We’re not much for pumping our own chest, and it’s never a good idea to argue by example, but when certain situations help prove our investment beliefs, we take notice. In this piece, let’s take a look at two firms that have been at opposite ends of our Valuentum Buying Index. At the high end of the scale we have American International Group (AIG). The firm has been rated a 9 on the VBI scale–which rates companies on a scale of 1-10–for years now. Our low-end example will be Lumber Liquidators (LL). While the firm’s poor rating may seem like an obvious call, the importance of our rating is based on timing, which will be expanded upon shortly. Let’s take a look at both of these companies, the factors that have caused them to receive their respective VBI ratings, and what is currently driving their businesses.

We’ll begin with AIG, the high-end company. Members know that we’re not fans of the investment prospects of the insurance industry, but they also know that we have liked AIG for some time. We were saying that shares were attractive as early as November 2012, and we reiterated the opinion that AIG was our favorite idea in the insurance industry in November 2013. As of our most recent update of the insurance industry, the company registers a 9 on the Valuentum Buying Index, and our fair value estimate stands at $75+ per share. Shares are currently trading at ~$60.

As can be seen in the graph above, AIG has been enjoying quite the bull run in recent years, and we don’t expect it to stop anytime soon. Shares recently reached their highest point since 2011. Management remains focused on the deployment of capital to enhance long-term returns, while prudently managing liquidity and capital risks. The firm reported solid results in the first quarter of 2015, indicating that it is on track with its long-term goals. After-tax operating income for the period was $1.7 billion, flat when compared to the year-ago period, but first-quarter book value per share excluding accumulated other comprehensive income (AOCI) and deferred tax assets (DTA) grew 14% from the first quarter of 2014, to $60.69.

Balance sheet improvements remain a focus at AIG. The company reduced its debt by over $10 billion in 2014 and has continued to improve its risk profile thus far in 2015. These actions have contributed to the decision of management to continually repurchase shares; it repurchased ~$1.4 billion of shares in the first quarter, as well as ~$800 million more in the month of April. Additionally, on April 30, the firm’s board of directors authorized the repurchase of up to $3.5 billion worth of shares. Since we value AIG’s shares above its current market price, we would view any buyback activity as value-creating.

Our Valuentum Buying Index rating of 9 remains unchanged upon the latest update, and we continue to expect upside. Our fair value estimate of $75+ per share is certainly attainable and considers only modest improvement in return on equity and value-generating capacity. Shares of AIG remain our favorite idea in the insurance space.

Let’s turn to our low-end example, Lumber Liquidators, which has had a history of poor VBI ratings. The firm has hit tough times of late and is currently attempting to navigate through a public relations nightmare. There have been concerns over its sourcing practices and the resulting impact on gross profits. Investigators are looking for evidence the company imported wood products from forests in far eastern Russia that are home to the endangered Siberian tiger. Adding to the public relations nightmare was a ’60 Minutes’ segment in early 2015 that revealed that Lumber Liquidators Chinese-made laminate flooring may be using an elevated amount of harmful chemicals (formaldehyde). The company claims its products are compliant, but perception may hurt sales.

Lumber Liquidators’ most recent quarterly results are showing signs of the negative publicity and regulatory actions against the firm. Though sales grew 5.6% from the year-ago period, net income declined from a positive $13.7 million in the same period in 2014 to a net loss of $7.8 million in the first quarter of 2015. A 23.8% increase in SG&A expenses is mostly to blame for the loss. The stark increase was primarily due to a ~$10 million non-deductible accrual for a regulatory matter resulting from the investigation of the firm’s sourcing practices.

So far in the second quarter of 2015, the effects of the ’60 Minutes’ scandal have been impactful. Sales were down ~2% through the month of April, with sales at comparable stores of the comparable year-ago period being down over 7%, and a ~6% decrease in number of customers invoiced. Much like the quality of its laminate flooring, the reputation of the company has been tainted, at least temporarily. Adding to the upheaval within the firm, it agreed to terminate its CFO, effective June–and the firm’s CEO just resigned unexpectedly.

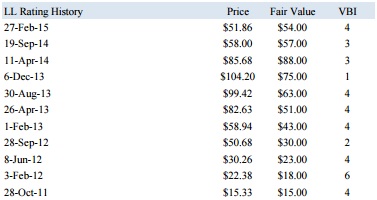

The previously mentioned events aren’t new news if you’ve been following the firm lately, so the significant share price drop may not have surprised many. However, the importance of the company’s poor VBI rating is timing. In the chart below, the historical VBI ratings for Lumber Liquidators can be seen.

Notice that near the peak of the firm’s bull run at the end of 2013 our index was prepared to make a call that some investors may have scoffed at. With a rating of 1 in December 2013 (when shares were over $100 each), those following Valuentum methodology would have received a very serious warning. As is displayed in the chart above, the market has been anything but kind to share prices since that time, and shares are now trading at ~$21. We hope you didn’t try to catch this falling knife. We sure didn’t.

The importance in both of these examples is the potential that the VBI has in identifying investment options that have a strong likelihood of equity price appreciation, or depreciation in the case of Lumber Liquidators. In both, the three pillars of the index–DCF valuation, relative valuation, and technicals/momentum–came together to provide an accurate forecast of what to expect from the companies.