“Whenever you find yourself on the side of the majority, it is time to pause and reflect.” – Mark Twain

The investment research publishing business is a brutal one, and we know you know it.

The very best of calls are the ones that go against the crowd and provide such a unique and fresh insight that readers have a difficult time grasping such a variant viewpoint. Once the call is published, the peanut gallery goes to work…and boy do they go to work. Biased and mostly uninformed commenters with stakes in the game do everything they can to try to discredit the author, from personal insults on the message boards to focusing on a minute part of the research to try to disprove the whole.

The investment research business is sometimes no fun at all. In fact, it’s sometimes a terrible experience for honest and independent publishers acting in readers’ best interests. Some readers think that an independent research provider is working against them, instead of giving them an insightful, informed opinion (acting in their best interest). What’s worse, when the call works out as outlined in the research, instead of championing the author, the peanut gallery is completely quiet…silence. All of the insults and mudslinging turns to nothing. The biased commentators do everything to try to ruin the author’s reputation once the call is made and then do nothing to reinforce the credibility of the author when he/she is right. There is no gain. The hecklers don’t care much for variant opinion, and they certainly don’t reward the author when they’ve been wrong. It’s sometimes a tough business, and having a thick skin doesn’t pay the bills.

Comments from the peanut gallery represent a dangerous dynamic because much like social media, they influence other readers — and create what is commonly known as groupthink. Groupthink is defined as a “psychological phenomenon that occurs within a group of people, in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome.” How true. We learn early in school that ‘what is popular is not always right, and what is right is not always popular,’ but yet when we’re investing in the stock market, we seem to forget all of that. It’s hazardous to forget. Groupthink can cause permanent damage to your portfolio, and we witnessed such behavior when we made our bearish calls on American Capital (AGNC), Annaly (NLY), and the mortgage REITs before the floor dropped out. We went against the crowd’s view on these risky entities, and we were right. We strive to be the gold standard, and for $0.50 a day. I’d tell the hecklers to keep their $0.50 a day, but they would, and they’re not members anyway. We’re your best friend in a world of biased and incomplete information.

More recently, we witnessed the pitfalls of groupthink with Seadrill (SDRL). We published a controversial piece on the offshore driller in August 2012 that was met with a wave of hecklers (the youngsters call them ‘haters’). The comments were brutal. Frankly, we were surprised that a fair risk assessment of the company was met with such opposition. At that point, we should have known the floor was about to drop out on the stock. Usually, when the crowd disagrees so vehemently with our informed opinion, there’s something terribly wrong. Here is a brief summary of that piece on Seadrill from August 2012:

We Don’t Think Seadrill’s Dividend Is Sustainable

“Though shares score a 6 on our Valuentum Buying Index (our stock-selection methodology) and trade at the low-end of our fair value range, we aren’t fans of the rig owner at current levels. In addition to shares trading in our fair value range, we are concerned about the long-term health of the company’s dividend. Management noted strong operating performance, a record high order backlog, and a positive outlook for the drilling industry as reasons for dividend sustainability, but SeaDrill posts a Valuentum Dividend Cushion™ score of 0–suggesting the dividend is at significant risk going forward. Either management will have to make sweeping changes to the growth and profitability of the firm or access the equity/debt markets to sustain the dividend, which may have dilutive implications on shareholders.”

But the story doesn’t end here. In September 2013, when Seadrill was making highs in the upper $40s per share, we published another bearish article. Here’s a quick summary of that piece:

Seadrill Doesn’t Quite Make The Cut

“Though Seadrill boasts a hefty payout, we don’t think its dividend is safe over the long haul on the basis of our Valuentum Dividend Cushion measure (which considers its hefty debt load). We’re not saying the dividend is going to get cut at this time, but as was displayed in the financial crisis, the firm’s over-leverage can be a recipe for disaster (when shares dropped from nearly $37 to $6 and change). When it comes to dividend growth investing, we don’t ignore the capital risks.”

