Dividend Growth Newsletter portfolio holding Procter & Gamble (PG) announced July 9 it has signed a definitive agreement to merge 43 of its beauty brands with Coty (COTY) for $12.5 billion, in what is likely to be a Reverse Morris Trust transaction. The transaction will include Procter & Gamble’s ‘Salon Professional’, ‘Retail Hair Color’, and ‘Cosmetics and Fine Fragrance’ businesses, along with select hair styling brands. This is a major step forward in the firm’s portfolio transformation plan, in which it intends to whittle its portfolio to 65 brands in 10 business categories that encompass the company’s core competencies.

As the company previously outlined, Procter & Gamble plans to divest, discontinue, or consolidate 100 of its brands and exit several areas of business. In all, it is looking to reduce its brands by 60% through strategic elimination of poor performing and inefficient brands that will result in 14% sales reduction and 6% before-tax profit reduction. As of June 11, the firm had eliminated over 40 brands, and this most recent agreement pushes the company much closer to its target. ‘Beauty, Hair, and Personal Care’ has been Procter & Gamble’s worst performing and least efficient segment through the first quarter of calendar 2015. The sale of many of these brands has been anticipated for months, so the transaction with Coty should not be viewed as a complete surprise.

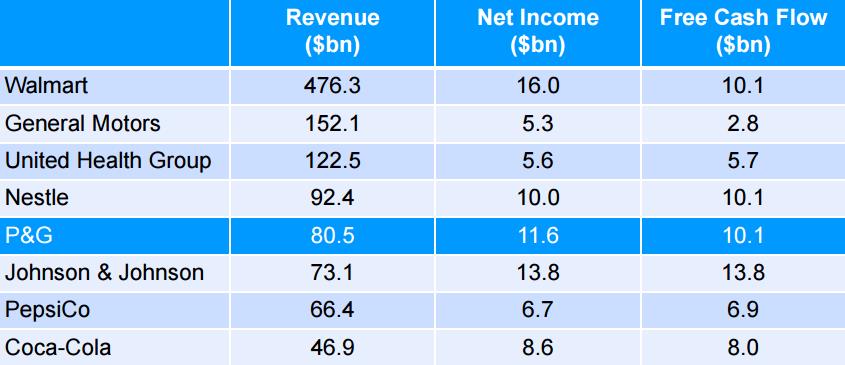

In addition to the brand reduction targets, management is targeting an elimination of 25%-35% of its non-manufacturing enrollment, intended to (along with projected increased growth of its core brands) improve margins and asset efficiency. Likely in accordance with management incentive plans, free cash flow conversion and total shareholder return is the end target of Procter & Gamble’s portfolio transformation plans. The chart below compares the relationship between the company’s revenue, net income, and free cash flow against that of its global food product/retailing peers.

Image source: Procter & Gamble February investor presentation

Though the structure of the arrangement has yet to be finalized, Procter & Gamble would prefer a Reverse Morris Trust split-off. In the proposed transaction, Procter & Gamble would create a new entity for the 43 brands it is shedding and then simultaneously merge the split-off entity with Coty. More than 413 million Procter & Gamble shares will be involved in the transaction, resulting in Procter & Gamble shareholders owning 52% of the post-merger company. Shareholders can elect to transfer all, some, or none of their Procter & Gamble shares for shares of the “new” Coty.

Procter & Gamble expects to realize a $0.02-$0.03 dilution to earnings per share in the quarter prior to the closing of the transaction in relation to transition activities required in establishing a separate entity for the departing brands. Procter & Gamble, however, expects the loss in its core annual earnings per share to be completely offset after the deal closes by the retiring of shares and offsetting overhead costs related to the brands being sold. The firm will also record a one-time earnings gain of $5-$7 billion in relation to the deal, expected to come at closing in the second half of calendar 2016. Procter & Gamble is expected to return $70 billion to shareholders in four years from 2016-2019 through the retirement of shares and dividend payouts in accordance with the Coty and Duracell deals.

The strength of Procter & Gamble’s core brands (especially Pampers, Tide, and Gillette) is undeniable, and we think the consolidation strategy looks good on paper. Optimization is always well-received, but we’re not completely convinced management is getting all it could for the brands it is shedding and feel that the firm could likely get more if it completed the planned divestitures over the next 5-10 years rather than rapidly unloading 100 brands before 2016. “The brands included in the (Coty) transaction are Wella Professionals (and its sub-brands), Sebastian Professional, Clairol Professional, Sassoon Professional, Nioxin, SP (System Professional), Koleston, Soft Color, Color Charm, Wellaton, Natural Instincts, Nice & Easy, VS Salonist, VS ProSeries Color, Londa/Kadus, Miss Clairol, L’image, Bellady, Blondor, Welloxon, Shockwaves, New Wave, Design, Silvikrin, Wellaflex, Forte, Wella Styling, Wella Trend, Balsam Color, Hugo Boss, Dolce & Gabbana, Gucci, Lacoste, bruno banani, Christina Aguilera, Escada, Gabriela Sabatini, James Bond 007, Mexx, Stella McCartney, Alexander McQueen, Max Factor and Covergirl.”

We’ve always liked Procter & Gamble, but with the planned divestitures, the company is becoming less and less like the dividend growth giant we’ve come to know. We’re keeping Procter & Gamble in the Dividend Growth portfolio for now, but we would view it as a source of cash at the right price. We have a lot to think about prior to the Coty deal closing, expected in the second half of next year.