There’s probably nothing more difficult to do in all of investing than predict the fashion trends of teenagers. Every season it seems there’s something new, and what was “in” a few weeks ago is now yesterday’s news. To me, predicting what kids will wear during each of the four seasons of the year is like asking my three-year-old what he did at school today: the answer is not always clear. Others say it’s like rolling the dice at the craps table. Very few firms make it in teen retail, and recent results reveal why.

Abercrombie & Fitch (ANF)

An excerpt from Abercrombie & Fitch’s third-quarter report:

“As referenced in our earlier Business Update, our third quarter results were disappointing in what remains a very challenging environment for young apparel. Comparable sales improved somewhat in November, and this improvement was maintained through the Black Friday weekend. However, we expect conditions to remain difficult through the balance of the fourth quarter.

Longer term, we continue to believe we are taking the right steps to position the company for future success, including our shift to a branded structure, changes in our assortment and how we engage with our customer, investing in direct-to-consumer and omni-channel, expanding our international reach, closing under-performing stores, and continuing to reduce expense. The aggregate impact of these changes represents a significant transformation for our company, and we are hopeful that the benefits will start to become evident as we move through 2015.”

The firm’s comparable store sales performance in the third quarter was -7% (negative 7%) and -15% (negative 15%) in the US and internationally, respectively, and speaks to a very difficult operating environment for teen retail. This won’t change anytime soon.

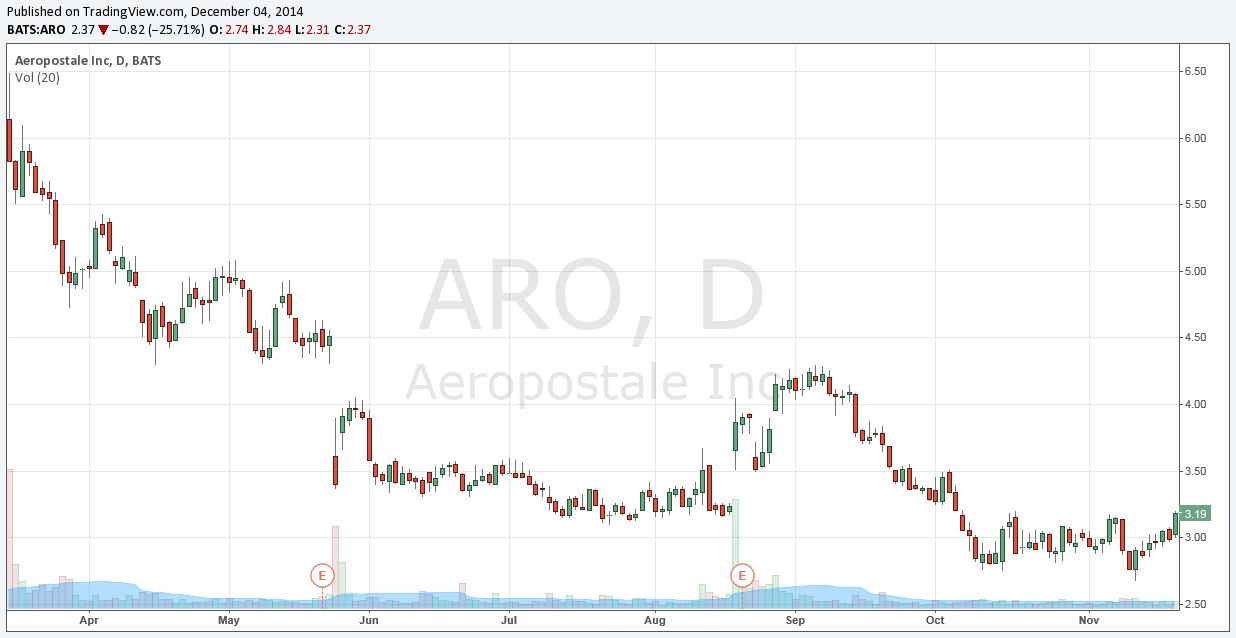

Aeropostale (ARO)

Aeropostale’s third-quarter results left much to be desired. Net sales fell 12%, while comparable sales, including the e-commerce channel, fell 11% compared to last year’s period. Excluding a number of charges in the quarter, Aeropostale posted an adjusted net loss of $35.2 million, or $0.45 per share. We think the firm’s fourth-quarter guidance tells the story well:

“For the fourth quarter of fiscal 2014, the Company expects operating losses in the range of $28.0 to $34.0 million, which translates to a net loss in the range of $0.37 to $0.44 per diluted share. The effective tax rate for the fourth quarter is projected to be approximately 4.0%. This earnings guidance does not include the impact of any store impairments, accelerated store closure costs, or real estate consulting fees.”