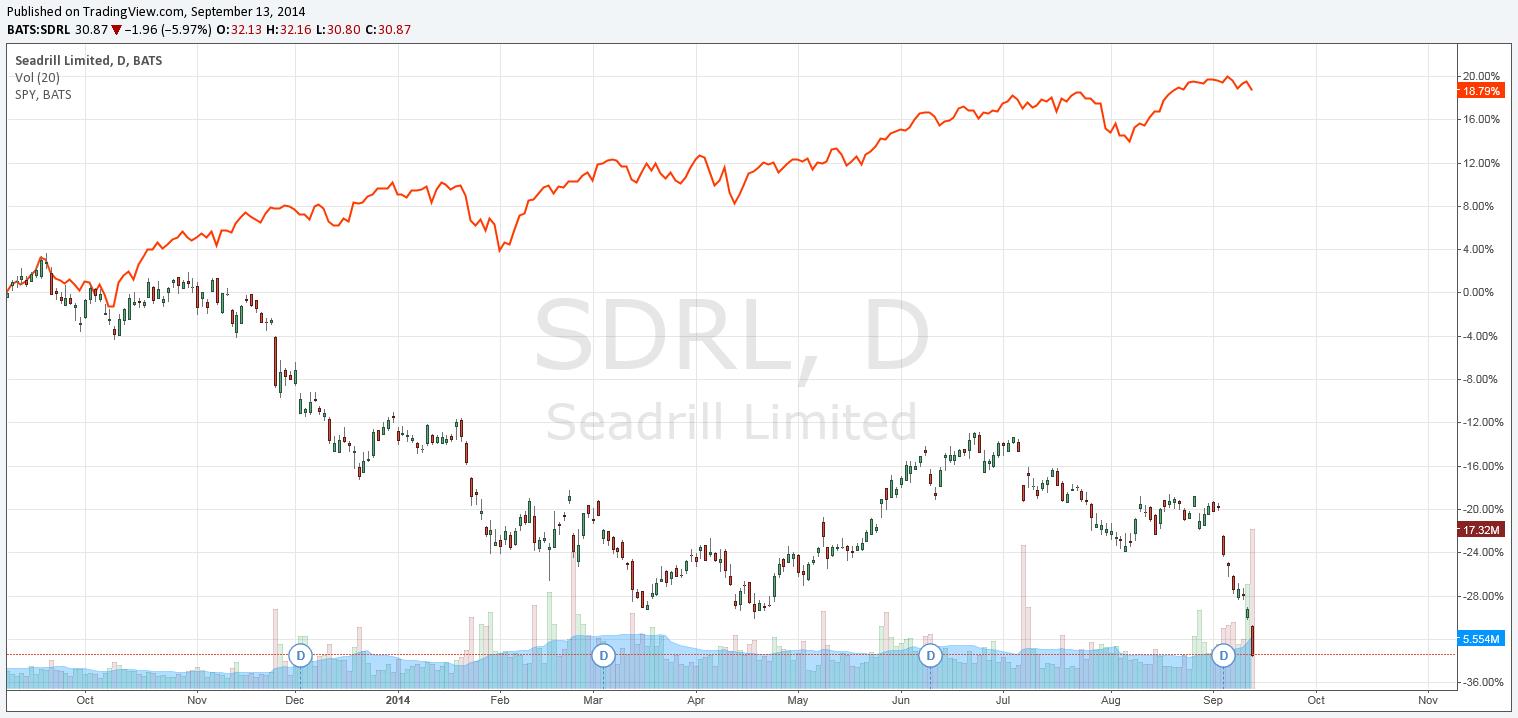

And then, much like in the American Capital and Annaly story, the sell-side started to come out negative on Seadrill (but only after we took most of the beating). From Nordea, Credit Suisse, Nomura to Wells Fargo, Canaccord and perhaps a half dozen more, downgrade after downgrade. Meanwhile, the peanut gallery remained silent…through all of this. The chart below shows Seadrill’s performance versus the market since the publishing of that article in September 2013. The stock is down more than 30% relative to a gain in the S&P 500 of nearly 20%! This is simply an incredible call – and we saved members from losing hard-earned capital. Will you ever hear about it? Perhaps. But most certainly not from a heckler that didn’t value our opinion. The value of a research provider not only rests in the quality of ideas it generates, but in the ideas it steers readers away from. Please don’t ever forget that.

Energy Equipment & Services – Offshore Drilling: ATW, DO, ESV, NE, RDC, RIG, SDRL