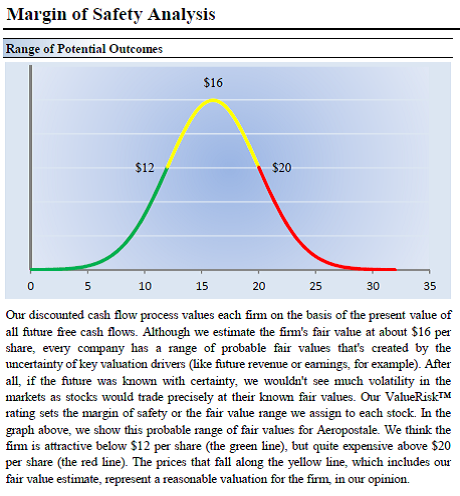

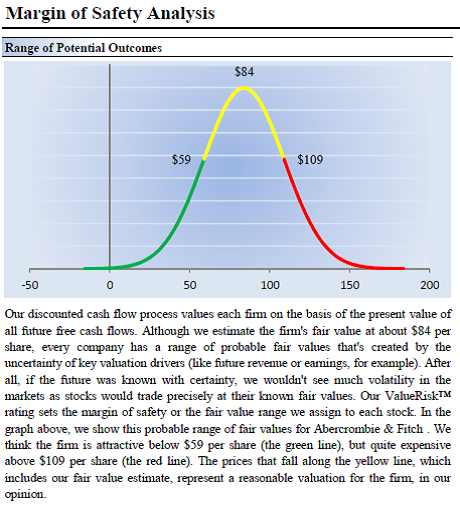

On Thursday, Abercrombie & Fitch (ANF) and Aeropostale (ARO) reported third-quarter sales. The resulting stock price performace from the two was completely opposite: Abercrombie fell sharply, while Aeropostale shot up significantly. We think Abercrombie now represents a bargain under $59 per share, but we are waiting for the technicals to firm before diving into the shares in the portfolio of our Best Ideas Newsletter. We think Aeropostale is fairly valued, even after the big move. Let’s dig into the reports of both of the companies.

Abercrombie was weighed down by poor results in Europe, Japan and Canada, with the company noting negative comps for its flagship stores in the regions. Though by itself, such news wouldn’t cause the massive 20%+ price decline, but it does represent a substantial change from the company’s commentary provided as recently as August. Plus, the firm has been adding stores internationally and is seemingly more dependent on international growth, given increasing competition in the US (though Aeropostale’s supposed better margin performance wouldn’t necessarily suggest excessive discounting in the category).

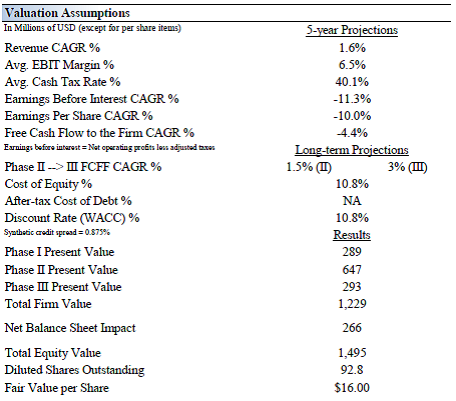

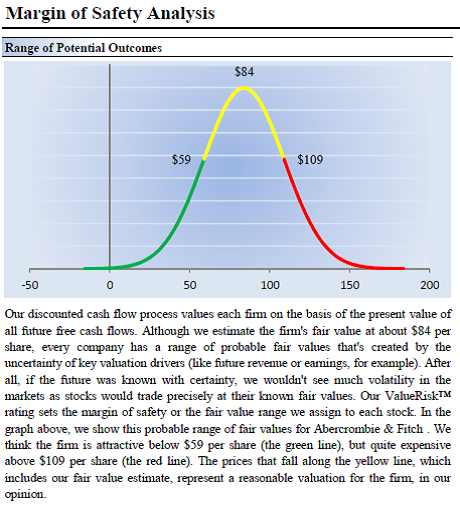

On the other hand, Aeropostale posted better-than-expected performance, raising its third-quarter earnings expectations to the range of $0.27-$0.28 from its previously-issued guidance of $0.09-$0.15 and concensus estimates of $0.12. This, despite, same-store sales that fell 9% (compared to flat same store sales last year)—total net sales fell 1%. We suspect the better-than-expected bottom-line performance was due to stronger-than-anticipated gross margins. Though we liked the pleasant surprise (and shares have rallied 15%+), we think Aeropostale remains fairly valued. Our fair value estimate is $16 per share for the company.

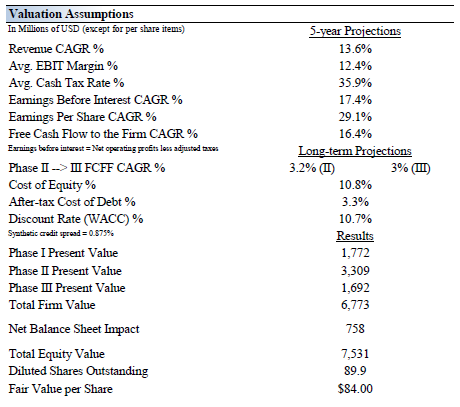

Net sales, however, still advanced 21% on the heels of same store sales growth of 4% for Abercrombie & Fitch, 6% for abercrombie kids, and 8% for Hollister Co (total comprable store sales for the quarter increased 7%). All of these same store increases are below year-to-date performance, signalling a slowing trend, despite the company mentioning that it experienced an acceleration in US chain stores. We’re sticking with our $84 fair value estimate, as we think the performance today is but a blip. [The company operates 316 Abercrombie & Fitch stores, 179 abercrombie kids stores, and 501 Hollister Co. stores.]

On the other hand, Aeropostale posted better-than-expected performance, raising its third-quarter earnings expectations to the range of $0.27-$0.28 from its previously-issued guidance of $0.09-$0.15 and concensus estimates of $0.12. This, despite, same-store sales that fell 9% (compared to flat same store sales last year)—total net sales fell 1%. We suspect the better-than-expected bottom-line performance was due to stronger-than-anticipated gross margins. Though we liked the pleasant surprise (and shares have rallied 15%+), we think Aeropostale remains fairly valued. Our fair value estimate is $16 per share for the company.