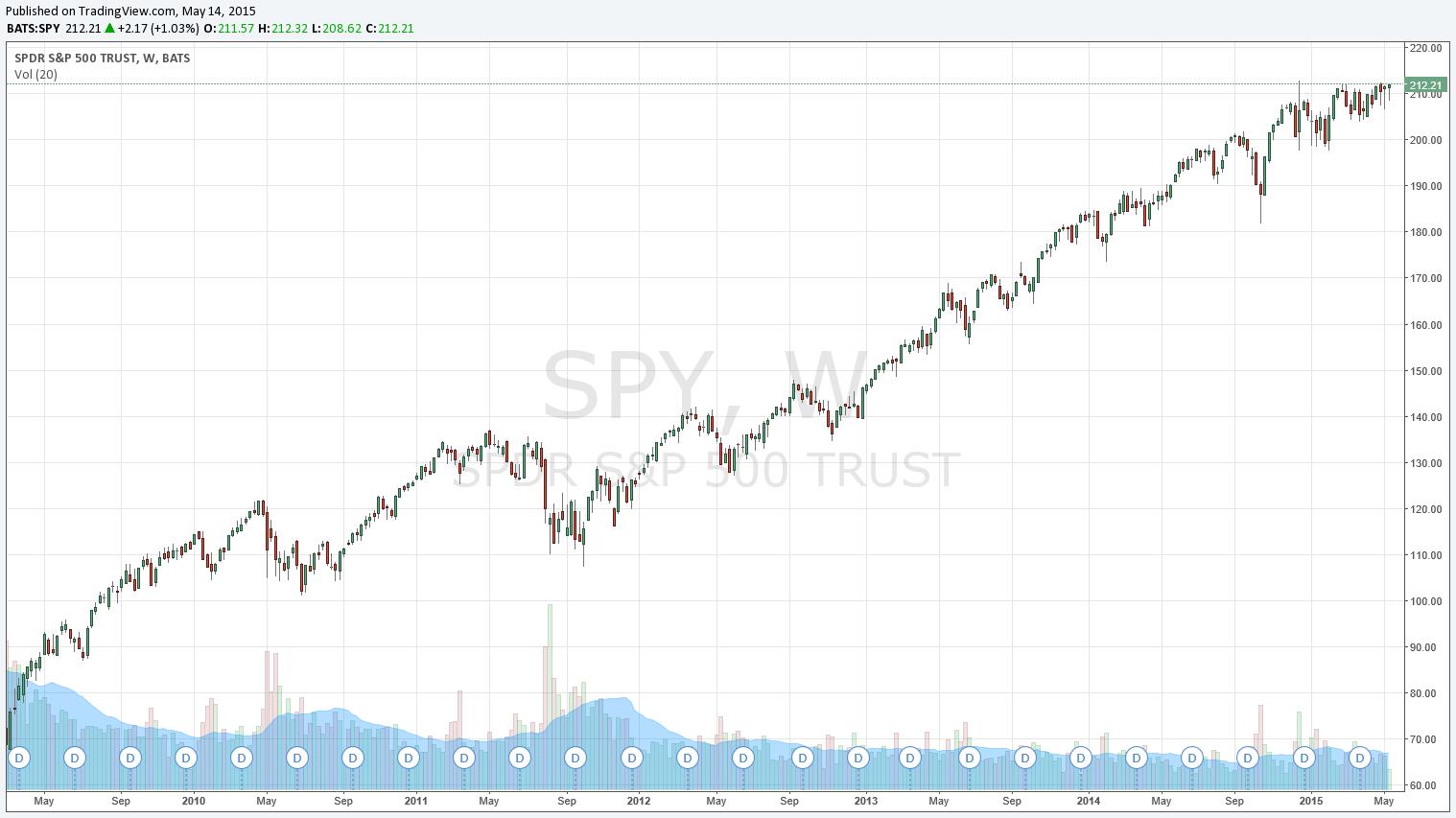

This is the performance of the S&P 500 (SPY) since the March 2009 panic bottom. It’s incredible, to say the least.

US stocks, as measured by the S&P 500 have more than tripled since the doldrums of the Financial Crisis, and for those of us that lived and breathed the markets during every day of the Financial Crisis, the lack of volatility and the ongoing, steady advance seemingly month after month during the past 6-plus years have been incredibly peculiar–and perhaps contradictorily–less-than-comforting. Any market that sets prices on the buying and selling behavior of a wide-variety of participants with differing views shouldn’t be so coordinated and one directional. It seems unnatural, or at the very least, unusual. While others are cheering new highs, we’re growing more and more worried.

Many of my closest colleagues have long speculated that, given the general lack of government transparency in perhaps more cases than we care to bring up, the possibility of the past equity market environment being predicated by the support of some variety of the Plunge Protection Team cannot be ruled out. Hogwash? Maybe. But something simply doesn’t pass muster by this team of onlookers. Natural, free markets do not go up forever, and this bull market has been one for the ages. You don’t need us to tell you to be careful where you put your capital. Buffett’s first rule is to never lose money. It’s a good rule.