Returning to profitability remains out of reach for Aeropostale, and it will be for some time to come.

Destination Maternity (DEST)

Though not exactly teen retail, as it caters more to millennial moms-to-be, here’s what’s happening at one of the world’s leading maternity apparel retailers, Destination Maternity:

“We are disappointed in our performance for both the quarter and full year. Like most of retail during our fourth quarter, we struggled with the macro-economic environment and traffic was challenging. Although several categories performed well, we believe our product offering did not consistently match what our customers wanted, particularly the millennial moms-to-be, who represent a growing share of today’s market. Therefore, we are working to aggressively manage our inventory and become more customer-focused and product-centric. It is our goal to provide a shopping experience, not available anywhere else, with fashion-right products to help our customer celebrate this amazing time in her life. I am optimistic about the long-term value of, and opportunities for, Destination Maternity Corporation.

Teens and millennials are proving to be a tough nut to crack in retail as of late.

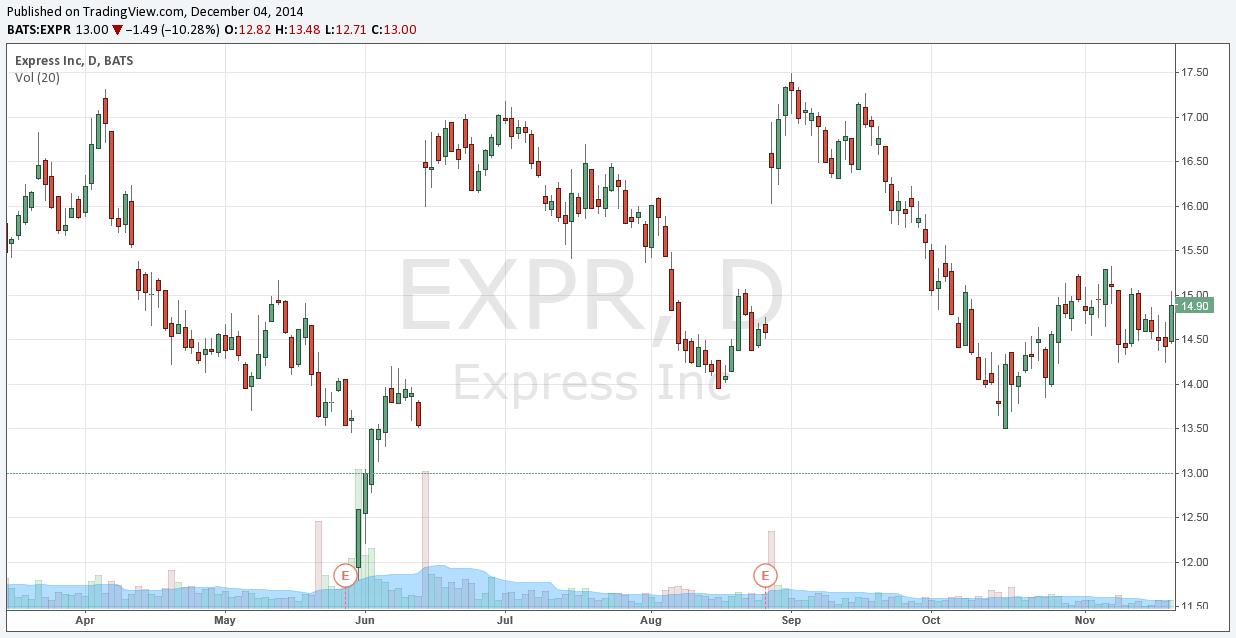

Express (EXPR)

Net sales in the third quarter at Express fell 1%, while comparable sales during the quarter dropped 5%, compared to a 5% jump in last year’s quarter. The company’s full-year guidance came in lower than what many had been expecting: $0.69-$0.76 per share versus $0.82 per share consensus and $1.37 per share last year. Comparable sales for the full-year are anticipated to be in the negative mid-to-high single-digit range, which offers little hope for improvement from the 7% slide through the first nine months of 2014.

