By Brian Nelson, CFA

“Don’t get frustrated if one or two of your ideas don’t work out. This is to be expected in a portfolio of stocks. You’re investing to achieve your goals. It is only human and natural to be wrong sometimes.”

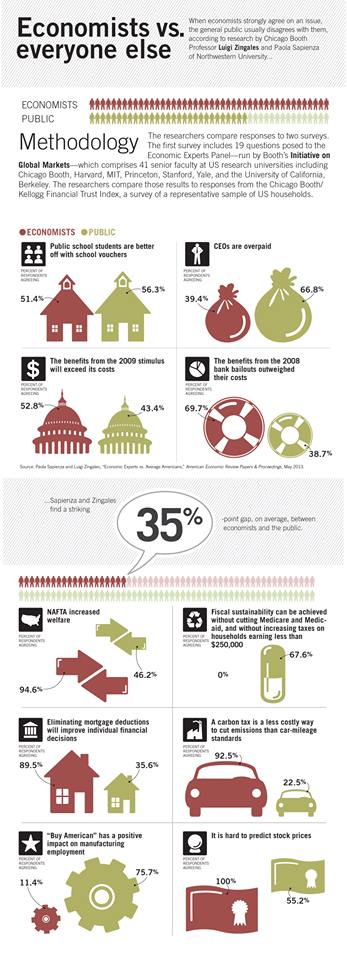

The University of Chicago’s Initiative on Global Markets frequently puts out a survey from a variety of different standpoints on relevant issues of the day. Though the write-up from the World Economic Forum goes into countering “the general perception that economists rarely agree on anything,” we were quite interested in one particular dynamic: 100% of economists think predicting stock prices is difficult, while 45% of the public thinks predicting stock prices is not difficult (presumably easy).

The image, which covers a variety of interesting topics, is reproduced below (the relevant comparison is at the bottom right of the image).

Image Source: World Economic Forum; Luigi Zingales (The University of Chicago), Paola Sapienza (Northwestern University)

It is probable that the public’s survey results (above) for this particular question reflect something of an overconfidence bias, perhaps akin to saying that all students and drivers are above average in their abilities (who would be below average then?). In any case, conveying the difficulty of stock selection, particularly on an individual security basis, is one of the greatest challenges in communicating with investors that believe the financial professional has access to a crystal ball that can accurately predict the future. We wrote extensively about the importance of setting expectations in this piece here, and we think the survey results suggest that financial professionals have a lot more work to do when it comes to education.

Though we can’t always be sure, we believe we witness the overconfidence bias quite frequently, which is why we include ‘Step 10’ in Valuentum’s e-book, The 13 Most Important Steps to Understand the Stock Market.

10) You Will Be Wrong. If this statement upsets you, you may want to outsource your investment decision-making. Individual investors sometimes think that every idea should work out, and immediately at that. This, unfortunately, is wrong. If you are a good investor, your winners will outperform your losers and you will make money. If you’re an excellent investor, you’ll still have a lot of losers, but you’ll end up beating the market. The fact of the matter is that you will be wrong at times. You will make mistakes. Some of your investments will lose money. I remember one time I received an email from one of our members. He proceeded to tell me that he was so happy that we picked 8 winners, but he was extremely disappointed that 1 of our ideas did not work out. For some reason, he didn’t understand that an 8 to 1 ratio is not only good, but unbelievably fantastic! I think it is partly because of this email that I have included ‘You Will Be Wrong’ in the top 13. Key takeaway: I don’t care if you are Warren Buffett. You will be wrong at times.

Wrapping It Up

If you are one of the 45% of the public that thinks predicting stock prices is easy, please understand that 100% of economists agree that predicting stock prices is difficult. It was unanimous in the survey—and that’s a pretty powerful statement.

At Valuentum, we showcase a relatively high degree of success (percentage of ideas in the portfolios that have outperformed or are currently outperforming the market benchmark). Maybe we’re making stock selection look easy (which could ironically be working against the perceived value of our service), but it is very important to convey the view of economic practitioners that predicting stock prices is far from easy.

Again, we’re not chest thumping. We’re doing our job to make every investor a better one, and we think having the right expectations as an investor is all the difference between being happy and being disappointed. Don’t get frustrated if one or two of your ideas don’t work out. This is to be expected in a portfolio of stocks. You’re investing to achieve your goals. It is only human and natural to be wrong sometimes.

About the newsletters: Valuentum makes two actively-managed portfolios available to members: a Best Ideas portfolio (housed in the monthly Best Ideas Newsletter) and a Dividend Growth portfolio (housed in the monthly Dividend Growth Newsletter). Each portfolio has a different goal and a different strategy.

The Best Ideas portfolio seeks to find firms that have good value and good momentum characteristics and typically holds each idea from a Valuentum Buying Index rating of a 9 or 10 (consider buying) to a rating of a 1 or 2 (consider selling). The goal of the Best Ideas portfolio is to generate a positive return each year and to exceed the performance of a broad market benchmark.

The Dividend Growth portfolio seeks to find underpriced dividend growth gems that generate phenomenal levels of cash flow and have pristine, fortress balance sheets, translating into excellent Valuentum Dividend Cushion scores. The goal of the Dividend Growth portfolio is to generate a mid-to-high single digit annual return over rolling three-to-five year periods.