Kinder Morgan (KMI) has moved to the top of our watch list after it made the decision to bring in-house Kinder Morgan Energy Partners (KMP), Kinder Morgan Management (KMR), and El Paso Pipeline Partners (EPB), thereby reducing its business structure risk as a holder of master limited partnerships (MLP), which remain heavily dependent on access to external new capital (something we’re not fond of). Holding an MLP in the newsletter portfolios is not a risk we take lightly.

On Wednesday, Kinder Morgan (KMI) reported that cash available to pay dividends advanced 2.6% in the third quarter, to $435 million. The solid performance facilitated a dividend increase to $0.44/share on a quarterly basis, a 2.3% jump from previous levels and a 7% leap on a year-over-year basis. Management indicated that it remains on track to meet or exceed its published annual budget of $1.78 billion in cash available to pay dividends. The mark stands at $1.34 billion through the first three quarters of the year. Kinder Morgan now yields ~5% after the raise.

Once the re-consolidation of Kinder Morgan’s publicly-traded units is complete, management expects the firm to have a projected dividend of $2 per share in 2015, which is roughly a mid-teens increase from the current annual run-rate ($1.76 per share). Even more important for dividend growth investors, however, Kinder Morgan expects to achieve 10% annual growth in the dividend from 2015-2020. With investment-grade marks from the rating agencies, this pace of dividend growth appears achievable.

The energy markets, however, continue to be in flux, but such volatility may present more of an opportunity for investors to establish a new position in Kinder Morgan than anything else. For one, the price of crude oil has fallen to the lowest levels in years, but Kinder Morgan’s assets are more of the fee-based variety, acting like a toll road operator (they aren’t as leveraged to oil price volatility). When we first received news of Kinder Morgan’s re-consolidation, we didn’t rush out to add shares of KMI, the parent, to the Dividend Growth portfolio. We did, however, raise our fair value estimate of KMI, to $41 per share, as a result of the re-consolidation and reduced business-structure risk through the course of the energy cycle. With shares now tumbling to the mid-$30s, we’ve become very interested in initiating a position.

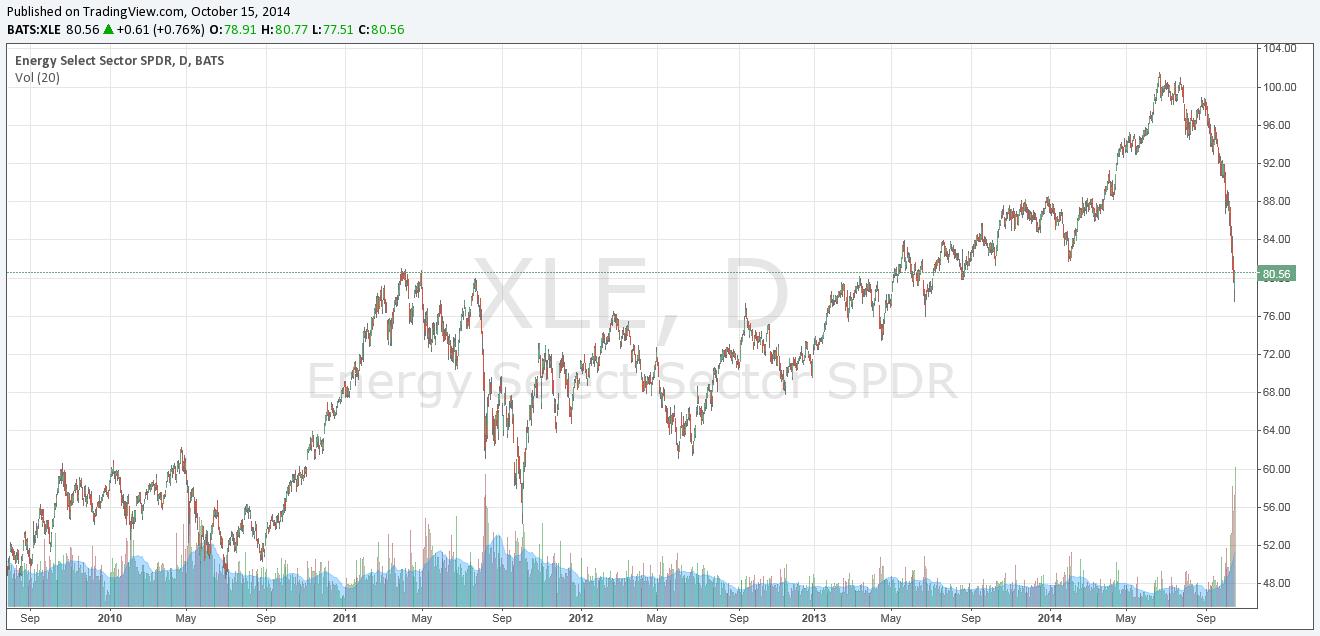

You may see us add Kinder Morgan (KMI) to the Dividend Growth portfolio soon, but we’re waiting patiently for the energy markets to calm down a bit. A look at the wreckage of the Energy Select SPDR (XLE), shown below, is enough to cause some pause. KMP, EPD, and KMR will cease trading once the roll-up is completed. We will drop coverage of those firms at that time. Our coverage of KMI will continue.