“As we began the fourth quarter, e-commerce enjoyed a strong Thanksgiving push through Cyber Monday and our outlet sales continued to exceed initial expectations. However, we have updated annual guidance to reflect our current retail store trends and expectations that mall traffic will continue to remain challenging throughout the holiday period.”

Guess (GES)

A look at the firm’s third-quarter highlights says it all:

• North American Retail revenues decreased 4%; retail comp sales including e-commerce decreased 5% in U.S. dollars and 4% in constant currency

• European revenues decreased 6% in U.S. dollars and 3% in local currency

• Asian revenues decreased 2% in U.S. dollars and 5% in constant currency

• North American Wholesale revenues were flat in U.S. dollars and increased 2% in constant currency

• Adjusted operating earnings decreased 50%; GAAP operating earnings decreased 48%

The company expects diluted earnings per share for the fourth-quarter to be in the range of $0.53 to $0.63, below expectations. Management is blaming overall trends in North America that have softened relative to the third quarter.

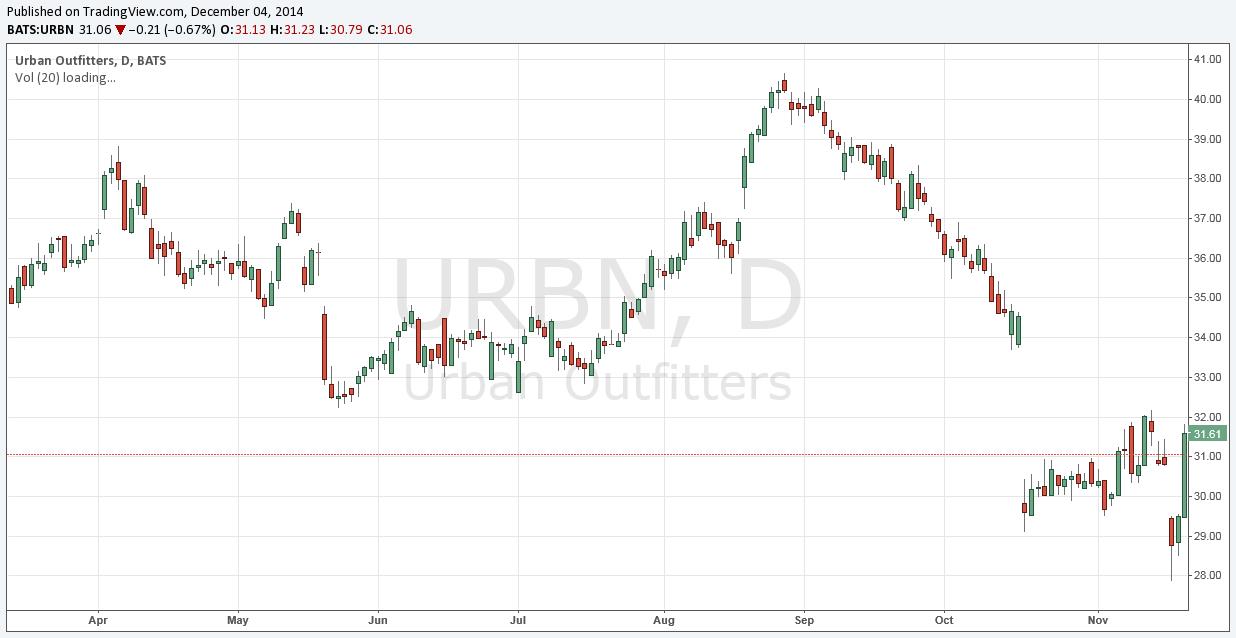

Urban Outfitters (URBN)

From the third-quarter conference call transcript:

“Let me say at the outset that URBN’s overall performance in this year’s third quarter was subpar. Disappointing results at the company’s namesake brand, Urban Outfitters, deflated what otherwise would have been a powerful company performance…

…And while we had many successes in the quarter, total performance, namely a 9.4% operating profit, is well below our historic norm, and certainly less than what we know our brands are capable of producing…

…It is obvious that the environment surrounding apparel retailing over the past year has been challenging. Many brands have struggled.” – CEO Richard Hayne

Teen retail is not something that we think hard-earned dollars are worth throwing at. Just don’t do it.