The S&P 500 set yet another high Thursday thanks in part to strength from three of our favorites Apple (AAPL), Google (GOOG, GOOGL) and Microsoft (MSFT); the index closed at 2,121. Even if next year’s election year spells the end of this seemingly-manufactured bull market, it may not matter for this publication. It is a widely-held fact that investors can do well in both bull and bear markets, and that’s what the Best Ideas Newsletter portfolio has been designed to do. A positive return from individual companies during a broad market decline is possible, and for some of the best stock pickers, we’d consider it probable.

Buy and hold was abolished when Lehman, AIG (AIG), and GM (GM) went belly-up during the Great Recession. Those that invested in the latest and greatest buggy-whip manufactures are long gone, but at one point, they were still hoping that the next-generation horse-and-carriage models would take share back from the automobile. If you’re getting my gist, what I’m trying to say is that it’s certainly okay to take profits—even on your favorite stocks. Overpriced stocks are overpriced, no matter how strong the business model.

Unlike those actively managing their futures, indexers have a much more difficult time navigating difficult times. Jack Bogle of Vanguard has long argued that, on average, the active investor trails the broad market after fees are deducted. This may be true. But what he doesn’t say is that the index investor is guaranteed to trail the index after fees are deducted. What a marketing genius, no? Indexers are going to get what’s coming to them when the next bear market takes hold. But remember, active investors don’t need the broader market index to advance to generate positive returns.

During the past several weeks, I’ve received a number of questions from members seeking international exposure for one reason or another–currency-exchange fluctuations or emerging strength from non-US regions. Inquiring about my views on global-macro exposure-shifts within a portfolio context has always been an unfair topic of discussion because it is a loaded one. By addressing the idea, I have to suspend my view that stock values reflect future expectations of free cash flow generation, which themselves already consider normalized currency expectations and normalized economic activity.

The US investment community is dominated by mutual fund investors, and many have been “sold” on the varying performance measures and risk statistics associated with different buckets of stocks. Perhaps sales associates have shown you how small cap stocks outperform large cap stocks over certain periods of time, or how international exposure can bolster returns while helping to reduce risk? Portfolio management techniques have been around for a long time, but they all suffer from the same problem—the reasoning is based on what’s happened in the past. What we learned during the Financial Crisis is that correlations go to 1 when diversification is most needed. That won’t stop the rear-view mirror thinking, however.

There are only three types of stocks, in our view: undervalued ones, fairly valued ones, and overvalued ones, and these stocks are located in all regions of the world. From our perspective, small-cap, mid-cap, large-cap, international, emerging markets, “smart beta,” and the like are categories designed to generate fees by selling investors more financial products. Let’s think about it: Do you think Warren Buffett concerns himself with whether a strong, moaty company is mid-cap or that it generates revenue from the US? These segments that mutual funds and now ETFs seem to be bucketed in are, in many ways, “made up” so that investors “feel” they can be diversified. Very few long investors were “saved” during the Financial Crisis (almost everything was punished). That should tell you something about portfolio theories based on historical correlations.

But for investors seeking non-US exposure, Alibaba (BABA) remains our favorite idea. The company is undervalued, and the firm has just started to turn heads regarding the improvement in its monetization rate. To us, it will always be more important that a company is undervalued than where it generates its business. Currency and country-specific risk is accounted for within the valuation process, either in a potential reduction of future expected free cash flows, a higher discount rate, or a larger fair value range. The DCF, the discounted cash-flow model, is a wonderful tool. Very few considerations cannot be captured in such a process.

As it relates to news with respect to other holdings in the Best Ideas Newsletter portfolio, Gilead Sciences (GILD) has finally turned the corner. For those that scooped up shares when we added them, we’re above water, and for those that scooped up shares in the mid-$80s, then you’re doing great! We continue to believe Gilead’s shares are trading at bargain-basement levels, and recent news suggests the heavily-debated pricing environment will be better-than-feared. Though Senator Bernie Sanders has been trying desperately to break Gilead’s patent on Solvaldi in the US by stirring the pot over invoking wartime provisions that prevent “profiteering” (an absurd insult to the hard work that goes into developing cures for diseases), news that Solvadi’s price in Japan was stronger-than-expected is encouraging.

We won’t go into too much detail on the recent news on Apple other than channel checks reveal that the iPhone remains as strong as ever. We talk a lot about Apple, and we’ll leave it at this: there may be no stronger company on the market today and one that fits the investing goals of a wide variety of investors. It remains a core position in both newsletter portfolios. Cisco (CSCO) put up great quarterly performance for the quarter ended April 25. Product and services revenue showed decent improvement, while the company’s gross margin came in higher-than-expectations. We value shares at ~$33 each, higher than its last closing price of ~$29. The company yields close to 3%.

Lastly, I wanted to thank each and every one of you for your membership. We’re turning the heads of some very important people, and our journey has just begun. Valuentum investing and the common sense we bring to evaluating the markets and individual companies is getting noticed. The more investors we reach, the more we can help—and that’s what Valuentum is all about.

Thank you.

Yours sincerely,

Brian Nelson, CFA

President, Equity Research