It’s always sad when good things come to an end. In this case, it appears to be the global potash cartel…permanently. According to reports from the Wall Street Journal this week, the CEO of “Russian potash giant Uralkali JSC has no plans to restore a sales partnership with Belarus.” It appears that the prospects for reconciliation of the Belarusian Potash Company (BPC) have passed, and the global pricing cartel in the fertilizer ingredient is now a thing of the past. There are no plans for further talks at this time.

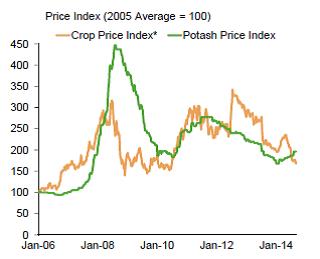

Canpotex, which is comprised of Potash Corp (POT), the Mosaic Co (MOS), and Agrium (AGU), and the BPC collectively controlled about 70% of global potash exports. With the breakup of the BPC, the duopoly is now finished. Strong demand for potash in emerging markets has prevented potash prices from responding naturally to the industry’s structural change, even as they have fallen considerably from the peak in 2009 (see green line below). The worst may still be ahead, in our view.

Image Source: Potash

In a cartel, participants generally are able to restrict supply in order to maximize selling prices, which in turn preserves excess economic returns and maximizes the profit pie for all constituents. Pricing swings can and do cause enormous changes in underlying profitability for commodities producers, as price, in almost all cases, falls straight to the bottom line. Weak pricing behavior drives one of the least desirable dynamics that can happen to a firm’s profit-and-loss statement — fixed cost deleveraging.

Moreover, political risks and economic retaliation could also find their way into the potash markets, particularly with respect to recent geopolitical events (the Ukraine and Russia crisis and the resulting economic sanctions placed on Russia by both the US and EU). Without a well-functioning BPC, the risks of global potash producers have increased exponentially. The table is set for potash pricing to get worse – if not in the near term, over the long haul.

Valuentum’s Take

With our warning duly noted, Potash Corp continues to forecast a relatively sanguine relationship between supply and demand of the ingredient in coming years. We also fully admit that, while a breakdown at BPC lessens the attractiveness of the global potash market, it doesn’t completely make it a free-for-all. Potash, Mosaic, and Agrium are still very good companies, and even after the breakup of BPC, one might still consider the global potash market an oligopoly.

That said, we’d be remiss if we didn’t inform readers that the group could one day wake up and find each other competing aggressively on price in the face of unexpected dwindling demand. The likelihood of this scenario remains remote given robust demand expected in coming years, but we certainly can’t possibly rule it out. For one, the BPC broke up for a reason, and this in itself could be considered an irrational move. How then can we expect participants to be rational?

No matter how one looks at it the breakup of BPC is a red flag, and we’re not ignoring it. Investors in companies tied to the potash market should take notice.

Chemicals – Agricultural: AGU, CF, CMP, IPI, MON, MOS, POT, SMG, TNH